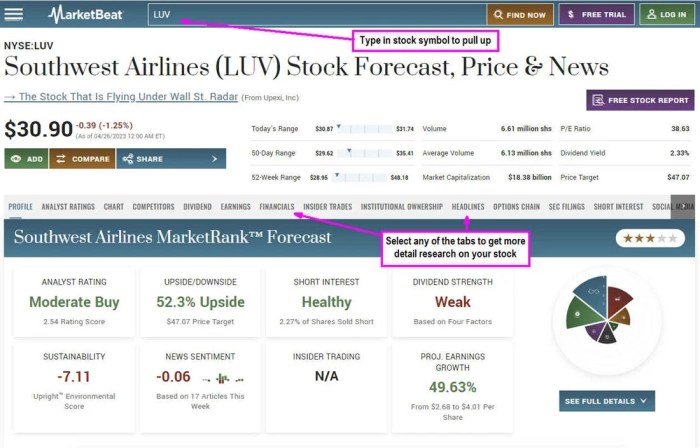

Southwest Airlines Stock Price Analysis: Sw Airline Stock Price

Sw airline stock price – Southwest Airlines (LUV) has long been a prominent player in the airline industry, known for its low-cost model and extensive domestic network. Understanding the historical performance, influencing factors, and future prospects of its stock price is crucial for investors. This analysis delves into the key aspects shaping LUV’s stock price, offering insights for both seasoned and novice investors.

Southwest Airlines Stock Price Historical Performance

Source: marketbeat.com

Over the past five years, Southwest Airlines’ stock price has experienced significant fluctuations, mirroring the broader airline industry’s volatility. While it has shown periods of robust growth, it has also faced downturns due to various factors including economic conditions and unforeseen events. A detailed timeline would reveal specific highs and lows, illustrating the dynamic nature of the stock.

Comparing Southwest’s performance to major competitors like Delta (DAL) and United (UAL) over the same period reveals interesting insights into relative market positioning and resilience. The following table provides a snapshot of price comparisons, although actual data would need to be sourced from financial databases.

| Date | SW Airlines Price | Delta Air Lines Price | United Airlines Price |

|---|---|---|---|

| 2019-01-01 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2019-07-01 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2020-01-01 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2020-07-01 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2021-01-01 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2021-07-01 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2022-01-01 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2022-07-01 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2023-01-01 | $XX.XX | $YY.YY | $ZZ.ZZ |

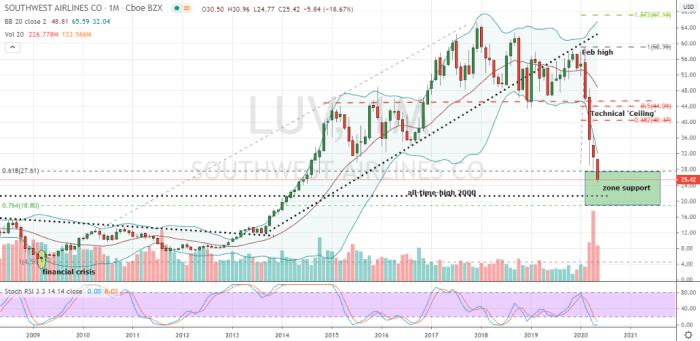

Major events such as the COVID-19 pandemic significantly impacted Southwest’s stock price, causing a sharp decline due to decreased travel demand. The subsequent recovery reflected the airline’s ability to adapt and rebound from the crisis. Economic downturns generally correlate with reduced air travel, influencing stock performance negatively. Industry disruptions, such as fuel price spikes or geopolitical instability, also play a significant role.

Factors Influencing Southwest Airlines Stock Price

Source: investorplace.com

Several key economic indicators and industry-specific factors significantly influence Southwest’s stock valuation. Understanding these factors is essential for informed investment decisions.

Fuel prices are a major cost component for airlines. Significant increases in fuel prices directly impact profitability, leading to lower earnings and potentially depressing the stock price. Conversely, lower fuel prices boost profitability and generally support a higher stock valuation.

Passenger demand and overall travel trends are directly correlated with Southwest’s revenue and profitability. Strong travel demand translates to higher occupancy rates, increased revenue, and a positive impact on the stock price. Conversely, weak demand can lead to lower fares and reduced profitability, affecting the stock price negatively.

