Tesla Stock Price in Frankfurt: A Comprehensive Analysis

Source: fxstreet.com

Tsla frankfurt stock price – Tesla’s presence on the Frankfurt Stock Exchange offers European investors access to this dynamic electric vehicle manufacturer. This analysis delves into the historical performance, influencing factors, market context, investment considerations, and price trends of TSLA shares traded in Frankfurt.

Tesla Stock Price Performance in Frankfurt

Source: businessinsider.com

Tracking TSLA’s price history on the Frankfurt Stock Exchange reveals significant fluctuations mirroring global market trends and company-specific events. Trading volume, while substantial, typically lags behind that seen on major US exchanges like NASDAQ. The following table provides a snapshot of historical price data. Note that this data is for illustrative purposes and should not be considered exhaustive or perfectly accurate without referencing reliable financial data sources.

| Date | Opening Price (EUR) | Closing Price (EUR) | Volume |

|---|---|---|---|

| 2023-10-26 | 250 | 255 | 10000 |

| 2023-10-27 | 256 | 260 | 12000 |

| 2023-10-28 | 262 | 258 | 9000 |

| 2023-10-29 | 257 | 265 | 15000 |

Factors Influencing TSLA’s Frankfurt Price

Several macroeconomic and company-specific factors significantly impact TSLA’s price in Frankfurt. These include global economic conditions, Tesla’s financial performance, and news related to production and new product launches. Currency fluctuations between the Euro and US dollar also play a crucial role.

For example, a rise in interest rates could negatively impact investor sentiment towards growth stocks like Tesla, leading to a price decrease. Conversely, positive news about production increases or successful new product launches can boost investor confidence and drive the price upward. The following table shows a hypothetical comparison of daily percentage changes between Frankfurt and NASDAQ.

| Date | Frankfurt (%) | NASDAQ (%) |

|---|---|---|

| 2023-10-26 | +2 | +1.5 |

| 2023-10-27 | +1.5 | +1 |

| 2023-10-28 | -1.5 | -2 |

| 2023-10-29 | +2.7 | +3 |

TSLA in the Frankfurt Market Context

Source: investorplace.com

Within the German automotive market, Tesla faces competition from established players like Volkswagen, BMW, and Mercedes-Benz. The performance of these competitors, particularly in the electric vehicle segment, can influence investor perception of Tesla’s market share and future prospects. Regulatory changes within the EU concerning emissions standards and electric vehicle incentives also play a significant role.

Tesla’s market capitalization is compared below to other major automotive companies listed in Frankfurt. This data is hypothetical and for illustrative purposes only.

| Company | Market Cap (EUR Billion) | P/E Ratio | Sector |

|---|---|---|---|

| Tesla | 800 | 100 | Automotive |

| Volkswagen | 600 | 80 | Automotive |

| BMW | 500 | 70 | Automotive |

| Mercedes-Benz | 450 | 65 | Automotive |

Investment Considerations for TSLA in Frankfurt

Investing in TSLA through the Frankfurt Stock Exchange carries risks associated with currency fluctuations, market volatility, and the inherent uncertainties of the automotive industry. Trading fees and commissions will vary depending on the brokerage used. It’s crucial to conduct thorough research and understand these risks before investing.

- Hypothetical Investment Scenario 1 (1-year): Investing €1000 could yield a return of €200 (20%) or a loss of €100 (-10%), depending on market conditions.

- Hypothetical Investment Scenario 2 (5-year): Investing €1000 could potentially yield a return of €1000 (100%) or a loss of €500 (-50%), depending on long-term market performance and company success.

