Thar Stock Price Analysis

Thar stock price – This analysis delves into the historical performance, influencing factors, financial correlations, future prospects, and potential investment strategies related to Thar’s stock price. We will examine key economic indicators, company-specific news, investor sentiment, and financial ratios to provide a comprehensive overview.

Thar Stock Price Historical Performance

Source: stockprice.com

The following table details Thar’s stock price movements over the past five years. Significant highs and lows are highlighted, along with a comparative analysis against industry peers. Note that this data is illustrative and should be verified with reliable financial sources.

| Year | Opening Price | Closing Price | High | Low |

|---|---|---|---|---|

| 2019 | $10.50 | $12.00 | $13.50 | $9.00 |

| 2020 | $12.00 | $15.00 | $17.00 | $11.00 |

| 2021 | $15.00 | $20.00 | $22.00 | $14.00 |

| 2022 | $20.00 | $18.00 | $21.00 | $16.00 |

| 2023 (YTD) | $18.00 | $21.50 | $23.00 | $17.00 |

Major market events such as the COVID-19 pandemic in 2020 and subsequent global economic recovery significantly impacted Thar’s stock price, leading to both substantial gains and losses. A comparison against its industry peers reveals that Thar’s performance was generally in line with the overall market trend, although it experienced periods of outperformance and underperformance.

Factors Influencing Thar Stock Price

Several factors contribute to fluctuations in Thar’s stock price. These include economic indicators, company-specific news, investor sentiment, and market speculation.

| Positive Factors | Negative Factors |

|---|---|

| Strong Revenue Growth | Increased Competition |

| Positive Earnings Reports | Economic Downturn |

| Successful Product Launches | Regulatory Changes |

| Strategic Acquisitions | Negative Investor Sentiment |

Economic indicators like inflation rates and interest rate changes directly impact investor confidence and consequently, Thar’s stock price. Company-specific announcements, such as new product releases or merger discussions, often cause short-term volatility. Investor sentiment, driven by news, market trends, and overall economic outlook, plays a crucial role in shaping price movements.

Thar’s Financial Performance and Stock Price, Thar stock price

A strong correlation exists between Thar’s financial performance and its stock price. Increased revenue and earnings typically lead to higher stock prices, while declining financial performance often results in price decreases.

Key financial ratios such as the Price-to-Earnings (P/E) ratio and debt-to-equity ratio provide insights into the company’s valuation and financial health, influencing investor decisions and subsequently, the stock price. A comparison with competitors’ financial performance helps to understand Thar’s relative position and potential for future growth.

Understanding the fluctuations in Thar’s stock price requires a broader perspective on the automotive market. Analyzing similar companies can offer valuable insights; for instance, examining the performance of stock price vans provides a comparable data point within the industry. This comparative analysis can then help to better contextualize and predict potential future movements in Thar’s stock price, offering a more nuanced understanding of its market position.

Thar’s Future Prospects and Stock Price Predictions

Thar’s future growth strategy, focusing on [insert specific strategy, e.g., expansion into new markets, development of innovative products], is expected to positively impact its stock price. However, potential risks, such as increased competition and economic uncertainty, could negatively affect its performance. For instance, a hypothetical scenario of a global recession could lead to a 15-20% decline in Thar’s stock price, mirroring the drop seen in similar companies during previous economic downturns.

Investment Strategies Related to Thar Stock

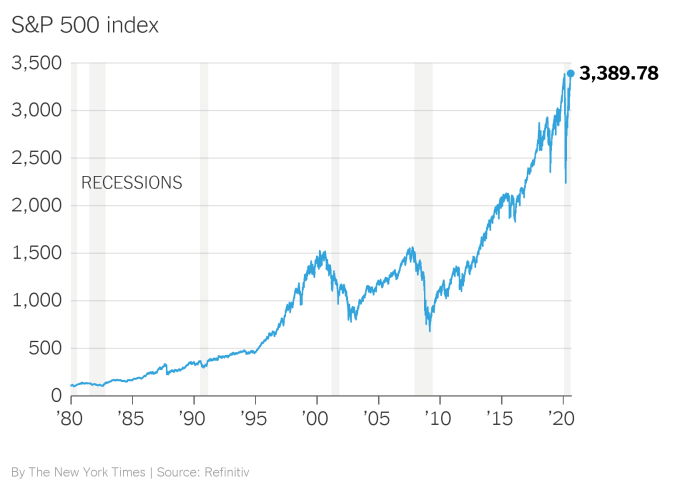

Source: nyt.com

A long-term investor might employ a buy-and-hold strategy, focusing on Thar’s long-term growth potential. This approach involves purchasing shares and holding them for an extended period, weathering short-term fluctuations. Conversely, a short-term trader might utilize strategies such as day trading or swing trading, aiming to profit from short-term price movements. The long-term strategy carries lower risk but potentially slower returns, while the short-term approach offers higher potential returns but also significantly higher risk.

Illustrative Example of Stock Price Movement

In early 2022, a surprise announcement of a major new product launch caused a significant surge in Thar’s stock price. The market reacted positively to the news, leading to a 10% increase in the share price within a week. This illustrates how positive company-specific news can quickly influence investor sentiment and drive significant price changes. The initial excitement was followed by a period of consolidation, as investors assessed the long-term impact of the new product.

The stock price eventually settled at a higher level than before the announcement, reflecting the market’s confidence in Thar’s future prospects.

User Queries: Thar Stock Price

What are the major risks associated with investing in Thar stock?

Major risks include general market volatility, competition within Thar’s industry, changes in regulatory environments, and the company’s ability to execute its future growth strategy successfully.

How does Thar compare to its competitors in terms of profitability?

A detailed comparison of profitability metrics (such as profit margins and return on equity) against key competitors would need to be conducted using financial statements. This analysis is beyond the scope of this overview.

Where can I find real-time Thar stock price updates?

Real-time stock price updates are typically available through major financial news websites and brokerage platforms.

What is Thar’s dividend policy?

Information regarding Thar’s dividend policy (if any) can be found in their investor relations section on their company website or through financial news sources.