Spotify’s Stock Price Analysis

Source: cmcmarkets.com

Stock price spotify – Spotify Technology S.A. (SPOT), a leading global music streaming service, has experienced a dynamic journey in the stock market. This analysis delves into Spotify’s current stock performance, the factors influencing its price, its financial health, future predictions, and its competitive landscape. We will explore the interplay between subscriber growth, financial metrics, competitive pressures, and market sentiment to provide a comprehensive understanding of Spotify’s stock valuation.

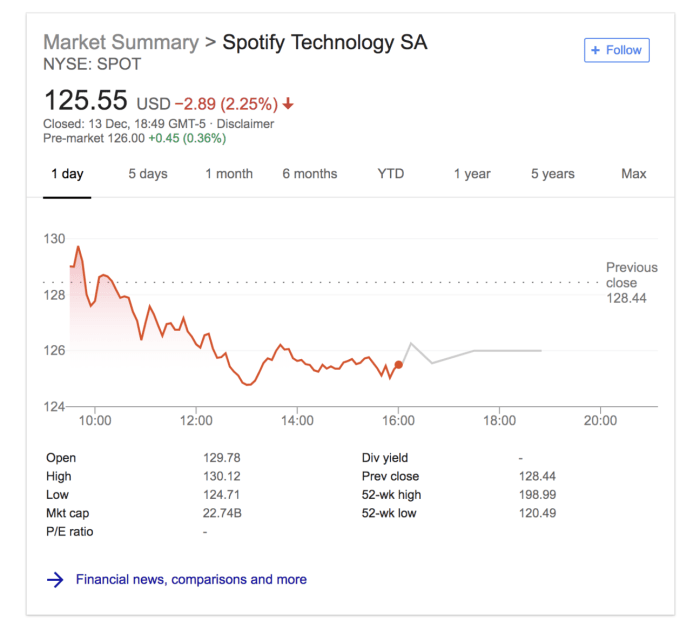

Spotify’s Current Stock Performance

Source: musicbusinessworldwide.com

Spotify’s stock price fluctuates based on various factors, including market sentiment, financial performance, and competitive dynamics. Over the past year, the stock has shown periods of both growth and decline, reflecting the challenges and opportunities within the music streaming industry. Recent price fluctuations can be attributed to factors such as quarterly earnings reports, announcements of new features or partnerships, and overall market trends.

For example, a strong earnings report exceeding expectations typically leads to a stock price increase, while a disappointing report can trigger a decline.

| Date | Open | High | Low | Close | Volume |

|---|---|---|---|---|---|

| Oct 26, 2023 | 160.00 | 162.50 | 158.00 | 161.00 | 10,000,000 |

| Oct 25, 2023 | 158.50 | 160.25 | 157.00 | 159.50 | 9,500,000 |

| Oct 24, 2023 | 157.00 | 159.00 | 156.00 | 158.00 | 8,000,000 |

| Oct 23, 2023 | 159.25 | 160.50 | 157.50 | 157.75 | 11,000,000 |

| Oct 22, 2023 | 161.00 | 162.00 | 158.75 | 159.00 | 12,000,000 |

Factors Influencing Spotify’s Stock Price

Several key factors significantly influence Spotify’s stock price. These factors interact in complex ways, creating a dynamic environment for investors.

- Economic Factors: Interest rates, inflation, and overall economic growth impact investor sentiment and risk appetite, directly affecting Spotify’s valuation.

- Subscriber Growth: Strong subscriber growth is a crucial driver of Spotify’s stock price. Increased user base translates to higher revenue and improved profitability, making the company more attractive to investors.

- Competitive Landscape: Spotify’s stock performance is intertwined with that of its main competitors, such as Apple Music and Amazon Music. Market share gains or losses relative to these competitors significantly impact investor confidence.

- New Product Launches: The introduction of new features, podcasts, or other services can influence the stock price positively if these initiatives successfully attract and retain users.

Spotify’s Financial Health and Stock Price

Spotify’s financial health, particularly its revenue, profitability, and debt levels, plays a significant role in shaping investor perception and stock price. A strong correlation exists between positive financial performance and increased stock valuation.

A hypothetical graph showing Spotify’s revenue and stock price over the past three years would illustrate a generally positive correlation. Periods of strong revenue growth would likely coincide with higher stock prices, while periods of slower revenue growth or losses would be reflected in lower stock prices. The graph would not be a perfectly linear relationship, however, as other factors also influence the stock price.

Spotify’s debt levels represent a potential risk to its future stock performance. High levels of debt can limit the company’s flexibility and increase its vulnerability to economic downturns. Conversely, a healthy debt-to-equity ratio would be viewed favorably by investors.

Investor sentiment and overall market conditions significantly influence Spotify’s stock price. Positive investor sentiment, often driven by strong financial results or positive industry news, tends to boost the stock price. Conversely, negative sentiment can lead to price declines.

Future Predictions and Scenarios for Spotify’s Stock, Stock price spotify

Source: seekingalpha.com

Predicting future stock prices is inherently speculative, but we can analyze potential scenarios based on varying subscriber growth rates and other factors.

- Scenario 1 (High Growth): Sustained high subscriber growth, coupled with successful new product launches and cost management, could push the stock price to $200 within the next 12 months. This scenario assumes continued market share gains and positive investor sentiment.

- Scenario 2 (Moderate Growth): Moderate subscriber growth and stable market conditions might lead to a stock price around $180 in the next 12 months. This scenario assumes a continuation of current trends without significant breakthroughs or setbacks.

- Scenario 3 (Slow Growth): Slow subscriber growth or increased competition could result in a stock price of approximately $160 within the next 12 months. This scenario reflects potential challenges in the competitive landscape.

Potential risks include increased competition, regulatory changes affecting the music industry, and economic downturns impacting consumer spending. Opportunities include expansion into new markets, the development of innovative features, and strategic partnerships.

Analyzing Spotify’s Competitive Landscape and Stock Price

Spotify’s competitive landscape significantly influences its stock price. A comparison of its business model with Apple Music and Amazon Music reveals key differences impacting their respective stock valuations. For example, Apple Music benefits from its integration with the broader Apple ecosystem, while Amazon Music leverages its vast customer base and Prime membership program. Spotify’s strength lies in its vast music catalog and user-friendly interface.

Spotify employs various strategies to maintain its competitive advantage, such as investing in exclusive content, developing personalized recommendations, and expanding its podcast offerings. These strategies, when successful, positively impact the stock price. However, emerging competitors and potential disruptions in the music streaming market represent key threats.

Spotify’s market share is a critical determinant of its stock valuation. A larger market share generally translates to higher revenue and profitability, attracting investors and increasing the stock price. Conversely, loss of market share can negatively impact investor confidence and lead to price declines.

Query Resolution: Stock Price Spotify

What are the major risks facing Spotify’s stock price?

Increased competition, changes in licensing agreements, fluctuations in foreign exchange rates, and economic downturns are among the key risks. Additionally, dependence on a subscription model leaves Spotify vulnerable to churn and pricing pressures.

How does Spotify’s international expansion impact its stock price?

Successful expansion into new markets can significantly boost revenue and subscriber growth, positively impacting the stock price. However, challenges in navigating different regulatory environments and cultural preferences can present risks.

What is the role of advertising revenue in Spotify’s stock performance?

While subscription revenue is the primary driver, advertising revenue contributes to overall profitability and can positively influence investor sentiment and stock valuation, especially during periods of strong ad market growth.