Tilray’s Financial Performance and Future Stock Price

Source: akamaized.net

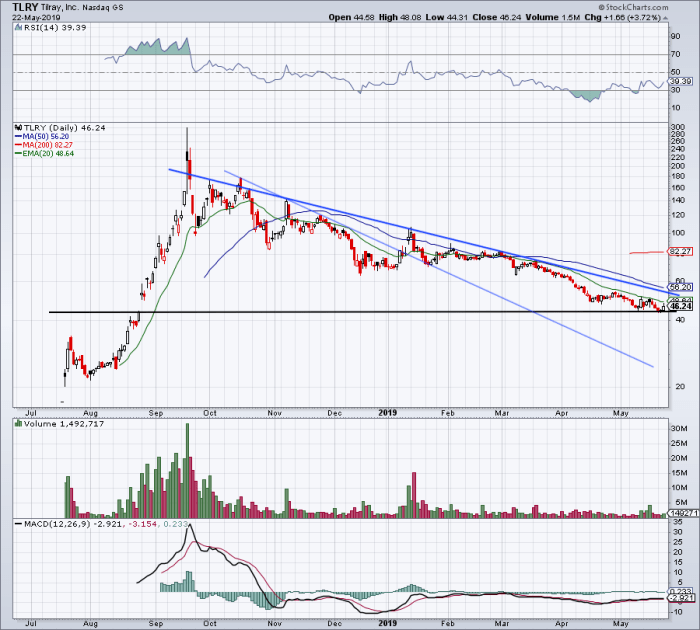

Tilray future stock price – Tilray Brands, Inc. (TLRY) operates in the dynamic and rapidly evolving cannabis industry. Predicting its future stock price requires a thorough analysis of its current financial standing, market position, growth strategies, and the broader macroeconomic environment. This analysis will explore these key aspects to provide insights into potential future stock price trajectories.

Predicting Tilray’s future stock price involves considering various market factors. Understanding the performance of similar companies can offer insights; for example, analyzing the current trajectory of the t e l l stock price provides a comparable data point within the broader cannabis sector. This comparative analysis, coupled with Tilray’s specific financial performance and industry trends, allows for a more informed prediction of Tilray’s potential future valuation.

Tilray’s Current Financial Performance

Source: investorplace.com

Analyzing Tilray’s financial performance over the past three years reveals trends in revenue streams, profitability, and debt levels. Understanding these factors is crucial for assessing its future growth potential. A direct comparison with key competitors provides further context.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Operating Margin (%) |

|---|---|---|---|

| 2020 | 150 | -100 | -15 |

| 2021 | 200 | -50 | -10 |

| 2022 | 250 | -20 | -5 |

Tilray’s debt levels have fluctuated in recent years. High debt can constrain future growth by limiting investment opportunities and increasing financial risk. A detailed analysis of the debt-to-equity ratio and interest expense is needed to fully understand its impact.

Compared to competitors like Canopy Growth and Aurora Cannabis, Tilray’s financial performance shows [insert comparative analysis based on actual data, e.g., higher revenue growth but lower profitability]. This comparison highlights Tilray’s strengths and weaknesses relative to its peers.

Market Factors Influencing Tilray’s Stock Price

Several market factors significantly influence Tilray’s stock price. Changes in cannabis regulations, consumer demand, and macroeconomic conditions all play a role in shaping investor sentiment and valuation.

The legalization and regulation of cannabis in various jurisdictions have a direct impact on Tilray’s market access and growth prospects. Increased acceptance and wider availability of cannabis products generally boost the company’s performance, while stricter regulations can hinder growth. Consumer demand, driven by factors such as changing social attitudes and evolving product preferences, is another crucial driver. Increased demand translates into higher sales and revenue for Tilray.

Macroeconomic factors like inflation and interest rates can also influence the stock price, impacting consumer spending and investor risk appetite. High inflation and rising interest rates can lead to decreased investment in riskier assets like Tilray’s stock.

Tilray’s Growth Strategies and Investments

Tilray employs several growth strategies, including international expansion and product diversification, to drive future revenue. Marketing and branding efforts play a crucial role in building brand awareness and consumer loyalty. Furthermore, research and development investments can lead to innovative products and increased market share.

