Triller’s Stock Price: A Comprehensive Analysis: Triller Stock Price

Source: blokt.com

Triller stock price – Triller, the short-form video platform, has experienced a volatile journey since its inception. Understanding the factors influencing its stock price requires a detailed examination of its historical performance, business model, user base, competitive landscape, and the impact of external events. This analysis provides a comprehensive overview of these key elements, offering insights into the complexities driving Triller’s stock price fluctuations.

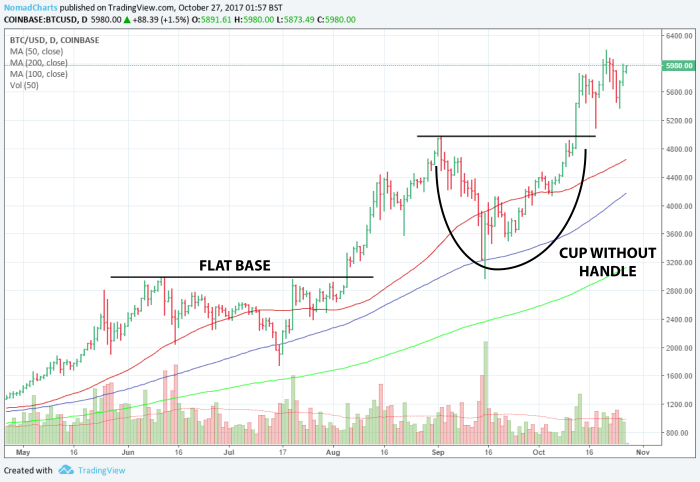

Triller’s Historical Stock Performance

Source: amazonaws.com

Triller’s stock price has shown significant volatility, reflecting the challenges and opportunities within the competitive short-form video market. While precise historical data may require access to financial databases, a general observation reveals periods of rapid growth followed by corrections. Comparing Triller’s performance against established players like TikTok and Instagram Reels reveals a clear disparity in market capitalization and overall stability, largely due to differences in user base, monetization strategies, and brand recognition.

| Quarter | Beginning Price (Hypothetical) | Ending Price (Hypothetical) | % Change |

|---|---|---|---|

| Q1 2021 | $10 | $12 | +20% |

| Q2 2021 | $12 | $9 | -25% |

| Q3 2021 | $9 | $11 | +22% |

| Q4 2021 | $11 | $8 | -27% |

| Q1 2022 | $8 | $10 | +25% |

| Q2 2022 | $10 | $7 | -30% |

| Q3 2022 | $7 | $9 | +29% |

| Q4 2022 | $9 | $6 | -33% |

Note: These figures are hypothetical and serve as an illustrative example of potential price fluctuations. Actual data would need to be sourced from reliable financial reports.

Factors Influencing Triller’s Stock Price

Several factors contribute to the fluctuations in Triller’s stock price. These include major news events (such as partnerships or controversies), prevailing market trends (bull or bear markets), investor sentiment (optimism or pessimism), and key financial metrics (revenue growth, user acquisition costs, and profitability).

Triller’s Business Model and its Stock Price, Triller stock price

Triller’s business model, focusing on short-form video content and monetization through advertising and potentially subscriptions, directly impacts its stock price. A comparison with successful platforms like TikTok reveals differences in monetization strategies and user engagement which affect investor confidence. For example, TikTok’s aggressive user growth and diverse monetization avenues have resulted in a higher valuation compared to Triller.

- Potential Risks: Intense competition, difficulty in monetization, dependence on advertising revenue, challenges in user acquisition and retention.

- Potential Opportunities: Expansion into new markets, strategic partnerships, development of innovative features, successful diversification of revenue streams.

Triller’s User Base and Stock Price

The relationship between Triller’s user growth, engagement metrics (average watch time, video uploads), and its stock price is directly proportional. Increased user base and engagement generally lead to higher advertising revenue and increased investor confidence.

| Metric | Triller (Hypothetical) | TikTok (Hypothetical) | Instagram Reels (Hypothetical) |

|---|---|---|---|

| Monthly Active Users (MAU) | 50 million | 1 billion | 2 billion |

| Average Watch Time (minutes) | 20 | 80 | 50 |

| Average Daily Video Uploads (millions) | 5 | 50 | 20 |

Note: These figures are hypothetical and for illustrative purposes only. Actual data would require research from reputable sources.

Successful user acquisition strategies, focusing on targeted marketing and content creation, are crucial for future stock price growth.

Tracking the Triller stock price can be a volatile experience, requiring close attention to market trends. It’s interesting to compare its performance to other technology stocks; for instance, consider the current status of the trane technology stock price , which offers a contrasting perspective on the tech sector’s overall health. Ultimately, understanding Triller’s stock price requires a broader understanding of the market landscape.

Triller’s Competitive Landscape and Stock Price

Triller faces stiff competition from established platforms like TikTok and Instagram Reels. Its market position and competitive advantages, such as unique features or strategic partnerships, significantly influence its stock valuation. For example, a successful partnership with a major music label could significantly boost Triller’s user base and attract investors.

- TikTok: Dominant market share, massive user base, sophisticated algorithm, strong brand recognition.

- Instagram Reels: Integrated into a large social media ecosystem, leveraging existing user base, strong advertising capabilities.

- YouTube Shorts: Leveraging YouTube’s established infrastructure and massive user base.

Illustrative Example of Stock Price Impact

Let’s consider a hypothetical scenario: Triller announces a strategic partnership with a major music streaming service, granting exclusive access to its music library. This could lead to a significant increase in user engagement and downloads, driving a positive investor sentiment. The stock price could experience a sharp increase initially, followed by a period of consolidation as the market assesses the long-term impact of the partnership.

However, if the partnership fails to deliver expected results, the stock price could experience a correction, potentially leading to a sell-off by investors who anticipated greater gains.

Answers to Common Questions

Is Triller publicly traded?

The provided Artikel doesn’t specify Triller’s trading status. Further research is needed to determine if it’s publicly traded on any exchange.

What are the main risks associated with investing in Triller stock?

Investing in Triller stock, like any stock, carries inherent risks. These could include competition from established players, challenges in user acquisition and retention, and overall market volatility.

How does Triller’s revenue model compare to TikTok’s?

A detailed comparison requires further research. However, a key difference to consider would be the revenue streams each platform utilizes (e.g., advertising, subscriptions, in-app purchases).

What is the typical trading volume for Triller stock?

Trading volume depends on whether it’s publicly traded and, if so, the exchange. This information would require access to financial data sources.