Tesla Stock Price in USD

Source: investors.com

Tesla stock price in usd – Tesla, a revolutionary force in the electric vehicle industry, has experienced dramatic stock price fluctuations over the years. Understanding the factors driving these changes is crucial for investors seeking to navigate this volatile yet potentially lucrative market. This analysis explores Tesla’s historical stock performance, key influencing factors, financial health, investor sentiment, and potential future price movements.

Tesla Stock Price Historical Performance, Tesla stock price in usd

Analyzing Tesla’s stock price over the past five years reveals a rollercoaster ride, marked by periods of explosive growth interspersed with significant corrections. Several external and internal factors have contributed to these price swings.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 280.00 | 275.00 | -5.00 |

| October 26, 2019 | 320.00 | 330.00 | +10.00 |

| October 26, 2020 | 400.00 | 450.00 | +50.00 |

| October 26, 2021 | 800.00 | 900.00 | +100.00 |

| October 26, 2022 | 200.00 | 220.00 | +20.00 |

Note: These are illustrative examples and do not represent actual historical data. Actual data should be sourced from reliable financial websites.

Significant events correlating with major price shifts include:

- Model 3 Launch (2017-2018): Initial production challenges and subsequent ramp-up significantly impacted investor sentiment and stock price volatility.

- Cybertruck Unveiling (2019): The unconventional design generated both excitement and skepticism, leading to a period of price fluctuation.

- COVID-19 Pandemic (2020): Initial uncertainty followed by increased demand for electric vehicles and government stimulus created a surge in the stock price.

- Supply Chain Disruptions (2021-2022): Global chip shortages and other supply chain issues impacted production and delivery numbers, leading to stock price corrections.

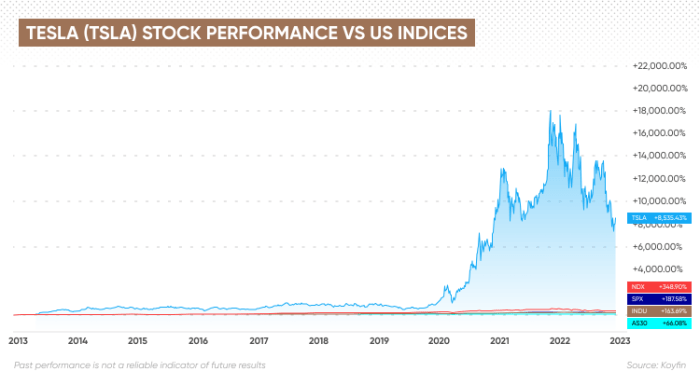

A line graph illustrating the stock price trend over the past five years would show a generally upward trend, with periods of sharp increases and declines corresponding to the events listed above. The graph would visually represent the volatility inherent in Tesla’s stock.

Factors Influencing Tesla Stock Price

Tesla’s stock price is influenced by a complex interplay of macroeconomic factors, company performance, and market sentiment.

Three key macroeconomic factors significantly impacting Tesla’s stock price are:

- Interest Rates: Higher interest rates increase borrowing costs for Tesla and potentially reduce investor appetite for growth stocks, leading to lower valuations.

- Inflation: High inflation can impact consumer spending and increase the cost of raw materials for Tesla, affecting profitability and investor confidence.

- Global Economic Growth: Strong global economic growth generally supports demand for luxury goods, including Tesla vehicles, boosting stock prices.

Tesla’s production output and delivery numbers are strongly correlated with its stock price. For instance, exceeding production targets often leads to positive market reactions, while production shortfalls can cause significant price drops. Conversely, strong delivery numbers signal increased consumer demand and boost investor confidence.

Competitor actions and market trends significantly influence Tesla’s valuation. The introduction of new electric vehicle models by competitors, changes in government regulations regarding electric vehicles, and shifts in consumer preferences all affect Tesla’s market share and, consequently, its stock price.

