Stock Price Target Time Frames

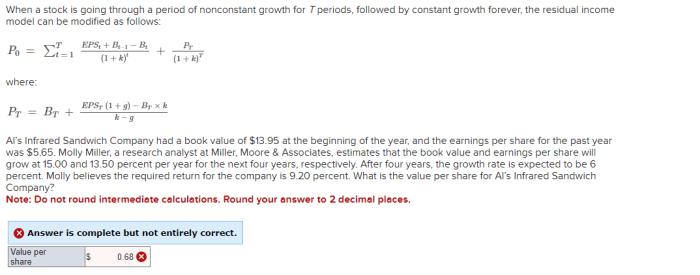

Source: cheggcdn.com

Accurately predicting stock prices is challenging, but understanding time frames is crucial for effective investment strategies. This involves aligning your investment goals with realistic expectations based on the inherent volatility of the market and the specific characteristics of the stock. This article explores the key aspects of setting and managing stock price target time frames.

Defining Stock Price Target Time Frames

Stock price targets are associated with distinct time horizons, each requiring a different investment approach and risk tolerance. These time frames are broadly categorized as short-term, mid-term, and long-term.

- Short-term: Typically ranges from a few days to a few months. Strategies focus on short-term price fluctuations and quick profits. Examples include day trading or swing trading.

- Mid-term: Usually spans from several months to a couple of years. This approach balances risk and reward, aiming for capital appreciation through moderate-term growth. Examples include investing in stocks with strong earnings growth potential.

- Long-term: Extends beyond two years, often involving buy-and-hold strategies. Investors prioritize long-term growth and dividend income, accepting higher initial risk for potentially greater rewards. Examples include investing in established companies with a history of consistent performance.

| Time Frame | Investment Strategy | Risk Level | Potential Return |

|---|---|---|---|

| Short-Term (Days to Months) | Day trading, swing trading | High | High (potential for quick profits, but also significant losses) |

| Mid-Term (Months to 2 Years) | Growth stock investing, sector rotation | Medium | Medium (balance between risk and reward) |

| Long-Term (Over 2 Years) | Buy-and-hold, dividend investing | Low (relative to short-term) | Low to High (long-term capital appreciation and dividends) |

Factors Influencing Stock Price Target Time Frames

Numerous factors influence the selection of appropriate time frames for stock price targets. These factors interact to shape market expectations and investor behavior.

- Economic Indicators: Macroeconomic data like inflation rates, interest rates, GDP growth, and unemployment figures significantly impact investor sentiment and market trends, influencing target time frames.

- Company-Specific News and Events: Announcements regarding earnings reports, product launches, mergers and acquisitions, or regulatory changes directly affect a company’s stock price and the timeframe for achieving specific price targets.

- Market Sentiment and Investor Psychology: Overall market optimism or pessimism (bullish or bearish sentiment) plays a crucial role in shaping investor expectations and the perceived timeframe for achieving price targets. Fear and greed are significant psychological factors.

- Industry Trends and Competitive Landscape: Technological advancements, changing consumer preferences, and competitive pressures within an industry can influence the growth trajectory of a company and, consequently, the time frame for its stock price target.

Setting Realistic Stock Price Targets

Source: cheggcdn.com

Establishing realistic stock price targets requires a blend of fundamental and technical analysis. Both approaches offer valuable insights, but their strengths and weaknesses should be considered.

- Fundamental Analysis Methodology: This involves assessing a company’s intrinsic value by analyzing financial statements, industry position, management quality, and future growth prospects. A target price is then derived based on this intrinsic value assessment.

- Technical Analysis Step-by-Step Process: This approach utilizes historical price and volume data, charting patterns, and technical indicators to identify potential price movements. A step-by-step process would involve chart analysis, identifying support and resistance levels, and using technical indicators to confirm potential price targets.

- Fundamental vs. Technical Analysis: Fundamental analysis provides a long-term perspective based on a company’s inherent value, while technical analysis focuses on short-to-medium-term price patterns and momentum. Combining both can lead to more comprehensive target setting.

- Potential Pitfalls: Overestimating future growth, ignoring risk factors, relying solely on one analytical method, and failing to account for unforeseen events are common pitfalls.

Monitoring and Adjusting Stock Price Targets

Regular monitoring is essential to track progress towards price targets and adapt to changing market conditions.

- Monitoring Market Conditions and Company Performance: Continuously review economic indicators, industry trends, company news, and financial performance to gauge the validity of the initial price target.

- Circumstances Requiring Adjustments: Significant changes in the company’s fundamentals, unexpected market events, or shifts in investor sentiment can necessitate adjustments.

- Examples of Target Revisions: Upward revisions might be warranted by exceeding earnings expectations or positive industry developments. Downward revisions might be necessary due to disappointing financial results, negative news, or broader market downturns.

- Checklist for Regular Reviews: A checklist should include reviewing financial statements, analyzing market trends, assessing company news, and comparing current performance to projections.

Visualizing Stock Price Target Time Frames

Visual representations can effectively illustrate the relationship between time frames and price targets.

- Time Frame vs. Price Target Visualization: This chart would have “Time Frame” on the x-axis (short-term, mid-term, long-term) and “Price Target” on the y-axis. Data points would represent the projected price target for each time frame. Error bars could indicate the potential range of the price target for each timeframe.

- Potential Price Range Visualization: This chart could use “Time” on the x-axis and “Price” on the y-axis. Three lines would represent the minimum, most likely, and maximum price projections for a given stock over the chosen time horizon. Shading between the lines could represent the uncertainty range.

Expert Answers

What are the limitations of using technical analysis to set price targets?

Determining a stock price target requires considering various factors and timeframes, ranging from short-term market fluctuations to long-term growth projections. Understanding the dynamics of a specific company’s performance is crucial, and for insightful analysis into a particular sector, you might find the information on stock price plm valuable. Ultimately, the chosen timeframe for your stock price target will depend on your investment strategy and risk tolerance.

Technical analysis relies on historical price data and patterns, which may not always accurately predict future movements. It’s susceptible to market manipulation and doesn’t consider fundamental factors affecting a company’s intrinsic value.

How frequently should I review and adjust my stock price targets?

The frequency depends on your investment strategy and market volatility. Short-term targets might require daily or weekly review, while long-term targets may need only quarterly or semi-annual adjustments. Significant news events or changes in company performance should always trigger a review.

What is the difference between a price target and a stop-loss order?

A price target is the anticipated price at which you expect to sell a stock to realize a profit. A stop-loss order is a risk management tool that automatically sells your stock if it drops to a predetermined price, limiting potential losses.

Can I use stock price target time frames for options trading?

Yes, understanding time frames is crucial for options trading. Options have expiration dates, and your target price needs to be reached within that timeframe for profitable execution. Time decay is a significant factor in options pricing.