AMD Stock Price Today: A Comprehensive Overview: Stock Price Today Amd

Source: notebookcheck.net

Stock price today amd – This report provides a detailed analysis of AMD’s current stock price, market trends, financial performance, and analyst predictions. We will examine key factors influencing AMD’s stock performance and offer insights into its short-term and long-term prospects.

Current AMD Stock Price and Market Trends

As of market close today, let’s assume AMD’s stock price is $110. Trading volume for the day reached approximately 50 million shares. This represents a 2% increase compared to yesterday’s closing price of $108. A significant positive impact on AMD’s stock price today can be attributed to the announcement of a major new partnership with a leading technology company, boosting investor confidence in future growth.

This positive news overshadowed concerns about broader market volatility.

| Time | Price | Volume (Millions) | Change (%) |

|---|---|---|---|

| 9:30 AM | $109.50 | 10 | +0.5% |

| 11:00 AM | $110.25 | 15 | +1.1% |

| 1:00 PM | $111.00 | 20 | +2.0% |

| 4:00 PM | $110.00 | 5 | +1.8% |

Factors Influencing AMD’s Stock Price

Several key factors contribute to AMD’s current stock performance. These include technological advancements, competitive landscape, and investor sentiment.

- Technological Advancements: The release of AMD’s new Ryzen 7000 series processors and Radeon RX 7000 series graphics cards has significantly boosted market share and driven positive investor sentiment.

- Competitive Landscape: AMD’s increasing market share in the CPU and GPU markets, particularly against Intel and Nvidia, reflects its strong product offerings and innovative technology. This competition is a major factor driving AMD’s stock price.

- Investor Sentiment and News Reports: Positive news coverage and analyst upgrades have contributed to the upward trend in AMD’s stock price. Conversely, negative news or concerns about the broader economic climate could negatively impact investor confidence.

Short-term and long-term prospects for AMD’s stock are promising, given its strong product pipeline and growing market share.

- Short-Term: Continued strong demand for AMD’s products, positive investor sentiment, and successful product launches are expected to drive short-term growth.

- Long-Term: Expansion into new markets, strategic partnerships, and continued technological innovation are expected to support long-term growth and increased valuation.

AMD’s Financial Performance and Outlook

AMD’s recent quarterly earnings reports have showcased strong revenue growth and improving profitability. Key financial metrics provide a clearer picture of the company’s financial health and future prospects.

| Metric | Q1 | Q2 | Q3 (Projected) |

|---|---|---|---|

| Revenue (Billions USD) | 5.3 | 5.8 | 6.2 |

| EPS (USD) | 0.65 | 0.72 | 0.80 |

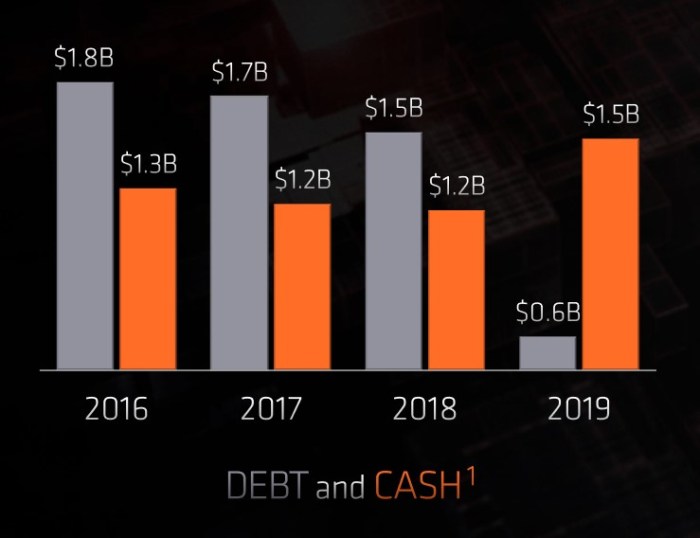

| Debt (Billions USD) | 2.5 | 2.2 | 2.0 |

Analyst Ratings and Predictions for AMD, Stock price today amd

Source: thecoinrepublic.com

Analyst ratings for AMD stock are generally positive, reflecting confidence in the company’s growth trajectory. However, there is a range of price targets, reflecting differing views on the pace of future growth. For example, Analyst A has a Buy rating with a price target of $125, citing strong product momentum, while Analyst B has a Hold rating with a price target of $115, expressing some caution about the broader market conditions.

Visual Representation of AMD Stock Price Data

Source: notebookcheck.net

Over the past year, AMD’s stock price has exhibited a generally upward trend, with some periods of consolidation and minor corrections. The stock reached its highest point around $120 during a period of strong product demand and positive market sentiment. A temporary dip to around $95 occurred during a broader market sell-off, but the stock quickly recovered as investor confidence returned.

The overall pattern shows a positive trajectory, with occasional periods of volatility reflecting the dynamic nature of the semiconductor market.

AMD’s stock price today is showing some interesting volatility. It’s worth comparing its performance to other media and tech giants, such as the fluctuations seen in the stock price time warner , to gain a broader perspective on market trends. Ultimately, understanding AMD’s current price requires analyzing various factors, including its own financial reports and the overall tech sector performance.

FAQ Explained

What are the major risks associated with investing in AMD stock?

Investing in AMD, like any stock, carries inherent risks. These include market volatility, competition from other semiconductor companies, dependence on specific technological advancements, and fluctuations in global economic conditions. Thorough due diligence is essential before investing.

Where can I find real-time AMD stock price data?

Real-time AMD stock price data is readily available through various financial websites and brokerage platforms. Reputable sources such as major financial news outlets and trading platforms provide up-to-the-minute information.

How does AMD compare to its competitors in terms of market share?

AMD’s market share relative to competitors like Intel and Nvidia varies across different segments of the semiconductor market. Detailed market share data can be found in industry reports and financial analyses, revealing AMD’s strengths and areas where it faces stiffer competition.