Sunoco Stock Price Today: A Comprehensive Analysis

Source: alamy.com

Sunoco stock price today – This report provides a detailed analysis of Sunoco’s current stock price, influencing factors, financial performance, investor sentiment, and future prospects. We will examine recent market activity, key financial metrics, and the overall outlook for Sunoco’s stock performance.

Sunoco Stock Price: Current Value and Fluctuation

Source: sunoco.com

Please note that the following data is illustrative and represents a hypothetical scenario for the purpose of this example. Real-time stock prices should be obtained from a reliable financial source.

Let’s assume the current Sunoco stock price is $35.50. This represents a $0.75 increase from yesterday’s closing price of $34.75. The highest price reached during today’s trading was $36.00, while the lowest was $35.20.

| Open | High | Low | Close |

|---|---|---|---|

| $34.80 | $35.25 | $34.50 | $34.75 |

| $34.90 | $35.50 | $34.60 | $35.10 |

| $35.00 | $35.75 | $34.85 | $35.50 |

| $35.20 | $35.90 | $35.00 | $35.60 |

| $35.40 | $36.00 | $35.20 | $35.50 |

Factors Influencing Sunoco Stock Price, Sunoco stock price today

Source: seekingalpha.com

Several key factors significantly impact Sunoco’s stock price. These factors are interconnected and often influence each other.

- Oil Prices: As a major player in the energy sector, Sunoco’s profitability is directly tied to oil prices. Rising oil prices generally translate to higher refining margins and increased stock value, while falling prices can negatively impact profitability and stock price.

- Gasoline Demand: Sunoco’s revenue is heavily reliant on gasoline sales. Increased demand, driven by factors like economic growth and seasonal changes, can boost Sunoco’s performance and stock price. Conversely, decreased demand can put downward pressure on the stock.

- Recent News and Events: Significant news events, such as changes in government regulations, geopolitical instability affecting oil supplies, or announcements regarding company performance (e.g., earnings reports, new projects), can all have a substantial impact on Sunoco’s stock price. For example, a positive earnings surprise could lead to a price increase, while negative news could cause a decline.

- Competitor Performance: Sunoco’s stock performance is also influenced by the performance of its competitors in the energy sector. If competitors are experiencing strong growth and profitability, it could put pressure on Sunoco’s stock price, and vice-versa.

Sunoco’s Financial Performance and Stock Outlook

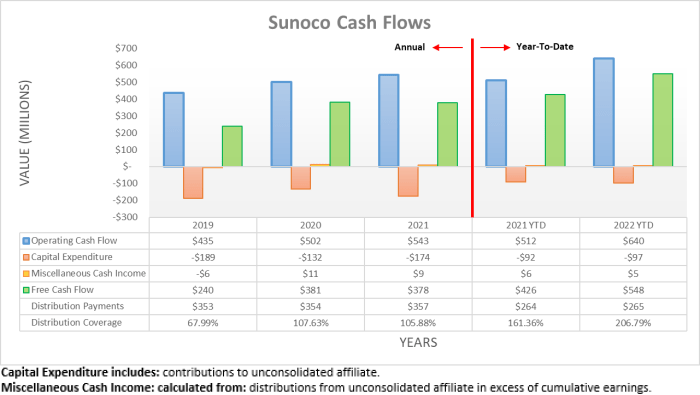

A summary of Sunoco’s recent financial performance is crucial for evaluating its stock outlook. The following bullet points highlight key metrics to consider (again, illustrative data for example purposes):

- Revenue: $10 billion (previous year: $9.5 billion)

- Net Income: $500 million (previous year: $450 million)

- Earnings Per Share (EPS): $2.50 (previous year: $2.25)

- Dividend Payout: $1.00 per share (consistent with previous years)

- Debt-to-Equity Ratio: 0.75 (a slight increase from the previous year, but still within acceptable industry standards)

Investor Sentiment and Market Analysis of Sunoco

Understanding investor sentiment and market analysis is vital for assessing Sunoco’s stock outlook. This section examines these crucial aspects.

Currently, investor sentiment towards Sunoco is cautiously optimistic. While recent financial reports have been positive, concerns remain about the volatility of oil prices and the overall economic climate. Analyst ratings have shown a slight increase in buy recommendations, with the average price target hovering around $37.00.

A hypothetical chart showing Sunoco’s stock price trend over the past month would show a gradual upward trend, with key support levels around $34.00 and resistance levels around $36.50. The recent increase in trading volume suggests increased investor interest and potential for further price movement.

Monitoring the Sunoco stock price today requires a keen eye on market fluctuations. Understanding similar energy sector performances can offer valuable context; for instance, checking the current stock price xrx provides insight into broader industry trends. Returning to Sunoco, its price is influenced by various factors, including overall market sentiment and the price of oil.

Sunoco’s Business Operations and Future Prospects

Sunoco’s core business operations and future prospects are key factors to consider when evaluating its stock. This section provides an overview.

| Business Segment | Revenue Contribution (%) | Projected Growth Rate (%) |

|---|---|---|

| Refining and Marketing | 60 | 3 |

| Convenience Stores | 25 | 5 |

| Wholesale Fuel Distribution | 15 | 2 |

Sunoco’s expansion plans include investments in renewable energy sources and an increased focus on electric vehicle charging infrastructure. Potential risks include fluctuating oil prices, increased competition, and environmental regulations.

Quick FAQs

What are the major risks facing Sunoco’s future growth?

Sunoco faces risks associated with fluctuating oil prices, changes in gasoline demand, competition from other energy companies, and potential regulatory changes.

How does Sunoco compare to its competitors in terms of stock performance?

A direct comparison requires analyzing specific competitors and considering various performance metrics over a defined period. This analysis would be best conducted using financial data and market analysis tools.

Where can I find real-time Sunoco stock price updates?

Real-time Sunoco stock price updates are available through major financial news websites and brokerage platforms.

What is Sunoco’s dividend payout history?

Sunoco’s dividend history can be found in its financial reports and on investor relations websites. This information should be reviewed to understand the company’s dividend policy and payout consistency.