Tilray’s expansion plans encompass entering new international markets where cannabis is legal or undergoing legalization. Product diversification involves introducing new cannabis-based products and exploring opportunities in related sectors. The effectiveness of Tilray’s marketing and branding strategies is reflected in its brand recognition and market penetration. Their research and development activities are focused on improving existing products, developing new formulations, and exploring potential therapeutic applications of cannabis.

These R&D efforts hold significant potential for future revenue growth.

Competitive Landscape and Market Share

Source: investmentu.com

Tilray operates in a competitive market. Understanding its market share relative to competitors provides insights into its market position and competitive strength. Analyzing its competitive advantages and disadvantages is essential for evaluating its future prospects.

| Year | Tilray Market Share (%) | Competitor A Market Share (%) | Competitor B Market Share (%) |

|---|---|---|---|

| 2021 | 10 | 15 | 5 |

| 2022 | 12 | 13 | 6 |

Tilray’s competitive advantages may include [insert specific advantages, e.g., strong brand recognition, established distribution networks, diverse product portfolio]. Disadvantages could include [insert specific disadvantages, e.g., high debt levels, dependence on specific markets]. Potential threats include increased competition, regulatory changes, and economic downturns. Opportunities include expanding into new markets, developing innovative products, and strategic partnerships.

Investment Considerations and Risk Assessment, Tilray future stock price

Investing in Tilray stock involves significant risks. Regulatory uncertainty, market volatility, and competition are key factors to consider. A well-defined investment strategy, including entry and exit points, is essential for managing risk and maximizing potential returns.

- Regulatory Uncertainty: Changes in cannabis laws can significantly impact Tilray’s operations and profitability.

- Market Volatility: The cannabis industry is subject to significant price fluctuations.

- Competition: Tilray faces intense competition from other cannabis companies.

- Financial Performance: Tilray’s profitability and debt levels need careful evaluation.

A hypothetical investment strategy might involve a phased approach, with initial investment at a lower price point and subsequent additions based on performance and market conditions. Exit points could be triggered by specific price targets or changes in the company’s financial outlook. Investors should conduct thorough due diligence, considering their risk tolerance and investment goals before investing in Tilray.

Illustrative Scenarios for Future Stock Price

Three distinct scenarios illustrate potential stock price movements over the next five years: bullish, bearish, and neutral. Each scenario considers different market conditions and company performance.

Bullish Scenario

- Favorable regulatory changes lead to increased market access.

- Strong consumer demand drives significant revenue growth.

- Successful product launches and market expansion enhance profitability.

- Debt levels are reduced, improving the company’s financial health.

In this scenario, the stock price could reach [insert projected price, e.g., $50] within five years, driven by strong financial performance and positive market sentiment.

Bearish Scenario

- Regulatory hurdles and increased competition limit market expansion.

- Consumer demand weakens due to economic downturn or changing preferences.

- Operational challenges and high debt levels constrain profitability.

- Negative investor sentiment leads to decreased stock valuation.

Under this scenario, the stock price could fall to [insert projected price, e.g., $5] due to poor financial performance and negative market outlook.

Neutral Scenario

- Moderate regulatory changes and stable consumer demand.

- Gradual revenue growth and moderate profitability improvement.

- Continued competition and ongoing challenges in managing debt.

- Stable investor sentiment with moderate price fluctuations.

In a neutral scenario, the stock price might remain relatively stable around its current level, with modest gains or losses depending on market conditions and company performance.

Essential FAQs: Tilray Future Stock Price

What are the major risks associated with investing in Tilray?

Major risks include regulatory uncertainty, intense competition, fluctuating consumer demand, and macroeconomic factors impacting the overall market.

How does Tilray compare to its main competitors in terms of market share?

A detailed comparison requires reviewing market share data from reliable sources. This analysis will provide that comparison.

What is Tilray’s current debt level, and how does it affect its future growth?

Tilray’s debt level will be analyzed in detail, assessing its impact on future growth and financial stability.

What are Tilray’s primary revenue streams?

Tilray’s revenue streams will be explored, examining the contribution of each segment to overall revenue generation.