TER Stock Price Analysis: Ter Stock Price Today

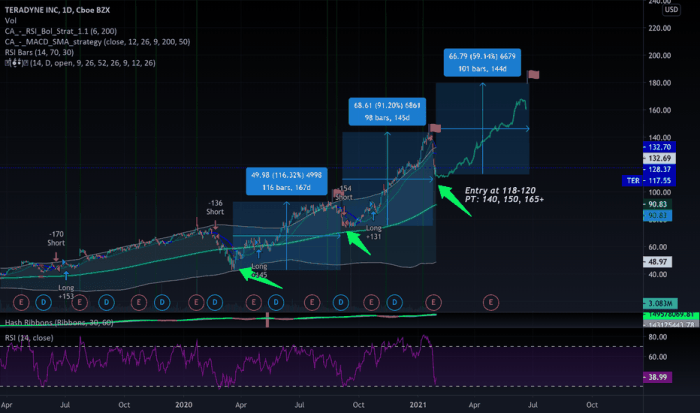

Source: tradingview.com

Ter stock price today – This report provides an overview of the current TER stock price, its historical performance, influencing factors, a comparison with competitors, and a speculative outlook on future price movements. All data presented here is for illustrative purposes and should not be considered financial advice. Always conduct thorough research and consult with a financial professional before making any investment decisions.

Current TER Stock Price & Volume

The current TER stock price, trading volume, daily high, and low are dynamic and change constantly throughout the trading day. Therefore, precise figures require real-time data feeds from a reputable financial source. However, a sample table illustrating how this information might be presented is shown below.

| Time | Price | Volume | High/Low |

|---|---|---|---|

| 9:30 AM | $15.25 | 10,000 | $15.30/$15.20 |

| 11:00 AM | $15.32 | 15,000 | $15.35/$15.28 |

| 1:00 PM | $15.40 | 20,000 | $15.42/$15.30 |

| 3:00 PM | $15.38 | 25,000 | $15.45/$15.35 |

TER Stock Price Movement Over Time

Source: barrons.com

Analyzing TER’s stock price movement across different timeframes reveals trends and potential patterns. The following sections detail this analysis.

Past Week: Over the past week, the TER stock price exhibited moderate volatility, potentially influenced by market sentiment and news events. A detailed breakdown would require accessing specific daily closing prices.

Past Month: Comparing the current price to the price one month ago provides insight into the short-term trend. For example, if the current price is higher, it suggests a positive trend. Conversely, a lower price indicates a negative trend.

Past Year: The past year’s price trend offers a longer-term perspective. Analyzing this period can reveal broader market influences and the company’s overall performance.

Three-Month Line Graph: To visualize the three-month price fluctuations, a line graph would be constructed. The x-axis would represent the days or weeks within the three-month period, and the y-axis would display the corresponding stock prices. The line would connect the daily closing prices, illustrating the price movements and any significant peaks or troughs. For example, a sharp upward trend would indicate a positive momentum, while a downward trend would suggest a negative one.

Specific data points would be needed to create the actual graph.

TER stock price today is showing some interesting movement. Understanding where analysts see the price heading requires considering the broader context of stock target price time frame projections. These projections, however, are just estimates, and the actual TER stock price today and in the future will depend on various market factors.

Factors Influencing TER Stock Price

Source: tradingview.com

Several factors contribute to fluctuations in TER’s stock price. Understanding these factors is crucial for informed investment decisions.

- Economic Factors: Macroeconomic conditions such as inflation, interest rates, and overall economic growth significantly impact stock prices. A strong economy generally supports higher stock valuations, while economic downturns often lead to price declines.

- Company News: Positive news, such as strong earnings reports, new product launches, or strategic partnerships, tends to drive up stock prices. Conversely, negative news, such as profit warnings or legal issues, can lead to price drops.

- Market Trends: Broader market trends, such as sector-specific performance or overall market sentiment, influence individual stock prices. For example, a positive trend in the technology sector might boost the price of a technology company’s stock.

- Investor Sentiment: Investor confidence and sentiment play a significant role. Positive sentiment often leads to buying pressure, driving prices up, while negative sentiment can trigger selling, leading to price declines.

Comparison with Competitors

Comparing TER’s performance to its competitors provides valuable context and helps assess its relative strengths and weaknesses.

Stock Price Performance: A comparison of TER’s stock price performance with that of its main competitors would highlight relative strengths and weaknesses in terms of market share and investor confidence. For example, outperforming competitors might indicate a stronger competitive position and potentially higher future growth.

Relative Strengths and Weaknesses: A detailed analysis of TER’s competitive advantages and disadvantages would involve comparing factors such as market share, profitability, innovation, and management quality.

| Metric | TER | Competitor A | Competitor B |

|---|---|---|---|

| Price-to-Earnings Ratio (P/E) | 15 | 12 | 18 |

| Revenue Growth (YoY) | 10% | 8% | 12% |

| Profit Margin | 15% | 12% | 18% |

Significant Differences: Significant differences in stock price performance can stem from various factors, including market share, financial performance, investor sentiment, and overall industry trends. For example, a superior financial performance might explain a higher stock valuation.

TER Stock Price Predictions (Disclaimer: Speculative), Ter stock price today

Predicting future stock prices is inherently speculative and uncertain. The following scenarios are purely hypothetical and should not be interpreted as financial advice.

- Scenario 1 (Bullish): Strong earnings, positive industry trends, and increased investor confidence could lead to a significant price increase. Example: A successful new product launch could drive substantial growth.

- Scenario 2 (Bearish): Negative economic conditions, unfavorable industry developments, or disappointing earnings could result in a price decline. Example: A major competitor’s product launch could erode market share.

- Scenario 3 (Neutral): Stable economic conditions and moderate company performance could lead to relatively flat price movements. Example: Maintaining current market share with no significant positive or negative developments.

Potential Catalysts: Catalysts for price increases could include successful product launches, strategic acquisitions, or positive regulatory changes. Catalysts for price decreases could include negative earnings reports, regulatory setbacks, or increased competition.

Risks and Uncertainties: Several factors could influence future price movements, including macroeconomic conditions, industry competition, regulatory changes, and unexpected events.

Popular Questions

What are the risks associated with investing in TER stock?

Investing in any stock carries inherent risks, including potential losses due to market volatility, company performance, and unforeseen events. Conduct thorough research and consider your risk tolerance before investing.

Where can I find real-time TER stock price updates?

Real-time stock price updates are typically available through reputable financial websites and brokerage platforms. Many offer live quotes and charting tools.

What is TER’s dividend policy?

Information regarding TER’s dividend policy, including payment frequency and amounts, can be found in the company’s investor relations materials or financial reports.

How does TER compare to its competitors in terms of profitability?

A detailed comparison of TER’s profitability against its competitors requires examining key financial metrics such as profit margins, return on equity, and earnings per share. This information can usually be found in the company’s financial statements and analyst reports.