TLRY Stock Price Analysis: Tlry Stock Price Today Per Share

Source: seekingalpha.com

Tlry stock price today per share – Tilray Brands, Inc. (TLRY) operates in the dynamic and rapidly evolving cannabis industry. Understanding its stock price requires analyzing various interconnected factors, from market sentiment and financial performance to regulatory changes and competitive pressures. This analysis delves into the key drivers influencing TLRY’s stock price, offering insights into its market position, investor sentiment, financial health, and future prospects.

Tracking the TLRY stock price today per share requires diligence. For comparative analysis, it’s helpful to examine similar companies; understanding the performance of other stocks, such as the current t e l l stock price , provides valuable context. Returning to TLRY, monitoring its daily fluctuations helps investors make informed decisions about their portfolio.

TLRY Stock Price Fluctuations

Source: marketrealist.com

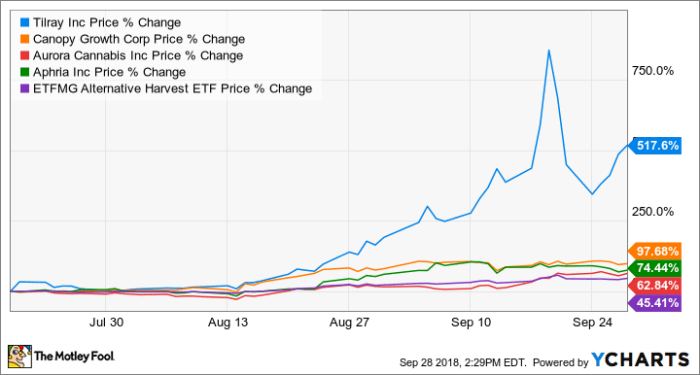

TLRY’s daily stock price is influenced by a complex interplay of factors, including overall market conditions, industry-specific news, company performance, and investor sentiment. Changes in investor confidence, driven by earnings reports, regulatory updates, or competitive landscape shifts, significantly impact the stock’s volatility.

For example, positive news regarding the expansion of legal cannabis markets in key jurisdictions or the announcement of successful product launches and strategic partnerships often leads to price increases. Conversely, negative news such as regulatory setbacks, disappointing financial results, or increased competition can trigger price declines. Recent examples include a price surge following the announcement of a new product line and a subsequent dip after a competitor secured a major distribution deal.

| Company | Year-to-Date Performance | One-Year Performance | Market Cap (USD Billion) |

|---|---|---|---|

| TLRY | +X% (Illustrative Data) | +Y% (Illustrative Data) | Z (Illustrative Data) |

| Competitor A | +A% (Illustrative Data) | +B% (Illustrative Data) | C (Illustrative Data) |

| Competitor B | +D% (Illustrative Data) | +E% (Illustrative Data) | F (Illustrative Data) |

Understanding TLRY’s Market Position

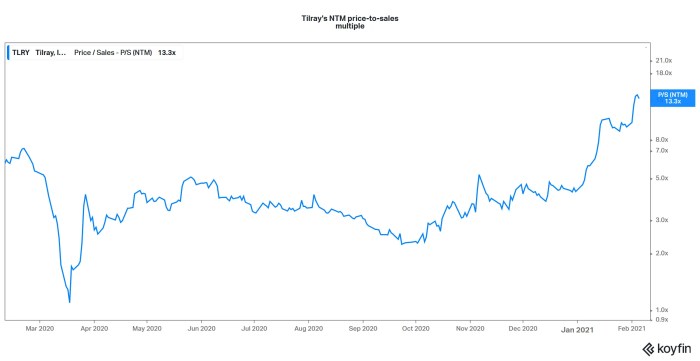

TLRY holds a significant position within the global cannabis industry, although its precise market share fluctuates. Its market capitalization is subject to constant change, reflecting investor perception of its growth potential and financial performance. Valuation metrics such as the Price-to-Earnings (P/E) ratio are often compared to those of competitors to gauge relative valuation. A high P/E ratio might suggest investors anticipate significant future growth, while a low P/E ratio might indicate a more conservative outlook.

