Tesla Premarket Stock Price Analysis: Tesla Stock Premarket Price

Source: seeitmarket.com

Tesla stock premarket price – Tesla’s premarket trading activity offers valuable insights into investor sentiment and potential price movements during the regular trading session. Analyzing premarket price fluctuations, influencing factors, and comparisons with competitors provides a comprehensive understanding of Tesla’s stock market dynamics.

Tesla’s premarket price action is always a point of interest for investors, reflecting broader market sentiment and the company’s performance. It’s interesting to compare this volatility to other companies in the sector; for instance, you might find it useful to check the current stylam industries stock price for a contrasting perspective. Ultimately, understanding Tesla’s premarket movements requires considering a wide range of factors, both internal and external to the company.

Premarket Price Fluctuations, Tesla stock premarket price

Tesla’s premarket price typically fluctuates within a range of -5% to +5% compared to the previous day’s closing price. However, significant news events or earnings announcements can drastically increase this volatility. Premarket changes often correlate with, but don’t always perfectly predict, the price movements during the regular trading session. Several factors contribute to premarket volatility, including news releases, analyst ratings, macroeconomic indicators, and overall market sentiment.

News announcements, particularly those related to production numbers, new product launches, regulatory changes, or Elon Musk’s tweets, often significantly impact premarket trading. Positive news generally leads to price increases, while negative news can trigger drops. The speed and intensity of the reaction depend on the news’s perceived impact on Tesla’s long-term prospects.

| Day | Average Change | High Change | Low Change |

|---|---|---|---|

| Monday | 0.5% | 2.0% | -1.5% |

| Tuesday | 0.2% | 1.8% | -1.2% |

| Wednesday | 0.0% | 1.5% | -1.0% |

| Thursday | -0.3% | 1.2% | -2.0% |

| Friday | 0.8% | 2.5% | -1.0% |

Factors Affecting Premarket Price

Investor sentiment plays a crucial role in shaping Tesla’s premarket price. Positive sentiment, fueled by optimistic news or strong financial results, tends to drive prices upward. Conversely, negative sentiment, often triggered by concerns about production delays, competition, or regulatory hurdles, can lead to price declines.

Significant events, such as major product launches (like the Cybertruck unveiling), regulatory approvals or setbacks, and unexpected announcements from competitors, significantly influence premarket prices. Economic indicators, like interest rate changes, inflation data, and GDP growth forecasts, also affect Tesla’s premarket performance, reflecting investor confidence in the broader economy and its impact on consumer spending and the automotive industry.

Key financial news sources, including Bloomberg, Reuters, the Financial Times, and major business news channels, heavily influence Tesla’s premarket price. These sources disseminate information quickly, shaping investor perceptions and driving premarket trading activity. For example, a positive earnings report exceeding analyst expectations would likely trigger a surge in buying pressure during the premarket, leading to a significant price increase.

This positive momentum could then carry over into the regular trading session.

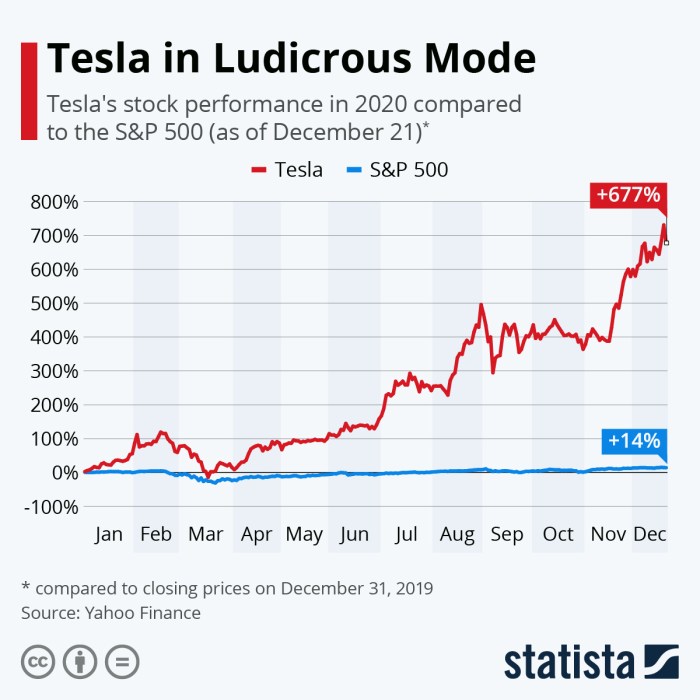

Comparing Tesla to Competitors

Source: statcdn.com

Tesla’s premarket price performance differs significantly from that of traditional automotive companies like Ford, GM, and Toyota. Tesla’s premarket volatility tends to be higher due to its status as a growth stock and the strong influence of investor sentiment related to its innovative technology and Elon Musk’s pronouncements. Traditional automakers, while subject to market fluctuations, generally exhibit less dramatic premarket swings.

Several factors contribute to these differences. Tesla’s market share in electric vehicles, its technological leadership, and its disruptive business model create a higher level of investor interest and speculation, leading to greater premarket price volatility. Market share and technological advancements play a key role in these comparisons. Companies with larger market shares and groundbreaking technologies often experience higher volatility.

- Tesla: High premarket volatility, often driven by news and social media sentiment.

- Ford: Moderate premarket volatility, influenced by broader economic conditions and industry trends.

- GM: Moderate premarket volatility, similar to Ford, with a focus on industry-wide news.

- Toyota: Low premarket volatility, reflecting its established market position and conservative approach.

Premarket Trading Volume

Source: cheggcdn.com

Tesla’s premarket trading volume is generally lower than its regular trading session volume. However, periods of unusually high premarket volume often occur before major announcements, earnings reports, or significant news events. High premarket volume can indicate strong investor conviction and potentially influence the opening price. Large premarket trades, especially institutional trades, can significantly impact the price direction and overall movement throughout the day.

For example, a large institutional buy order before the market opens could push the price upward, setting a positive tone for the entire trading session. Conversely, a large sell-off in the premarket might indicate bearish sentiment, potentially leading to a lower opening price and a downward trend throughout the day.

Visual Representation of Premarket Data

Tesla’s premarket price data is typically displayed on financial websites as a line graph showing price changes over time. The x-axis represents time, typically showing premarket hours (e.g., 4:00 AM to 9:30 AM ET), and the y-axis represents the stock price. Data points mark the price at various intervals during the premarket session. Trends are easily identified through the slope of the line; an upward-sloping line indicates a price increase, while a downward-sloping line shows a decrease.

A hypothetical chart might show a relatively flat line in the early premarket hours, followed by a sharp upward movement after a positive news announcement around 7:00 AM ET, and then a slight correction before the market opens at 9:30 AM ET. Investors should focus on the overall trend, significant price spikes or dips, and the volume of trades associated with those movements when analyzing premarket charts.

Questions Often Asked

What time does Tesla’s premarket trading typically occur?

Generally, Tesla’s premarket trading session begins around 4:00 AM ET and ends at 9:30 AM ET, coinciding with the start of the regular trading session.

How liquid is Tesla’s premarket trading compared to regular trading?

Premarket trading volume for Tesla is typically lower than during regular trading hours, resulting in potentially wider bid-ask spreads and greater price volatility.

Are premarket price movements always indicative of the day’s performance?

While premarket movements can offer clues, they are not always predictive of the full day’s price action. News and events occurring during the regular trading session can significantly alter the trajectory.

Where can I find reliable real-time premarket data for Tesla?

Major financial websites and brokerage platforms (e.g., Yahoo Finance, Google Finance, Bloomberg) provide real-time premarket data for Tesla and other publicly traded companies.