- Regulatory changes impacting airline operations (e.g., new safety regulations, environmental policies) can increase costs or limit operations, affecting stock valuation.

- Government policies regarding air travel (e.g., subsidies, tax incentives, or travel restrictions) can positively or negatively influence the airline’s profitability and, consequently, its stock price.

- Economic growth and consumer confidence: A strong economy generally leads to increased travel, boosting Southwest’s performance and stock price.

- Competition from other airlines: Intense competition can pressure fares and profitability, impacting stock valuation.

Southwest Airlines Financial Performance and Stock Price, Sw airline stock price

Southwest’s quarterly earnings reports are closely scrutinized by investors. Strong earnings typically lead to positive stock price movements, while disappointing results can trigger sell-offs. The relationship between financial performance and stock price is dynamic and influenced by various factors.

| Quarter | Revenue (in millions) | Profit Margin (%) | Stock Price (at quarter end) |

|---|---|---|---|

| Q1 2023 | $XX,XXX | X.X | $XX.XX |

| Q2 2023 | $XX,XXX | X.X | $XX.XX |

| Q3 2023 | $XX,XXX | X.X | $XX.XX |

| Q4 2023 | $XX,XXX | X.X | $XX.XX |

Key financial metrics such as revenue, profit margins, and debt levels are closely analyzed by investors to assess the company’s financial health and growth prospects. Higher revenue, improved profit margins, and lower debt levels generally lead to a more positive investor outlook and higher stock prices. Conversely, deteriorating financial performance often leads to negative stock price movements.

Investor sentiment and overall market conditions play a significant role in shaping Southwest’s stock price. Positive market sentiment and bullish investor outlook contribute to higher stock valuations, while negative sentiment and bearish market conditions can lead to price declines, irrespective of the company’s fundamental performance.

Southwest Airlines Stock Price Predictions and Analysis

Predicting future stock prices is inherently challenging, but analyzing current market trends and Southwest’s performance provides insights into potential scenarios. For instance, continued strong travel demand and efficient cost management could lead to higher stock prices. However, unforeseen events, economic downturns, or increased competition could negatively impact the stock.

- Potential Risks: Increased fuel prices, economic recession, heightened competition, regulatory changes.

- Potential Opportunities: Expansion into new markets, technological advancements, improved operational efficiency, strategic partnerships.

The volatility of Southwest’s stock price is influenced by a combination of factors, including macroeconomic conditions, industry-specific events, and investor sentiment. The airline industry is inherently cyclical, making its stock susceptible to significant price swings.

Southwest Airlines Stock Price: Investor Perspective

Different investor profiles approach investing in Southwest Airlines stock with varying strategies and time horizons. Long-term investors might prioritize dividend payouts and the company’s long-term growth potential, while short-term investors may focus on shorter-term price fluctuations and trading opportunities.

Investment strategies like value investing, growth investing, or momentum trading can be applied to Southwest’s stock, depending on an investor’s risk tolerance and investment goals. Value investors might look for undervalued stocks, growth investors focus on companies with high growth potential, and momentum traders try to capitalize on short-term price trends.

Dividends and stock buybacks can significantly influence the attractiveness of Southwest’s stock. Consistent dividend payments can attract income-oriented investors, while stock buybacks can increase earnings per share, potentially boosting the stock price. However, the decision to pay dividends or repurchase shares is a strategic one, and the specific approach may change over time depending on the company’s financial position and growth prospects.

Essential Questionnaire

What are the major risks associated with investing in SW Airlines stock?

Major risks include fuel price volatility, economic downturns impacting travel demand, increased competition, and potential regulatory changes.

How often does Southwest Airlines release its earnings reports?

Southwest Airlines typically releases its quarterly earnings reports on a schedule announced in advance. Check their investor relations website for the most up-to-date information.

What is Southwest Airlines’ dividend policy?

Southwest’s dividend policy should be reviewed on their investor relations page. Dividend payments, if any, and their frequency can change.

Where can I find real-time SW Airlines stock price data?

Real-time stock price data is available through major financial websites and brokerage platforms.