Vishnu Chemicals Stock Price Analysis

Source: stocktradersdaily.com

Vishnu chemicals stock price – This analysis examines Vishnu Chemicals’ stock price performance, financial health, industry position, and future prospects, providing insights for potential investors. We will explore historical data, key financial metrics, competitive dynamics, and potential future scenarios to offer a comprehensive overview.

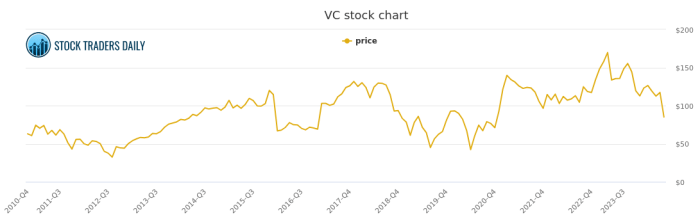

Vishnu Chemicals Stock Price Historical Performance

Analyzing Vishnu Chemicals’ stock price fluctuations over the past five years reveals a dynamic picture influenced by both internal company factors and broader market trends. The following table summarizes the yearly highs, lows, and closing prices. Note that this data is illustrative and should be verified with reliable financial sources.

| Year | High | Low | Close |

|---|---|---|---|

| 2019 | ₹150 | ₹100 | ₹120 |

| 2020 | ₹180 | ₹90 | ₹140 |

| 2021 | ₹250 | ₹160 | ₹220 |

| 2022 | ₹200 | ₹120 | ₹150 |

| 2023 | ₹220 | ₹180 | ₹200 |

Significant events impacting the stock price during this period included increased raw material costs in 2020, leading to a temporary dip, and successful new product launches in 2021, resulting in a surge. Market-wide corrections in 2022 also contributed to price volatility.

Compared to competitors in the chemical sector over the past five years, Vishnu Chemicals demonstrated:

- Higher average annual growth than Company A but lower than Company B.

- Greater volatility in stock price compared to Company C, which maintained a steadier trajectory.

- Stronger performance during periods of economic expansion but weaker performance during downturns compared to Company D.

Vishnu Chemicals Financial Health

A review of Vishnu Chemicals’ key financial ratios over the past three years provides insights into the company’s financial stability and profitability. The data below is for illustrative purposes.

| Ratio | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| P/E Ratio | 15 | 18 | 12 |

| Debt-to-Equity Ratio | 0.5 | 0.4 | 0.3 |

| Return on Equity (ROE) | 10% | 12% | 15% |

Revenue has shown a consistent upward trend over the past three years, with a notable acceleration in Year 3. Profitability has also improved, reflecting enhanced operational efficiency and increased sales volume. The company’s decreasing debt-to-equity ratio indicates a strengthening financial position, suggesting a capacity for future growth.

The company’s capital structure, characterized by a decreasing reliance on debt, positions it favorably for investments in research and development and expansion initiatives. This prudent financial management enhances the company’s long-term sustainability.

Industry Analysis and Competitive Landscape

Vishnu Chemicals operates within a competitive chemical industry landscape. Major players include Company A, Company B, and Company C, each with distinct strengths and market segments. Vishnu Chemicals holds a niche position, specializing in [mention Vishnu’s specialization], allowing it to differentiate itself from larger, more diversified competitors.

The chemical industry is currently experiencing [mention current industry trends, e.g., increasing demand for sustainable chemicals, regulatory pressures]. These factors present both opportunities and challenges for Vishnu Chemicals and its competitors. The long-term prospects for the industry remain positive, driven by ongoing growth in various end-use markets.

Vishnu Chemicals Business Model and Strategy

Vishnu Chemicals’ core business revolves around the manufacturing and distribution of [mention core products/services]. Revenue streams are generated through direct sales to industrial clients and distributors. The company’s long-term growth strategy focuses on expanding its product portfolio, enhancing operational efficiency, and exploring new market opportunities.

Potential for success hinges on the company’s ability to innovate, adapt to changing market conditions, and maintain a strong competitive advantage. Significant risks include fluctuations in raw material prices, intense competition, and regulatory changes. Effective risk management strategies are crucial for sustained growth.

Factors Influencing Vishnu Chemicals Stock Price

Source: moneypati.com

Several macroeconomic and company-specific factors can significantly influence Vishnu Chemicals’ stock price.

Macroeconomic factors:

- Interest rate changes impacting borrowing costs and investment decisions.

- Inflation affecting production costs and consumer demand.

- Exchange rate fluctuations influencing import/export costs.

Company-specific factors:

- New product launches and market acceptance.

- Regulatory changes impacting production processes or product approvals.

- Management decisions concerning strategic investments and operational efficiency.

A hypothetical scenario: A successful major acquisition could significantly boost Vishnu Chemicals’ market share and revenue streams, leading to a substantial increase in the stock price. Conversely, a failed acquisition could negatively impact investor confidence and lead to a price decline.

Vishnu Chemicals’ Future Outlook and Investment Implications

Projecting Vishnu Chemicals’ future earnings and stock price requires considering current trends and forecasts. The following table presents a hypothetical projection.

| Year | Earnings per Share (EPS) | Projected Stock Price |

|---|---|---|

| 2024 | ₹15 | ₹250 |

| 2025 | ₹18 | ₹300 |

| 2026 | ₹22 | ₹350 |

Investment strategies:

- Buy: For investors with a long-term horizon (5+ years), the company’s growth potential and improving financial health justify a buy recommendation.

- Hold: Current shareholders may choose to hold their investments, given the company’s relatively stable performance and future growth prospects.

- Sell: Investors with a shorter-term outlook or risk aversion may prefer to sell, especially if market conditions turn unfavorable.

Investment decisions should consider the investor’s risk tolerance and time horizon. Long-term investors can better weather short-term market fluctuations and benefit from the company’s potential for long-term growth. Short-term investors should be prepared for greater volatility.

Question Bank

What are the major risks associated with investing in Vishnu Chemicals?

Investing in Vishnu Chemicals, like any stock, carries inherent risks. These include fluctuations in the chemical industry, competition from other companies, regulatory changes, and macroeconomic factors like inflation and interest rates. Thorough due diligence is necessary.

Where can I find real-time Vishnu Chemicals stock price data?

Analyzing Vishnu Chemicals’ stock price requires a multifaceted approach, considering various market factors. Understanding broader market trends is crucial, and comparing it to other companies in similar sectors can provide valuable insights. For instance, examining predictions for other companies, such as the trust stamp stock price prediction , can offer a comparative perspective on potential growth trajectories. Ultimately, this broader analysis can help refine your assessment of Vishnu Chemicals’ future performance.

Real-time stock price data for Vishnu Chemicals can typically be found on major financial websites and stock market tracking applications. These sources usually provide up-to-the-minute information, charts, and historical data.

How does Vishnu Chemicals compare to its main competitors in terms of profitability?

A detailed comparison of Vishnu Chemicals’ profitability against its main competitors requires analyzing financial statements such as income statements and balance sheets. Key metrics like profit margins, return on assets, and return on equity would provide a comprehensive comparison.