Understanding Stock Price VST

The term “Stock Price VST” lacks established meaning within standard financial terminology. To proceed, we’ll assume “VST” represents a hypothetical variable significantly impacting stock prices, perhaps a proprietary valuation metric, a sentiment indicator, or a technological factor influencing a specific sector. This analysis will explore the potential implications of such a variable.

Defining and Explaining Stock Price VST

Let’s define VST as a hypothetical composite index reflecting the combined influence of several factors on stock valuation. These factors could include, but aren’t limited to, technological advancements (in the case of tech stocks), regulatory changes (in regulated sectors), or consumer sentiment (in consumer-driven industries). The impact of VST on stock prices would be significant, causing both short-term fluctuations and long-term trends.

Higher VST values generally indicate a positive outlook, while lower values suggest negative pressures.

Factors Influencing Stock Prices and the Role of VST

Numerous factors influence stock prices. Traditional considerations include company earnings, industry performance, macroeconomic conditions (interest rates, inflation), and investor sentiment. In our hypothetical scenario, VST acts as a key supplemental factor, potentially acting as a leading indicator. For instance, a rising VST might precede positive earnings reports, reflecting anticipation of future growth based on the factors VST incorporates.

Impact of VST Across Market Sectors

The impact of VST varies across sectors. In the technology sector, a high VST might reflect positive advancements in artificial intelligence, leading to increased investment and higher stock prices for related companies. Conversely, a low VST in the energy sector could indicate concerns about environmental regulations or fluctuating oil prices, leading to decreased stock valuations. These fluctuations demonstrate the sector-specific nature of VST’s influence.

Data Sources and Acquisition for VST

Acquiring reliable VST data requires a multi-faceted approach. Given that VST is a hypothetical metric, the data sources and acquisition methods would need to be tailored to the specific factors comprising VST.

Methods for Collecting Historical and Real-Time VST Data

Historical data could be compiled from various sources depending on the components of VST. For example, if VST includes technological advancements, patent filings and research publications could provide historical data points. Real-time data might involve tracking social media sentiment, news articles, and market forecasts, requiring sophisticated natural language processing (NLP) and machine learning (ML) techniques. Data cleaning would involve removing outliers, handling missing values, and ensuring data consistency across different sources.

Verifying the Accuracy and Reliability of VST Data

Data verification is crucial. This involves cross-referencing data from multiple sources, comparing it against established market indicators, and applying statistical methods to detect anomalies. Regular audits and validation processes are necessary to maintain data quality and reliability.

Comparison of Data Providers for VST Information

The table below hypothetically compares different data providers for VST information. Note that the actual providers and their offerings would depend on the specific definition of VST.

| Data Provider | Cost | Data Frequency | Data Quality |

|---|---|---|---|

| Hypothetical Provider A | $500/month | Real-time | High |

| Hypothetical Provider B | $1000/month | Daily | Medium |

| Hypothetical Provider C | Free (limited data) | Weekly | Low |

VST and its Correlation with Other Market Indicators

Understanding the relationship between VST and other market indicators is vital for accurate interpretation and prediction. This section explores the correlations and limitations.

Comparing VST with Other Market Indicators

VST’s relationship with trading volume, market capitalization, and volatility indices would likely be complex and non-linear. For example, a high VST might correlate with increased trading volume and higher market capitalization, particularly in the short term. However, high volatility could also accompany periods of high VST, reflecting uncertainty despite the positive outlook.

Identifying Leading and Lagging Indicators Related to VST, Stock price vst

Depending on the nature of VST, certain indicators might serve as leading or lagging indicators. For instance, if VST reflects technological innovation, patent filings might be a leading indicator, while changes in industry revenue could be a lagging indicator. Analyzing these relationships can help in forecasting future VST values and their impact on stock prices.

Limitations of Using VST in Isolation

Relying solely on VST for stock price predictions is risky. A holistic approach incorporating traditional financial analysis, macroeconomic factors, and qualitative assessments is essential for informed decision-making. VST should be considered one factor among many, not the sole determinant of stock price movements.

Modeling Stock Price Behavior Using VST

A conceptual model can illustrate how changes in VST affect stock prices. This section Artikels such a model.