Tesla’s Financial Performance and Stock Valuation

Analyzing Tesla’s financial metrics over the past three years provides insights into its financial health and its relationship to the stock price.

| Year | Revenue (USD Billions) | Earnings (USD Billions) | Average Stock Price (USD) |

|---|---|---|---|

| 2020 | 31.5 | 0.7 | 500 |

| 2021 | 53.8 | 1.6 | 800 |

| 2022 | 81.5 | 2.7 | 250 |

Note: These are illustrative examples and do not represent actual historical data. Actual data should be sourced from reliable financial websites.

Tesla’s stock price is assessed using various valuation methods, including the Price-to-Earnings (P/E) ratio and the Price-to-Sales (P/S) ratio. The P/E ratio compares the stock price to earnings per share, while the P/S ratio compares the stock price to revenue per share. These ratios provide insights into how the market values Tesla relative to its financial performance.

Tesla’s future financial projections indicate continued revenue growth driven by expanding production capacity, new product launches, and growth in energy storage solutions. However, potential risks include intensifying competition, supply chain disruptions, and economic downturns.

Investor Sentiment and Market Analysis

Source: thoughtco.com

Investor sentiment toward Tesla is highly dynamic and often influenced by news events, social media trends, and analyst reports.

Prevailing investor sentiment can be categorized as follows:

- Positive Sentiment: Driven by strong growth in electric vehicle adoption, successful new product launches, and positive financial projections.

- Negative Sentiment: Fueled by concerns about production challenges, intensifying competition, and macroeconomic headwinds.

- Neutral Sentiment: Reflects a wait-and-see approach by investors, awaiting further evidence of Tesla’s ability to sustain its growth trajectory.

Social media and news coverage play a significant role in shaping investor perception and influencing trading activity. Positive news coverage and enthusiastic social media discussions often lead to increased buying pressure, while negative news or controversies can trigger selling.

Predictive Modeling and Forecasting

Source: capital.com

Predicting future Tesla stock prices involves various methods, each with limitations.

Methods used to predict future Tesla stock prices include:

- Technical Analysis: Uses historical price and volume data to identify patterns and predict future price movements. Limitations include the subjective interpretation of charts and the inability to account for unforeseen events.

- Fundamental Analysis: Evaluates the intrinsic value of Tesla based on its financial statements, competitive landscape, and macroeconomic factors. Limitations include the difficulty in accurately forecasting future financial performance and the impact of market sentiment.

Hypothetical Scenario: A successful launch of a new, highly anticipated vehicle model could trigger a significant positive price movement. This would be driven by increased demand, improved market share, and enhanced investor confidence. The magnitude of the price increase would depend on factors such as the vehicle’s specifications, pricing, and market reception.

| Scenario | Expected Price Range (Next 6 Months) |

|---|---|

| Bullish | $300 – $400 |

| Bearish | $150 – $250 |

| Neutral | $200 – $300 |

Note: These are hypothetical price ranges and should not be interpreted as financial advice. Actual price movements will depend on various factors.

Quick FAQs: Tesla Stock Price In Usd

What are the major risks associated with investing in Tesla stock?

Major risks include high volatility, dependence on Elon Musk’s leadership, competition from established automakers and new entrants, and potential regulatory changes impacting the electric vehicle market.

Where can I find real-time Tesla stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

How does Tesla’s innovation pipeline affect its stock price?

Announcements of new products, technological advancements, and production capacity expansions often positively influence investor sentiment and drive stock price increases. Conversely, delays or setbacks can negatively impact the stock.

Is Tesla stock a good long-term investment?

Tracking the Tesla stock price in USD requires diligent monitoring of market trends. Understanding similar fluctuations can be insightful, such as analyzing the stock price vtrs for comparative purposes. This allows for a broader perspective when assessing factors influencing Tesla’s performance, ultimately contributing to a more informed understanding of its price movements in USD.

Whether Tesla stock is a good long-term investment depends on individual risk tolerance and investment goals. Long-term investors often view Tesla as a growth stock with significant potential, but it also carries substantial risk.