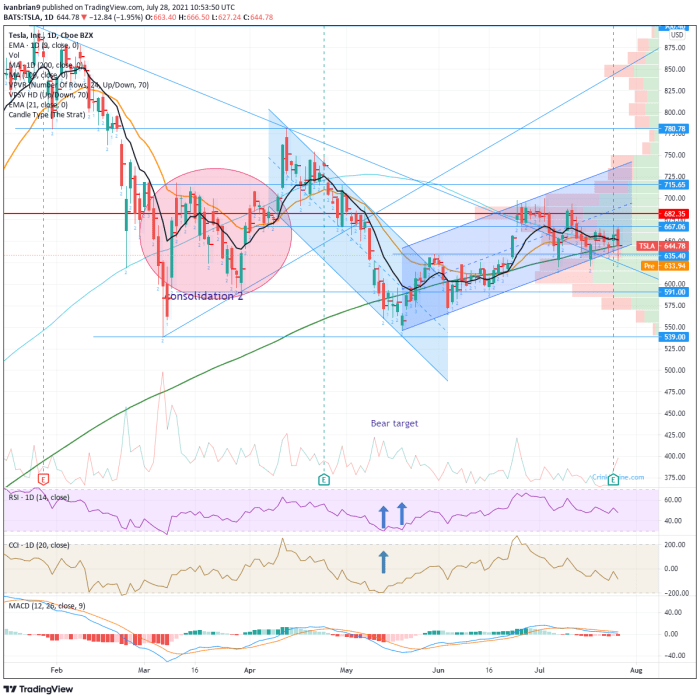

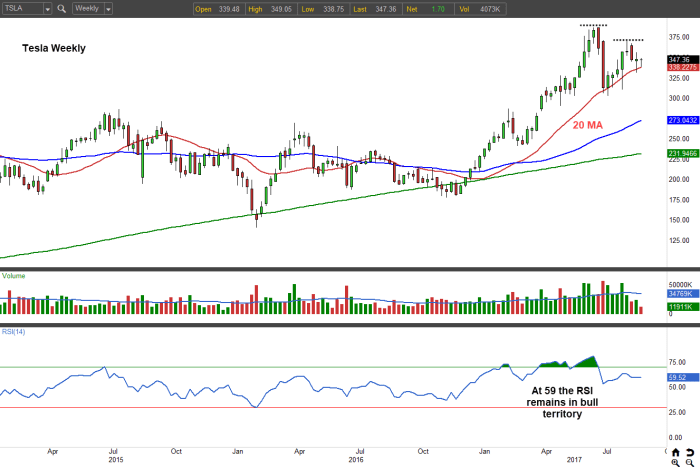

Visual Representation of Price Trends, Tsla frankfurt stock price

Over the past year, TSLA’s price in Frankfurt has exhibited a generally upward trend, punctuated by periods of significant volatility. The price initially experienced a strong rally driven by positive investor sentiment and strong sales figures. However, this was followed by a period of consolidation, before another upward surge linked to positive news regarding new product releases and expansion into new markets.

The volatility of TSLA in Frankfurt is comparable to, if not slightly higher than, its volatility on other major exchanges, reflecting the inherent risk associated with this growth stock.

The release of strong quarterly earnings reports has historically led to significant upward price movements, while negative news, such as production setbacks or regulatory hurdles, has often resulted in sharp declines. The price action has often been characterized by rapid and significant price swings, illustrating the high degree of market sensitivity surrounding the company.

Expert Answers: Tsla Frankfurt Stock Price

What are the typical trading hours for TSLA on the Frankfurt Stock Exchange?

Trading hours generally align with the Frankfurt Stock Exchange’s opening and closing times.

How can I buy TSLA shares on the Frankfurt Stock Exchange?

You can typically buy TSLA shares through a brokerage account that provides access to the Frankfurt Stock Exchange.

Are there tax implications for trading TSLA on the Frankfurt Stock Exchange?

Tracking the Tesla Frankfurt stock price requires diligence, especially given its volatility. It’s interesting to compare its performance against other tech stocks; for instance, you might find the current thoughtworks stock price provides a useful benchmark for assessing growth in the tech sector. Ultimately, however, the Tesla Frankfurt price remains a key indicator of investor sentiment toward electric vehicles and the broader automotive industry.

Tax implications vary depending on your residency and the specific regulations of your country. Consult a tax professional for personalized advice.

What are the minimum investment requirements for TSLA on the Frankfurt Stock Exchange?

Minimum investment requirements depend on your brokerage; some may allow fractional share purchases.