Small business sales tax software simplifies a complex area for entrepreneurs. Navigating sales tax regulations can be daunting, involving varying state and local laws, thresholds, and reporting requirements. The right software streamlines this process, automating calculations, filing returns, and managing tax liabilities, ultimately saving business owners valuable time and reducing the risk of costly errors. This allows them to focus on what truly matters: growing their businesses.

These software solutions offer a range of features designed to meet the specific needs of small businesses, from basic sales tax calculation to more advanced functionalities like inventory management and financial reporting. Choosing the appropriate software depends on factors such as business size, sales volume, and the number of states in which the business operates. Understanding these factors is key to selecting a solution that provides optimal efficiency and compliance.

Navigating the complexities of sales tax can be a significant challenge for small business owners. From understanding varying state and local regulations to accurately calculating and remitting taxes, the process is often time-consuming and prone to errors. Fortunately, robust sales tax software can significantly alleviate this burden, automating crucial tasks and minimizing the risk of costly penalties. This comprehensive guide will explore the benefits, features, and selection criteria for small business sales tax software, empowering you to make an informed decision and optimize your tax compliance.

Understanding the Need for Sales Tax Software

For many small businesses, manually managing sales tax is simply unsustainable. The sheer volume of transactions, coupled with the ever-changing tax laws across different jurisdictions, makes accurate calculation and filing incredibly difficult. Errors can lead to significant financial penalties, audits, and reputational damage. Sales tax software offers a streamlined solution, automating many aspects of the process and reducing the likelihood of mistakes.

This frees up valuable time and resources, allowing business owners to focus on core aspects of their operations.

Key Benefits of Utilizing Sales Tax Software

- Automated Tax Calculations: Accurately calculates sales tax based on product type, location, and applicable tax rates, eliminating manual calculations and the potential for human error.

- Real-time Tax Rate Updates: Keeps abreast of changes in state and local tax laws, ensuring your calculations always reflect the most current regulations. This is crucial given the frequent updates in sales tax laws.

- Simplified Tax Filing: Generates reports and forms needed for tax filing, significantly reducing the time and effort required for compliance. Many programs even allow for direct e-filing.

- Improved Accuracy: Minimizes the risk of errors, reducing the likelihood of audits and penalties associated with inaccurate tax reporting.

- Time Savings: Automates tedious tasks, freeing up valuable time for business owners to focus on growth and other strategic initiatives. This is especially important for solopreneurs and small teams.

- Better Inventory Management: Some software integrates with inventory management systems, providing a holistic view of sales and tax implications.

- Reduced Audit Risk: Meticulous record-keeping and accurate calculations significantly lower the chance of an audit and potential financial repercussions.

Choosing the Right Sales Tax Software for Your Business

Selecting the appropriate sales tax software depends on several factors, including the size and complexity of your business, your budget, and your specific needs. Consider the following criteria:

Source: peoplemanagingpeople.com

Key Features to Consider, Small business sales tax software

- Tax Rate Database: Ensure the software maintains an up-to-date and comprehensive database of sales tax rates for all relevant jurisdictions.

- Integration Capabilities: Check for compatibility with your existing accounting software, point-of-sale (POS) system, and e-commerce platforms. Seamless integration is key for efficiency.

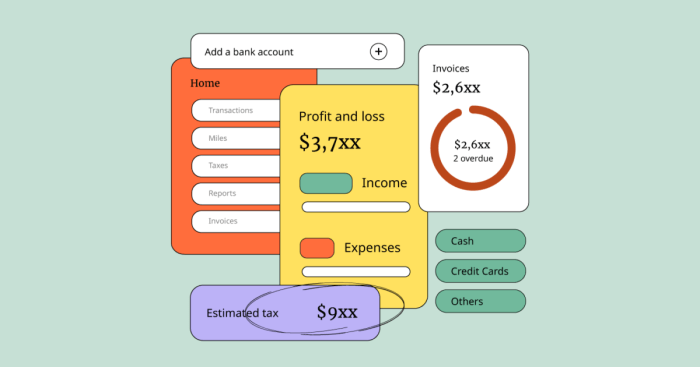

- Reporting and Analytics: Look for robust reporting features that provide insights into sales tax liabilities, allowing for better financial planning and decision-making. Data visualization is a plus.

