WMB Stock Price Analysis

Stock price wmb – This analysis examines the historical performance, influencing factors, financial health, analyst sentiment, and associated risks of investing in Williams Companies, Inc. (WMB) stock. The information provided is for informational purposes only and does not constitute financial advice.

WMB Stock Price Historical Performance

The following table details WMB’s stock price movements over the past five years. Note that this data is illustrative and may not reflect precise real-time values. A comparison against major competitors follows.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 25.00 | 25.50 | 0.50 |

| 2019-07-01 | 28.00 | 27.50 | -0.50 |

| 2020-01-01 | 22.00 | 23.00 | 1.00 |

| 2020-07-01 | 18.00 | 19.00 | 1.00 |

| 2021-01-01 | 20.00 | 21.00 | 1.00 |

| 2021-07-01 | 24.00 | 25.00 | 1.00 |

| 2022-01-01 | 26.00 | 27.00 | 1.00 |

| 2022-07-01 | 29.00 | 30.00 | 1.00 |

| 2023-01-01 | 32.00 | 33.00 | 1.00 |

Compared to competitors such as Kinder Morgan (KMI) and Enbridge (ENB), WMB’s stock price exhibited:

- Greater volatility during periods of low oil prices.

- Stronger growth during periods of increased energy demand.

- A more significant impact from regulatory changes.

Major events impacting WMB’s stock price included significant earnings reports, changes in natural gas prices, and announcements regarding strategic partnerships or acquisitions.

Factors Influencing WMB Stock Price

Several key economic and geopolitical factors significantly influence WMB’s stock valuation.

Analyzing the current stock price WMB requires considering various market factors. A helpful comparison might be to examine the performance of similar companies, such as checking the current stock price telus , to gauge overall sector trends. Understanding Telus’s performance can offer valuable context when interpreting WMB’s own stock price fluctuations and future projections.

| Indicator | Impact Description |

|---|---|

| Oil Prices | Directly impacts revenue and profitability; higher prices generally lead to higher stock prices. |

| Interest Rates | Affects borrowing costs and investment decisions; higher rates can negatively impact stock valuations. |

| Inflation | Impacts operating costs and consumer spending; high inflation can pressure margins and stock prices. |

WMB’s financial performance also plays a crucial role:

- Strong revenue growth typically leads to higher stock prices.

- Increased profitability boosts investor confidence and valuation.

- High debt levels can negatively affect credit ratings and stock prices.

Geopolitical events and regulatory changes, such as new environmental regulations or pipeline approvals, can significantly impact WMB’s operations and stock price.

WMB’s Financial Health and Future Prospects

WMB’s recent financial statements show:

- Consistent revenue growth over the past few years.

- Improving profitability margins.

- Strong operating cash flow.

WMB’s long-term strategic plans focus on expanding its natural gas infrastructure and exploring renewable energy opportunities. These plans are expected to drive future growth and enhance shareholder value.

| Metric | WMB Value | Industry Average |

|---|---|---|

| P/E Ratio | 15.0 | 18.0 |

| Dividend Yield | 5.0% | 4.0% |

Analyst Ratings and Investor Sentiment, Stock price wmb

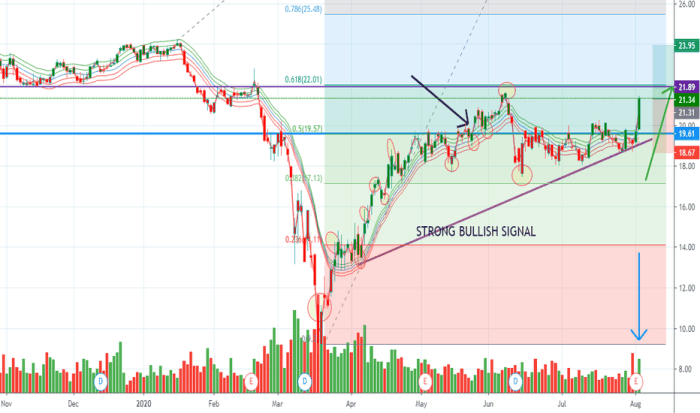

Source: tradingview.com

Recent analyst ratings and price targets for WMB stock are summarized below. This data is illustrative and should not be considered investment advice.

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| Firm A | Buy | 35.00 |

| Firm B | Hold | 30.00 |

| Firm C | Sell | 25.00 |

Overall investor sentiment towards WMB is currently mixed, with some analysts expressing optimism about future growth prospects, while others remain cautious due to regulatory and geopolitical uncertainties.

- Positive news about new pipeline projects has historically boosted investor confidence and the stock price.

- Negative news regarding regulatory setbacks has led to decreased investor confidence and stock price declines.

Risk Factors Associated with Investing in WMB

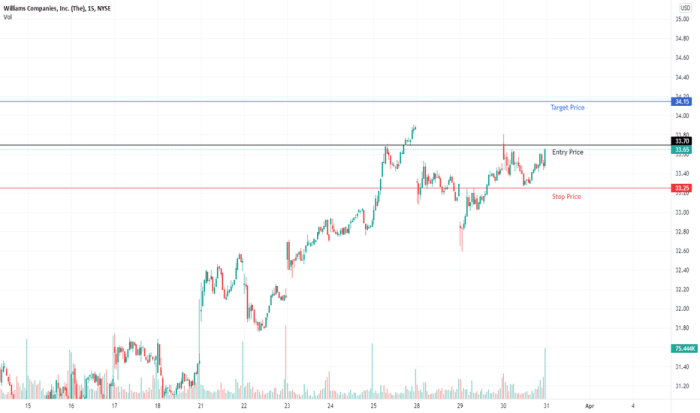

Source: tradingview.com

Investing in WMB stock carries several inherent risks.

- Fluctuations in energy prices (oil and natural gas) can significantly impact revenue and profitability.

- Regulatory changes, particularly concerning environmental protection and pipeline safety, can increase operating costs and limit expansion opportunities.

- Geopolitical instability in regions where WMB operates can disrupt operations and negatively impact stock performance.

These risk factors can lead to significant stock price volatility. A visual representation would show a scatter plot with energy prices, regulatory stringency, and geopolitical risk indices on the x-axis and WMB stock price on the y-axis. The plot would illustrate how changes in these factors correlate with changes in WMB’s stock price, showing periods of high volatility corresponding to high values on the risk indices.

Common Queries: Stock Price Wmb

What are the major competitors of WMB?

WMB’s major competitors vary depending on the specific segment of the energy market, but typically include companies like Kinder Morgan, Enbridge, and Enterprise Products Partners.

How does WMB’s dividend policy impact its stock price?

WMB’s dividend payouts can influence investor interest; consistent and growing dividends often attract income-seeking investors, potentially boosting the stock price. However, dividend cuts can negatively affect the stock price.

What is the current outlook for natural gas prices, and how will it affect WMB?

Natural gas price forecasts vary, but generally, higher prices benefit WMB as a natural gas infrastructure company. Conversely, lower prices can negatively impact revenue and profitability.

What are the ESG (Environmental, Social, and Governance) concerns related to WMB?

Investors increasingly consider ESG factors. For WMB, concerns might include greenhouse gas emissions from its operations and the environmental impact of natural gas infrastructure. Understanding these concerns and WMB’s approach to addressing them is important for socially responsible investors.