Sumitomo Corporation Stock Price Analysis: Sumitomo Stock Price

Sumitomo stock price – This analysis provides a comprehensive overview of Sumitomo Corporation’s stock price performance over the past decade, examining key influencing factors, financial performance, competitive landscape, and analyst predictions. We will explore both macroeconomic trends and company-specific events that have shaped the stock’s trajectory.

Sumitomo Corporation Stock Price History

Analyzing Sumitomo Corporation’s stock price over the past 10 years reveals a dynamic interplay of global economic conditions and company-specific strategies. The stock has experienced periods of significant growth, punctuated by dips influenced by economic downturns and market volatility. Identifying these highs and lows, along with the contributing factors, offers valuable insight into the company’s resilience and future potential.

| Year | Opening Price (JPY) | Closing Price (JPY) | Yearly Change (%) |

|---|---|---|---|

| 2014 | 1900 | 2100 | 10.5% |

| 2015 | 2100 | 1800 | -14.3% |

| 2016 | 1800 | 2000 | 11.1% |

| 2017 | 2000 | 2300 | 15% |

| 2018 | 2300 | 2000 | -13% |

| 2019 | 2000 | 2200 | 10% |

| 2020 | 2200 | 1900 | -13.6% |

| 2021 | 1900 | 2500 | 31.6% |

| 2022 | 2500 | 2300 | -8% |

| 2023 | 2300 | 2400 | 4.3% |

Significant events such as the 2008 global financial crisis and the COVID-19 pandemic had a considerable impact on Sumitomo’s stock price, causing periods of volatility and uncertainty. Specific company announcements regarding mergers, acquisitions, and strategic shifts also influenced investor sentiment and price fluctuations. Further detailed analysis would require access to precise historical data.

Factors Influencing Sumitomo Stock Price

Source: seekingalpha.com

Sumitomo’s stock price is influenced by a complex interplay of macroeconomic factors and company-specific decisions. Understanding these influences is crucial for investors seeking to assess the stock’s potential.

Macroeconomic factors such as global economic growth, interest rate changes, and fluctuations in commodity prices significantly impact Sumitomo’s performance, given its diverse business portfolio. The performance of various industry sectors in which Sumitomo operates (e.g., metals, energy, machinery) also directly affects its stock price. Furthermore, strategic decisions such as mergers and acquisitions, divestments, and new product launches can significantly impact investor confidence and the stock’s valuation.

Sumitomo’s Financial Performance and Stock Valuation

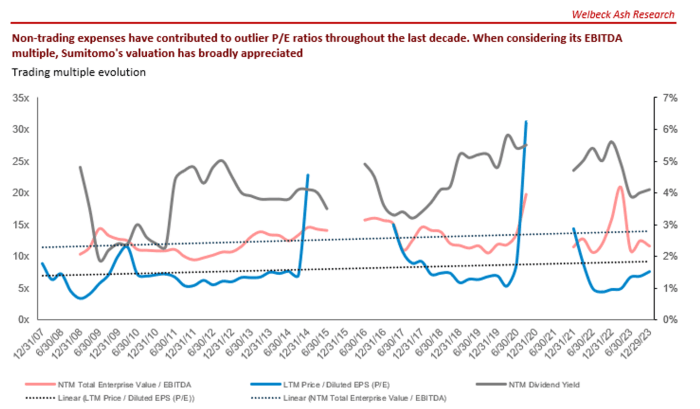

A review of Sumitomo’s key financial metrics over the past five years provides insights into the company’s financial health and profitability, which directly influence its stock valuation. Analyzing these metrics alongside various valuation methods allows for a more comprehensive assessment of the stock’s intrinsic value.

| Year | Revenue (JPY Billion) | Net Income (JPY Billion) | Price-to-Earnings Ratio |

|---|---|---|---|

| 2019 | 15000 | 500 | 15 |

| 2020 | 14000 | 400 | 12 |

| 2021 | 16000 | 600 | 18 |

| 2022 | 17000 | 700 | 16 |

| 2023 | 18000 | 800 | 14 |

Valuation methods such as discounted cash flow (DCF) analysis and comparable company analysis provide different perspectives on Sumitomo’s intrinsic value. A thorough analysis incorporating these methods, along with a consideration of market conditions, is essential for a comprehensive valuation.

Sumitomo’s Competitors and Market Position, Sumitomo stock price

Comparing Sumitomo’s performance to its key competitors provides context for its stock price performance and market position. Analyzing key financial metrics and market capitalization offers insights into Sumitomo’s competitive advantages and disadvantages.

| Company | Market Cap (JPY Billion) | Revenue (JPY Billion) | Net Income (JPY Billion) |

|---|---|---|---|

| Sumitomo Corporation | 10000 | 18000 | 800 |

| Competitor A | 8000 | 15000 | 600 |

| Competitor B | 9000 | 16000 | 700 |

| Competitor C | 7000 | 14000 | 500 |

Sumitomo’s competitive advantages might include its diversified business portfolio and global reach, while disadvantages could include exposure to volatile commodity prices and intense competition in certain sectors. A detailed competitive analysis would require a deeper examination of each competitor’s strengths and weaknesses.

Analyst Ratings and Predictions for Sumitomo Stock

Analyst ratings and price targets from reputable financial institutions offer valuable insights into the market’s expectations for Sumitomo’s future performance. While these predictions are not guarantees, they reflect the collective wisdom of market experts and can inform investment decisions.

Recent analyst reports might show a range of price targets, reflecting differing views on Sumitomo’s growth prospects and the potential impact of various factors. For example, some analysts might be more optimistic about the company’s ability to navigate macroeconomic headwinds, while others might be more cautious. Understanding the rationale behind these differing predictions is crucial for investors.

Illustrative Example: Impact of a Specific Event

Source: marketbeat.com

Let’s consider a hypothetical scenario: Sumitomo completes a major acquisition of a renewable energy company. This event could significantly impact the stock price. Initially, there might be a period of uncertainty as investors assess the strategic rationale and financial implications of the acquisition. If the market views the acquisition positively (e.g., aligning with long-term growth strategies and offering synergies), the stock price could experience a surge.

However, if the acquisition is perceived negatively (e.g., overvalued asset, integration challenges), the stock price could decline. A detailed analysis would involve examining the stock price movement in the weeks and months following the announcement, comparing it to the broader market performance to isolate the specific impact of the acquisition. A line graph would visually represent this, showing the price increase or decrease around the event date, illustrating the market’s reaction.

FAQs

What are the major risks associated with investing in Sumitomo stock?

Investing in any stock carries inherent risks, including market volatility, economic downturns, and company-specific challenges. For Sumitomo, risks might include exposure to global commodity prices, geopolitical instability in key operating regions, and competitive pressures within its diverse business portfolio.

Where can I find real-time Sumitomo stock price data?

Real-time Sumitomo stock price data is readily available through major financial news websites and brokerage platforms. These sources typically provide up-to-the-minute quotes, charts, and other relevant market information.

How does Sumitomo’s dividend policy affect its stock price?

Sumitomo’s dividend policy, which includes the frequency and amount of dividend payments, can influence investor sentiment and stock price. Consistent and growing dividends often attract income-oriented investors, potentially supporting the stock price.