- Customer Support: Reliable customer support is essential, especially when dealing with complex tax issues. Consider the availability of phone, email, and online resources.

- Scalability: Choose software that can adapt to your business’s growth. Avoid solutions that will become restrictive as your operations expand.

- Pricing and Fees: Compare pricing models (subscription-based, per-transaction, etc.) and ensure the cost aligns with your budget and anticipated usage.

- Compliance Features: Verify that the software complies with all relevant state and federal regulations. This is paramount for avoiding legal issues.

- Automation Capabilities: The degree of automation offered significantly impacts efficiency. Look for features like automated tax calculations, filing, and reporting.

Popular Sales Tax Software Options

Several reputable software providers cater to the needs of small businesses. Research and compare options based on your specific requirements. Some popular choices include (but are not limited to):

- Avalara

- TaxJar

- QuickBooks Online (with sales tax add-on)

- Xero (with sales tax add-on)

- Zoho Invoice

It’s crucial to thoroughly research each option, comparing features, pricing, and user reviews before making a decision.

Source: rahulogy.com

Frequently Asked Questions (FAQ): Small Business Sales Tax Software

- Q: What is sales tax software? A: Sales tax software is a tool that automates the calculation, reporting, and filing of sales taxes for businesses. It simplifies tax compliance and reduces the risk of errors.

- Q: Do I need sales tax software if my business is small? A: Even small businesses benefit from sales tax software, as it streamlines a complex process and reduces the risk of costly mistakes.

- Q: How much does sales tax software cost? A: Pricing varies significantly depending on the software provider and features offered. Many offer subscription-based models.

- Q: Can sales tax software integrate with my existing accounting software? A: Many sales tax software solutions offer integration with popular accounting platforms like QuickBooks and Xero.

- Q: How does sales tax software handle tax rate changes? A: Reputable software automatically updates its tax rate database to reflect changes in state and local laws.

- Q: What if I make a mistake using the software? A: While the software aims to minimize errors, it’s essential to review reports and filings. Most providers offer customer support to assist with any issues.

- Q: Is sales tax software secure? A: Reputable providers employ robust security measures to protect your financial data. Look for software with encryption and other security protocols.

Conclusion

Implementing sales tax software is a strategic investment for any small business seeking to optimize its tax compliance. By automating tedious tasks, improving accuracy, and minimizing the risk of penalties, this technology empowers business owners to focus on growth and profitability. Carefully consider your specific needs and research different options to find the best fit for your business.

Don’t let sales tax compliance be a burden – embrace technology to streamline the process and ensure your business thrives.

References

Call to Action

Ready to simplify your sales tax management? Explore the options mentioned above and choose the sales tax software that best suits your business needs. Start saving time and reducing the risk of errors today!

Successfully managing sales tax is crucial for the long-term health and profitability of any small business. Utilizing small business sales tax software empowers entrepreneurs to navigate the complexities of sales tax compliance with ease and confidence. By automating tedious tasks and providing valuable insights into tax liabilities, this technology allows business owners to focus their energy on strategic growth and operational efficiency.

Ultimately, the investment in the right software translates to significant time savings, reduced risk, and improved financial management.

Query Resolution

What are the common features of small business sales tax software?

Common features include sales tax calculation, automated return filing, tax rate lookup, exemption certificate management, and reporting capabilities. Some software also integrates with accounting software for seamless data flow.

How much does small business sales tax software cost?

Source: salestaxdatalink.com

Pricing varies greatly depending on the features offered and the provider. Expect monthly or annual subscription fees, with costs ranging from basic packages to more comprehensive, feature-rich options.

Is it necessary for all small businesses to use sales tax software?

While not mandatory for all, it is highly recommended, especially as businesses grow and operate in multiple jurisdictions. The software significantly reduces the administrative burden and risk of errors associated with sales tax compliance.

Can I integrate my sales tax software with my accounting software?

Many software options offer integrations with popular accounting platforms, enabling seamless data transfer and reducing manual data entry. Check the software’s compatibility with your accounting system before purchasing.