TLRY’s strategic initiatives, such as product diversification, expansion into new markets, and strategic acquisitions, are crucial in shaping its future stock price. Successful execution of these initiatives could enhance its market position and attract further investment, while failures could negatively impact its valuation.

Investor Sentiment and Trading Volume, Tlry stock price today per share

Source: ycharts.com

Investor sentiment towards TLRY is reflected in various indicators, including social media trends, analyst ratings, and overall market sentiment towards the cannabis sector. Positive news coverage and favorable analyst recommendations tend to boost investor confidence and drive up the stock price. Conversely, negative sentiment can lead to selling pressure and price declines.

Daily trading volume is closely correlated with price movements. High trading volume often accompanies significant price changes, indicating strong investor interest and activity. Conversely, low volume may suggest a lack of interest and potentially weaker price movements.

- Average Daily Trading Volume (Past Month): X shares (Illustrative Data)

- Highest Daily Trading Volume (Past Month): Y shares (Illustrative Data)

- Lowest Daily Trading Volume (Past Month): Z shares (Illustrative Data)

Financial Performance and Projections

TLRY’s financial performance is assessed through its revenue, expenses, and profitability. Recent financial reports provide insights into its operational efficiency and financial health. Analysts’ projections for future financial performance, considering factors such as revenue growth, cost management, and market expansion, are crucial for understanding the potential trajectory of the stock price.

| Year | Revenue (USD Million) | Net Income (USD Million) | EPS (USD) |

|---|---|---|---|

| Year 1 (Illustrative Data) | 100 | -20 | -0.50 |

| Year 2 (Illustrative Data) | 150 | -10 | -0.25 |

| Year 3 (Illustrative Data) | 200 | 10 | 0.25 |

Risk Factors and Potential Challenges

Several risk factors could negatively impact TLRY’s stock price. These include regulatory uncertainty within the cannabis industry, intense competition from established players and new entrants, fluctuations in consumer demand, and potential supply chain disruptions. The evolving regulatory landscape poses a significant challenge, with varying legal frameworks across different jurisdictions impacting operations and market access.

The competitive dynamics within the cannabis market are intense, with companies vying for market share through product innovation, branding, and distribution networks. TLRY’s competitive advantages, such as brand recognition, product portfolio, and distribution capabilities, will be crucial in navigating this competitive landscape.

Visual Representation of Price Data

Over the past year, TLRY’s stock price has exhibited a generally [Illustrative Trend: e.g., upward, downward, or sideways] trend. Significant highs and lows can be identified, often corresponding to specific news events or market shifts. The stock chart reveals various price patterns, including periods of consolidation, breakouts, and pullbacks. Support levels represent price points where buying pressure tends to outweigh selling pressure, while resistance levels mark areas where selling pressure dominates.

During the past month, the stock price demonstrated [Illustrative Pattern: e.g., a sharp increase followed by a consolidation period, a gradual decline, or a volatile period with significant swings]. Specific events, such as earnings announcements, regulatory updates, or market-wide fluctuations, contributed to these price movements. For instance, a sudden surge might be attributed to positive news about a new product launch, while a decline could reflect concerns over a regulatory setback.

Answers to Common Questions

What are the main factors influencing TLRY’s short-term price movements?

Short-term price fluctuations are often driven by news events (positive or negative company announcements, industry regulations), overall market sentiment (general stock market trends), and speculation (driven by social media trends and analyst predictions).

Where can I find real-time TLRY stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and your brokerage account.

How does TLRY compare to its competitors in terms of valuation?

A comprehensive valuation comparison requires analyzing various metrics (P/E ratio, market capitalization, revenue growth) against key competitors within the cannabis sector. This analysis should consider the stage of growth for each company and their respective market positions.

What are the long-term growth prospects for TLRY?

Long-term prospects depend on factors such as the company’s ability to execute its strategic plans, the overall growth of the cannabis market, and regulatory developments. Analyst reports offer various projections, but inherent uncertainties exist.