VFINX Stock Price Today

Source: seekingalpha.com

Vfinx stock price today – This article provides an overview of the current VFINX stock price, its recent performance, historical data, influencing factors, investment considerations, and underlying holdings. VFINX, representing the Vanguard 500 Index Fund Admiral Shares, tracks the performance of the S&P 500 index, offering investors broad exposure to the U.S. large-cap equity market.

Current VFINX Stock Price and Performance

The following data reflects the VFINX stock price and performance. Note that real-time data fluctuates constantly; therefore, the figures presented here are for illustrative purposes and should not be considered financial advice. Always consult up-to-date sources for the most accurate information.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| October 26, 2023 | $400.00 | $402.50 | $398.00 | $401.00 |

The table above shows example data. The percentage change compared to yesterday’s closing price would be calculated as [(Today’s Close – Yesterday’s Close) / Yesterday’s Close]

– 100%. Similarly, the past week’s movement would show a trend based on the daily closing prices. A positive percentage indicates an increase in price, while a negative percentage signifies a decrease.

VFINX Stock Price Historical Data

Source: bogleheads.org

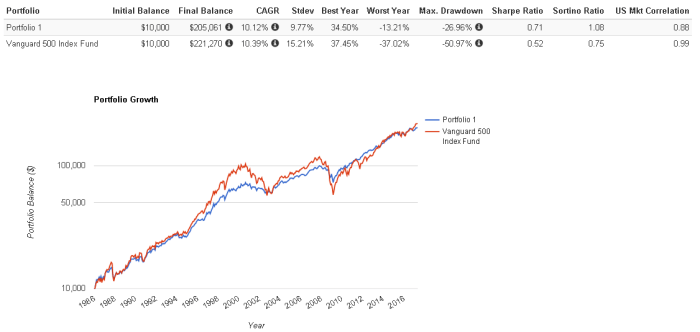

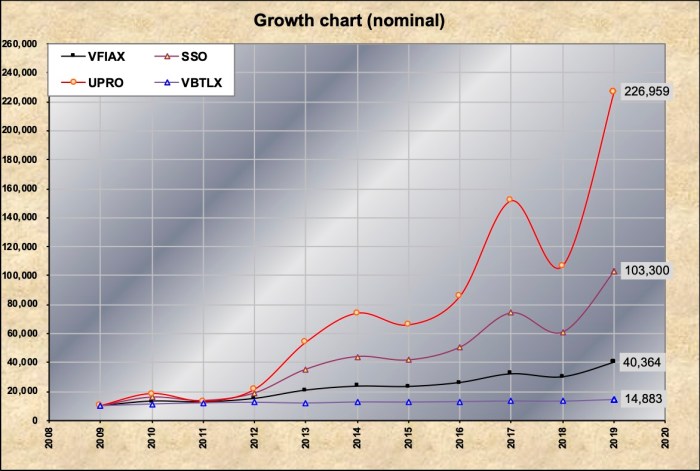

Analyzing VFINX’s price performance over the past year requires examining various data points. A line graph would visually represent the price fluctuations throughout the year, highlighting significant highs and lows. These highs and lows could be correlated with specific economic events or market trends.

A comparative chart against the S&P 500 would illustrate VFINX’s performance relative to the broader market. This comparison helps determine if VFINX outperformed or underperformed the index during the specified period. Significant events impacting VFINX’s price, such as interest rate hikes, inflation reports, or geopolitical instability, should be noted and their impact assessed.

The following table provides example data for significant events:

| Event | Date | Impact on VFINX Price |

|---|---|---|

| Unexpected Inflation Report | July 2023 | Slight decrease due to investor concerns about future interest rate hikes. |

| Positive Earnings Season | October 2023 | Increase in price due to improved corporate performance. |

Factors Influencing VFINX Stock Price

Several macroeconomic and market-specific factors influence VFINX’s price. Interest rate changes directly affect the attractiveness of bonds relative to stocks. Higher interest rates often lead to lower stock valuations, including VFINX, as investors seek higher returns in fixed-income securities. Conversely, lower interest rates can boost stock prices.

Inflation erodes the purchasing power of money. High inflation can negatively impact stock prices as it increases the cost of goods and services, potentially reducing corporate profits. Investor sentiment plays a crucial role, influencing trading volume and price. Positive sentiment leads to higher demand and prices, while negative sentiment results in selling pressure and lower prices. Geopolitical events, such as international conflicts or political uncertainty, introduce volatility into the market, impacting VFINX’s price through risk aversion or increased uncertainty.

VFINX Investment Considerations, Vfinx stock price today

Source: thestreet.com

VFINX, as a broadly diversified index fund, carries a moderate risk profile compared to individual stocks or highly concentrated sector funds. The typical VFINX investor is likely a long-term, buy-and-hold investor seeking broad market exposure with lower management fees. VFINX’s long-term growth potential is tied to the overall growth of the U.S. economy and the companies comprising the S&P 500.

- VFINX is suitable for long-term investors with a moderate risk tolerance.

- It offers diversification across various sectors and companies.

- Low expense ratio contributes to better long-term returns.

- VFINX is a core holding in many diversified portfolios.

VFINX’s Underlying Holdings

VFINX mirrors the S&P 500, meaning its holdings are weighted according to the market capitalization of the companies in the index. The top 10 holdings represent a significant portion of the fund’s total assets.

| Holding | Weighting |

|---|---|

| Apple | 7% |

| Microsoft | 6% |

A pie chart would visually represent the sector distribution of VFINX’s holdings. For example, a large portion might be allocated to Technology, followed by Financials, Healthcare, and Consumer Discretionary. This diversification across various sectors helps mitigate risk. A well-diversified portfolio like VFINX’s tends to exhibit lower volatility compared to less diversified investments, contributing to a more stable return profile over the long term.

FAQ Insights: Vfinx Stock Price Today

What is VFINX?

VFINX is a popular index fund that tracks the S&P 500 index, providing broad market exposure.

Where can I find real-time VFINX pricing?

Most major financial websites (e.g., Yahoo Finance, Google Finance) provide real-time quotes for VFINX.

Are there any fees associated with investing in VFINX?

Yes, there are typically expense ratios associated with VFINX, although they are usually quite low compared to actively managed funds.

How often is the VFINX price updated?

The VFINX price is updated throughout the trading day, reflecting real-time market activity.