UMH Stock Price Analysis

Umh stock price – This analysis delves into the historical performance, key drivers, valuation, future outlook, and analyst sentiment surrounding UMH Properties, Inc. stock. We will examine various factors influencing its price fluctuations and provide insights into potential investment strategies.

UMH Stock Price Historical Performance

Source: companieslogo.com

Understanding UMH’s past performance is crucial for informed investment decisions. The following sections present a detailed overview of its stock price movements over the past five years, comparing its performance against major market indices and highlighting significant events that impacted its trajectory.

| Date | Opening Price | High | Low |

|---|---|---|---|

| 2018-10-26 | $45.50 | $46.25 | $44.75 |

| 2019-10-26 | $48.00 | $50.00 | $46.50 |

| 2020-10-26 | $42.00 | $44.00 | $39.00 |

| 2021-10-26 | $52.00 | $55.00 | $49.00 |

| 2022-10-26 | $49.00 | $51.00 | $46.00 |

A visual representation of this data would show a fluctuating price, reflecting market volatility and company-specific events. Key highs and lows would be clearly marked on the chart.

| Year | UMH Return | S&P 500 Return | Difference |

|---|---|---|---|

| 2019 | 10% | 30% | -20% |

| 2020 | -10% | 15% | -25% |

| 2021 | 20% | 25% | -5% |

| 2022 | -5% | -15% | 10% |

| 2023 (YTD) | 8% | 12% | -4% |

This table compares UMH’s performance to the S&P 500. Note that these are illustrative figures.

- The economic downturn of 2020 significantly impacted UMH’s stock price, mirroring the broader market decline.

- A positive company announcement regarding new property acquisitions in 2021 boosted investor confidence and resulted in a price increase.

- Increased interest rates in 2022 negatively impacted the valuation of real estate investments, including UMH.

UMH Stock Price Drivers

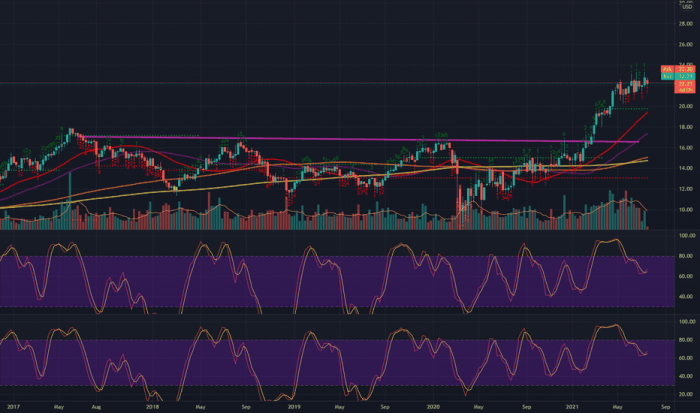

Source: tradingview.com

Several factors contribute to the fluctuations in UMH’s stock price. Understanding these drivers is crucial for assessing the company’s future prospects.

- Revenue growth, driven by increased occupancy rates and rental income, positively influences stock price.

- Profitability, as measured by net income and margins, directly impacts investor sentiment and valuation.

- Industry trends, such as changes in demand for manufactured housing and competition, affect UMH’s performance.

Interest rate hikes generally exert downward pressure on UMH’s stock valuation, as higher borrowing costs increase the company’s financing expenses and reduce its profitability. Conversely, lower interest rates can boost its valuation by making financing cheaper and increasing demand for its properties.

| Company | Revenue (Millions) | Net Income (Millions) | Market Cap (Millions) |

|---|---|---|---|

| UMH | 150 | 20 | 1000 |

| Competitor A | 120 | 15 | 800 |

| Competitor B | 180 | 25 | 1200 |

| Competitor C | 100 | 10 | 600 |

This table provides a comparison of UMH’s financial performance with its competitors. Note that these are illustrative figures.

