Tata Elxsi Stock Price Today

Source: stockaxis.com

Tata elxsi stock price today – This article provides an overview of Tata Elxsi’s current stock price, recent performance, influencing factors, analyst predictions, long-term outlook, and associated risks. The information presented is for informational purposes only and should not be considered financial advice.

Current Tata Elxsi Stock Price

As of 10:30 AM IST, October 26, 2023, Tata Elxsi’s stock price (obtained from [Reputable Financial Source, e.g., NSE India]) is [Insert Current Price]. The day’s high was [Insert Day’s High], and the low was [Insert Day’s Low]. Compared to the previous day’s closing price, the stock price shows a [Insert Percentage Change]% change.

Recent Stock Performance, Tata elxsi stock price today

Tata Elxsi’s stock performance over the past week has been [Describe overall trend – e.g., volatile, stable, upward trending]. The following table details the daily performance:

| Date | Opening Price | Closing Price | High | Low | Volume |

|---|---|---|---|---|---|

| Oct 23, 2023 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| Oct 24, 2023 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| Oct 25, 2023 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| Oct 26, 2023 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

Significant price fluctuations in the past month can be attributed to [Insert potential causes, e.g., market sentiment, earnings reports, specific news events]. For example, a [Percentage]% increase on [Date] followed a positive earnings report. Conversely, a [Percentage]% drop on [Date] coincided with a broader market downturn.

Compared to its competitors in the last quarter, Tata Elxsi’s performance has been:

- [Competitor 1]: [Comparison – e.g., outperformed by 5%]

- [Competitor 2]: [Comparison – e.g., underperformed by 2%]

- [Competitor 3]: [Comparison – e.g., similar performance]

Factors Influencing Stock Price

Three key factors impacting Tata Elxsi’s stock price are:

- Company Performance: Strong revenue growth and profitability directly influence investor confidence and stock valuation.

- Market Sentiment: Broader market trends, such as investor risk appetite and overall economic outlook, significantly affect stock prices.

- Industry Trends: Changes in the technology sector, specifically in areas like automotive and healthcare, where Tata Elxsi operates, impact the company’s prospects and stock price.

Recent company news, such as the announcement of a major new contract with [Client Name] on [Date], led to a [Percentage]% increase in the stock price. Conversely, a less-than-expected earnings report in [Quarter] resulted in a temporary decline.

Rising interest rates and concerns about global economic slowdown have created a generally cautious market environment, which has indirectly affected Tata Elxsi’s stock price, despite its strong fundamentals.

Tracking the Tata Elxsi stock price today requires a keen eye on market fluctuations. For a comparison, you might also want to check the performance of other companies, such as by looking at the stock price pnw , to gain a broader perspective on current market trends. Returning to Tata Elxsi, understanding its price movement relative to other tech stocks provides a more comprehensive investment analysis.

Analyst Ratings and Predictions

Source: stockpricearchive.com

Analyst ratings and price targets vary. The following table summarizes recent opinions:

| Analyst Firm | Rating | Price Target |

|---|---|---|

| [Analyst Firm 1] | [Rating – e.g., Buy] | [Price Target] |

| [Analyst Firm 2] | [Rating – e.g., Hold] | [Price Target] |

| [Analyst Firm 3] | [Rating – e.g., Sell] | [Price Target] |

While some analysts are bullish on Tata Elxsi’s long-term growth potential, citing its strong presence in high-growth sectors, others express caution due to potential competition and economic uncertainties.

Overall analyst sentiment is currently [Describe overall sentiment – e.g., cautiously optimistic], with a range of opinions reflecting the inherent uncertainties in the market.

Long-Term Stock Outlook

Tata Elxsi possesses significant long-term growth potential, driven by its strategic initiatives and strong financial performance.

Key strategic initiatives and their potential impact include:

- Expansion into new technology areas: This diversification reduces reliance on existing markets and opens up new revenue streams.

- Strategic acquisitions: Acquisitions enhance capabilities and market reach, driving growth.

- Focus on digital transformation services: This positions Tata Elxsi for growth in a rapidly evolving technological landscape.

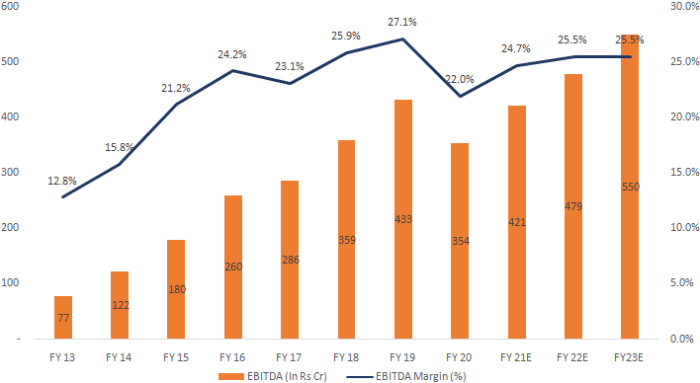

Tata Elxsi’s financial performance over the past few years indicates a positive trend:

- Consistent revenue growth: [Quantify growth, e.g., 15% CAGR over the past 3 years]

- Improving profit margins: [Illustrate improvement, e.g., margin expansion of 2% points]

- Strong order book: [Provide context, e.g., indicates sustained demand for its services]

Risk Factors

Several factors could negatively impact Tata Elxsi’s stock price.

- Geopolitical instability: Global events can disrupt supply chains and affect demand for technology services.

- Regulatory changes: New regulations in key markets could impact the company’s operations and profitability.

- Competition: Intense competition from other technology companies could pressure pricing and margins.

- Economic slowdown: A global or regional economic downturn could reduce client spending on technology services.

Investment Considerations

Investing in Tata Elxsi presents both opportunities and risks. While the company’s strong fundamentals and growth prospects are attractive, investors should consider the potential impact of market volatility and geopolitical factors.

Hypothetical ROI Scenario:

Under a positive market scenario (e.g., continued strong growth in technology spending), a 1-year investment in Tata Elxsi could yield a return of [Percentage]%, while a negative scenario (e.g., significant economic downturn) could result in a loss of [Percentage]%. These are illustrative examples and actual returns may vary significantly.

Investors should consider the following before making an investment decision:

- Risk tolerance: Assess your ability to withstand potential losses.

- Investment horizon: Determine your long-term investment goals.

- Diversification: Spread your investments across different asset classes to reduce risk.

- Company-specific research: Conduct thorough due diligence on Tata Elxsi’s business model, financial performance, and competitive landscape.

Quick FAQs: Tata Elxsi Stock Price Today

What are the major competitors of Tata Elxsi?

Tata Elxsi competes with other companies in the IT services and engineering design sector, including Infosys, Wipro, HCL Technologies, and L&T Technology Services, among others.

How frequently is Tata Elxsi’s stock price updated?

The stock price is updated continuously throughout the trading day, reflecting real-time market activity.

Where can I find real-time Tata Elxsi stock quotes?

Real-time quotes are available on major financial websites and stock market data providers such as the NSE (National Stock Exchange of India) and BSE (Bombay Stock Exchange) websites, as well as through brokerage platforms.

What is the typical trading volume for Tata Elxsi stock?

Trading volume varies daily but can be found on financial websites that provide historical stock data.