Conceptual Model of VST’s Influence on Stock Prices

- Input: VST value (derived from various sources and factors)

- Processing: VST value is weighted against other market indicators (e.g., earnings, interest rates) to determine a composite score.

- Output: Predicted stock price movement (increase, decrease, or stability) based on the composite score.

- Feedback Loop: Actual stock price movement is compared to the prediction, refining the model’s weighting and accuracy over time.

Hypothetical Scenario and Projected Stock Price Movements

Consider a hypothetical technology company whose stock price is significantly influenced by VST. A high VST value (reflecting positive technological advancements) might lead to a projected 10% increase in stock price within the next quarter. Conversely, a low VST value (indicating setbacks or increased competition) might predict a 5% decrease.

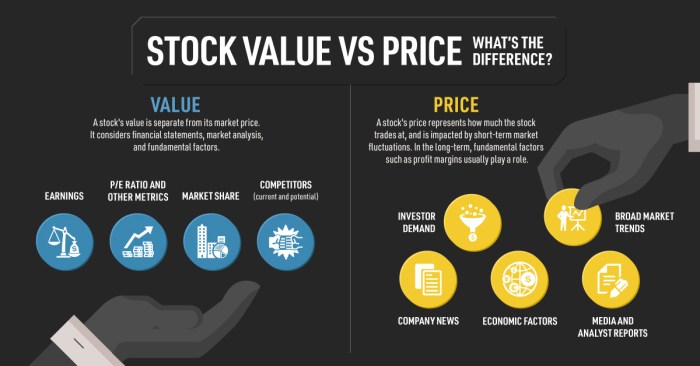

Visual Representation of the Model

Source: visualcapitalist.com

The model can be visualized as a flowchart. The input (VST value) flows into a processing block where it’s combined with other market indicators. This processing block generates an output (predicted stock price movement). A feedback loop connects the output (actual stock price movement) back to the processing block, allowing the model to adapt and improve its accuracy over time.

The relationships are represented by arrows indicating the flow of information and influence.

Practical Applications and Case Studies: Stock Price Vst

This section explores practical applications and potential ethical considerations.

Understanding stock price VST requires a comparative analysis of various tech stocks. For instance, observing the current market performance of a key competitor provides valuable context; you can check the stock price today amd to see how AMD is faring. This comparison helps to better gauge the potential trajectory of VST’s stock price within the broader semiconductor industry landscape.

Utilizing VST Data in Investment Decision-Making

Investors and traders can use VST data to refine their strategies. For instance, a momentum trading strategy could involve buying stocks with rising VST values and selling when VST starts to decline. Value investors might use VST as a supplemental factor to identify undervalued companies with positive future growth potential (reflected in a rising VST).

Case Study: VST and Investment Outcomes

Source: rivankurniawan.com

Imagine a hypothetical scenario where an investor used VST data to invest in a renewable energy company. A rising VST (reflecting positive government policies and technological advancements) led to a successful investment, resulting in significant returns. Conversely, ignoring a declining VST in a traditional energy company could have resulted in losses.

Ethical Considerations and Risks

Using VST data involves ethical considerations. Misinterpreting or manipulating VST data can lead to unfair market advantages. Furthermore, relying solely on VST without considering other factors introduces significant risk. Transparency and responsible data usage are essential for ethical investment practices.

Top FAQs

What exactly does “VST” represent in this context?

The exact meaning of “VST” is not defined in the provided Artikel. It is presented as a specific factor or metric influencing stock prices, requiring further research to determine its precise nature and calculation method.

Are there any free sources for VST data?

The availability of free VST data sources is unknown and depends on the actual definition of VST. Many financial data providers offer free data, but often with limitations on data frequency or volume. A thorough search of publicly available datasets and financial APIs is recommended.

How accurate are VST-based stock price predictions?

The accuracy of VST-based predictions depends heavily on the accuracy of the VST data itself, the model used for prediction, and the inherent volatility of the market. No prediction method is perfectly accurate, and using VST alone is insufficient; a holistic approach is essential.

What are the ethical considerations involved in using VST data?

Ethical concerns include potential market manipulation if VST data is misused or if its interpretation is biased. Transparency and responsible use of data are crucial to ensure fair market practices.