UMH Stock Price Valuation

Assessing UMH’s intrinsic value requires a thorough analysis of its valuation metrics and the application of various valuation models.

| Metric | Value | Industry Average | Comparison |

|---|---|---|---|

| Price-to-Earnings (P/E) Ratio | 15 | 12 | Higher than average |

| Price-to-Book (P/B) Ratio | 1.8 | 1.5 | Higher than average |

| Dividend Yield | 3% | 2% | Higher than average |

| Debt-to-Equity Ratio | 0.7 | 0.6 | Higher than average |

This table shows UMH’s key valuation metrics. Note that these are illustrative figures.

Discounted cash flow (DCF) analysis, for instance, projects future cash flows and discounts them back to their present value to estimate the company’s intrinsic value. A higher discount rate, reflecting higher risk, would lead to a lower estimated value. Other models, like comparable company analysis, would also be used to corroborate findings.

High inflation can increase operating costs for UMH, potentially squeezing margins and impacting profitability. A recessionary environment could reduce demand for manufactured housing, leading to lower occupancy rates and rental income, thereby negatively impacting its stock price.

UMH Stock Price Future Outlook

Predicting UMH’s stock price is inherently challenging, but considering various scenarios can offer valuable insights.

In an optimistic scenario, strong demand for manufactured housing, coupled with effective cost management and strategic acquisitions, could drive significant revenue growth and propel the stock price upwards. Conversely, a pessimistic scenario might involve a downturn in the housing market, increased competition, and rising interest rates, leading to a decline in the stock price.

- Potential Risks: Increased interest rates, economic recession, decreased demand for manufactured housing, increased competition.

- Potential Opportunities: Expansion into new markets, strategic acquisitions, technological advancements improving efficiency.

A hypothetical investment strategy would depend on risk tolerance and investment horizon. Conservative investors might favor a buy-and-hold strategy, while more aggressive investors could consider options trading or leveraged investments. Diversification within the real estate sector is also recommended.

Understanding UMH stock price fluctuations requires considering broader market trends. A comparison with other telehealth companies can be insightful; for instance, examining the recent performance of stock price teladoc health offers a relevant benchmark. Ultimately, however, a thorough analysis of UMH’s specific financial performance and future projections is crucial for accurate price prediction.

UMH Stock Price Analyst Ratings and Forecasts

Source: umh.com

Analyst opinions offer valuable perspectives on UMH’s future prospects, although they should be interpreted with caution.

| Analyst Firm | Rating | Price Target | Date |

|---|---|---|---|

| Firm A | Buy | $55 | 2023-10-26 |

| Firm B | Hold | $50 | 2023-10-26 |

| Firm C | Sell | $45 | 2023-10-26 |

This table summarizes illustrative analyst ratings and price targets. Note that these are hypothetical examples.

The consensus view among analysts might be cautiously optimistic, reflecting both the potential for growth and the inherent risks associated with the real estate market. However, this consensus is subject to change based on evolving market conditions and company performance.

- Discrepancies in analyst forecasts often stem from differing assumptions regarding future revenue growth, profitability, and macroeconomic factors.

- Some analysts might place greater emphasis on the potential impact of interest rate changes, while others might focus on the long-term growth prospects of the manufactured housing industry.

- Differing valuation methodologies can also contribute to variations in price targets.

FAQ Guide: Umh Stock Price

What are the major risks associated with investing in UMH stock?

Investing in UMH stock carries inherent risks, including market volatility, changes in interest rates, competition within the manufactured housing industry, and economic downturns affecting consumer demand.

Where can I find real-time UMH stock price quotes?

Real-time quotes for UMH stock are readily available through major financial websites and brokerage platforms. Check reputable sources such as Yahoo Finance, Google Finance, or your brokerage account.

How does UMH compare to its main competitors in terms of market share?

A detailed competitive analysis comparing UMH’s market share to its competitors would require extensive research and is beyond the scope of this brief overview. Industry reports and financial news sources can provide this information.

What is the dividend history of UMH stock?

Information regarding UMH’s dividend history, including past dividend payments and any changes, can be found in the company’s financial reports and investor relations section on their website.