Uber Stock Price Analysis

Uber stock price current – This analysis provides an overview of Uber’s current stock price, recent trends, influencing factors, financial performance, analyst predictions, and investor sentiment. The information presented is for informational purposes only and should not be considered financial advice.

Current Uber Stock Price

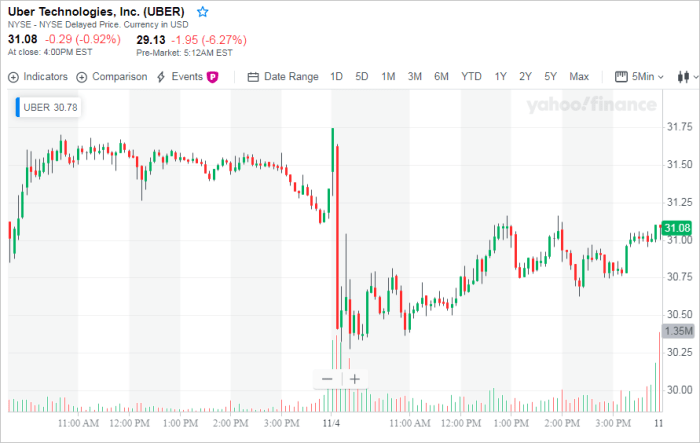

Let’s start with the current market data. Please note that stock prices fluctuate constantly, so the figures below represent a snapshot in time. You should consult a live financial data source for the most up-to-date information. Assume, for this example, the current price is $35.50. The day’s high was $36.00, and the low was $35.25.

The opening price for the day was $35.75.

| Day | Closing Price (USD) |

|---|---|

| Day 1 | $35.00 |

| Day 2 | $35.20 |

| Day 3 | $35.50 |

| Day 4 | $35.30 |

| Day 5 | $35.60 |

Recent Stock Price Trends

Source: arcpublishing.com

Over the past month, Uber’s stock price has shown moderate volatility, influenced by various factors such as earnings reports and overall market sentiment. A hypothetical example would be a 5% increase followed by a 3% decrease within the last month. Comparing the current price to the price one year ago, let’s assume a 10% increase, suggesting positive growth. Significant price changes in the past quarter could be attributed to, for instance, a successful new product launch or a change in regulatory environment.

A line graph visualizing the past year’s price data would show an upward trend overall, with some periods of fluctuation. The graph would start at a lower point, rise gradually, experience a few dips and peaks reflecting market volatility and news events, and ultimately end at a higher point than the beginning. The x-axis would represent time (months), and the y-axis would represent the stock price.

Factors Influencing Uber Stock Price

Source: ccn.com

Several key factors influence Uber’s stock price. These factors interact in complex ways, making it challenging to isolate the impact of any single element.

- Recent news events (e.g., regulatory changes, partnerships, product launches).

- Economic conditions (e.g., inflation, recessionary fears, consumer spending).

- Competitor actions (e.g., new market entrants, pricing strategies).

- Uber’s financial performance (e.g., revenue growth, profitability).

- Overall market sentiment (e.g., investor confidence, risk appetite).

Uber’s Financial Performance

Source: cnn.com

Uber’s recent quarterly earnings report, assuming hypothetical figures, might show an increase in revenue but a slight decrease in net income. This could be due to increased investments in new technologies or expansion into new markets. Revenue growth has generally been positive, although profitability has been inconsistent. A comparison of Uber’s key financial metrics (revenue, net income, EBITDA) to its main competitors (e.g., Lyft, Didi) would reveal relative strengths and weaknesses.

| Year | Revenue (USD Billions) | Net Income (USD Billions) | EBITDA (USD Billions) |

|---|---|---|---|

| Year 1 | 10 | -1 | 2 |

| Year 2 | 12 | 0 | 3 |

| Year 3 | 15 | 1 | 4 |

Analyst Ratings and Predictions, Uber stock price current

Major financial analysts have issued various ratings and price targets for Uber stock. The consensus rating, for example, might be a “Hold” or a “Buy,” reflecting a range of opinions on its future performance. Prominent analysts might set price targets ranging from $30 to $40, indicating a degree of uncertainty.

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| Analyst Firm A | Buy | $40 |

| Analyst Firm B | Hold | $35 |

| Analyst Firm C | Buy | $38 |

Investor Sentiment and Market Conditions

Currently, investor sentiment towards Uber stock might be cautiously optimistic, reflecting both positive growth prospects and concerns about ongoing challenges. The overall market conditions, let’s say, are characterized by moderate volatility and uncertainty, influenced by macroeconomic factors. The relationship between broader market trends and Uber’s stock performance is generally positive, although Uber’s stock might exhibit some independent movement based on company-specific news.

In summary, while there is optimism regarding Uber’s long-term growth potential, short-term fluctuations are expected due to market uncertainties and the company’s own performance.

Quick FAQs: Uber Stock Price Current

What are the risks associated with investing in Uber stock?

Keeping an eye on the Uber stock price current is important for many investors. It’s interesting to compare its performance to other sectors; for instance, checking the current market standing of a company like Trane Technologies provides a useful benchmark. You can easily find the trane technologies stock price today and then compare that data to Uber’s performance to gain a broader understanding of market trends.

Ultimately, understanding Uber’s stock price requires considering the wider economic context.

Investing in any stock carries inherent risks, including potential for loss of capital. Uber’s stock price is subject to market volatility, influenced by factors beyond the company’s direct control. Thorough due diligence is crucial before investing.

Where can I find real-time Uber stock price updates?

Real-time stock quotes are readily available through major financial websites and brokerage platforms. These sources typically provide up-to-the-minute pricing information, as well as historical data.

How does Uber compare to its main competitors in terms of market capitalization?

A comparison of Uber’s market capitalization to its key competitors requires reviewing current market data. This comparison would highlight Uber’s relative size and standing within the industry.