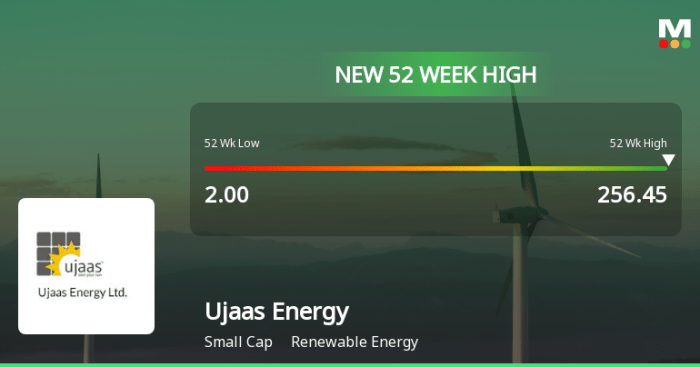

Ujaas Energy Limited: A Stock Price Deep Dive

Source: marketsmojo.com

Ujaas stock price – Ujaas Energy Limited operates within a dynamic and often volatile energy sector. Understanding its history, financial performance, and market position is crucial for investors seeking to assess the potential of its stock. This analysis explores various factors influencing Ujaas Energy’s stock price, providing a comprehensive overview for informed decision-making.

Ujaas Energy Limited Company Overview

Ujaas Energy Limited is a renewable energy company with a focus on [mention specific area of renewable energy, e.g., solar power, wind power]. While precise founding details are needed for a complete history, a general overview can be provided. The company’s primary business activities center around the development, construction, and operation of renewable energy projects. Revenue streams are generated primarily through the sale of electricity produced from these projects, as well as potential revenue from government subsidies and carbon credits.

Key financial metrics, such as market capitalization and debt levels, fluctuate and should be obtained from reliable financial data sources for the most current information.

| Subsidiary | Business Activity | Contribution to Revenue (%) | Geographic Location |

|---|---|---|---|

| [Subsidiary 1 Name] | [Description of Activity] | [Percentage] | [Location] |

| [Subsidiary 2 Name] | [Description of Activity] | [Percentage] | [Location] |

| [Subsidiary 3 Name] | [Description of Activity] | [Percentage] | [Location] |

Factors Influencing Ujaas Stock Price

Several factors contribute to the fluctuations in Ujaas Energy’s stock price. These can be broadly categorized into macroeconomic influences, industry-specific trends, competitive dynamics, and the company’s own performance.

Macroeconomic factors such as interest rate changes, inflation rates, and overall economic growth significantly impact investor sentiment and capital flows into the renewable energy sector. Industry-specific trends, like government policies supporting renewable energy or technological advancements in energy production, also play a crucial role. Competitor actions, including new market entrants or aggressive pricing strategies, can affect Ujaas’s market share and profitability.

Finally, the company’s own financial performance, operational efficiency, and project execution capabilities are paramount.

- Comparative Performance: A comparison with similar companies, such as [Company A], [Company B], and [Company C], could be made using metrics like return on equity (ROE) or price-to-earnings (P/E) ratio to gauge Ujaas’s relative performance. This comparison requires accessing up-to-date financial data from reliable sources.

Recent News and Events Affecting Ujaas

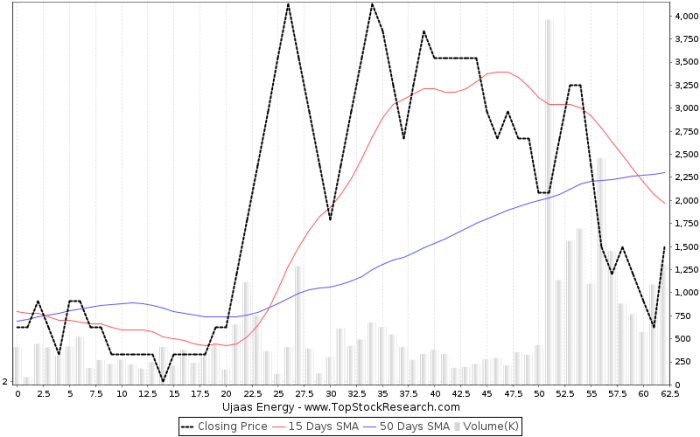

Source: topstockresearch.com

Significant news and events can substantially impact Ujaas Energy’s stock price. These events can include contract awards, regulatory changes, or announcements regarding financial performance. A chronological overview is essential to understand the cumulative effect of these occurrences.

| Date | Event Description | Impact on Stock Price |

|---|---|---|

| [Date 1] | [Description of Event 1] | [Positive/Negative/Neutral, with percentage change if available] |

| [Date 2] | [Description of Event 2] | [Positive/Negative/Neutral, with percentage change if available] |

| [Date 3] | [Description of Event 3] | [Positive/Negative/Neutral, with percentage change if available] |

Ujaas Stock Price Performance Analysis (Technical Aspects)

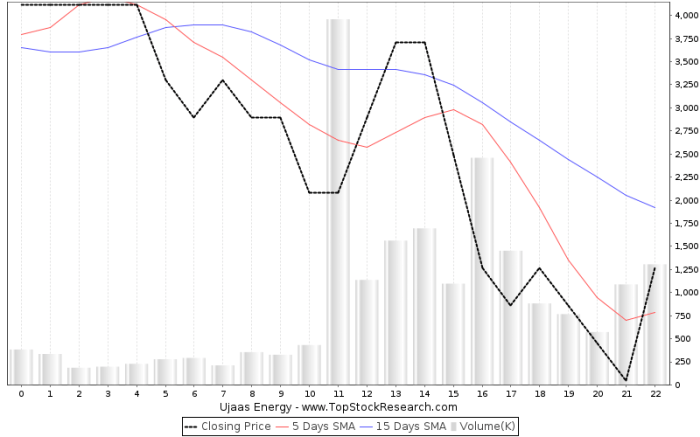

Source: topstockresearch.com

A five-year chart of Ujaas Energy’s stock price would reveal significant trends, highs, lows, and periods of volatility. This chart, while not physically displayed here, would ideally show the overall price movement, identifying key support and resistance levels. Support levels represent prices where buying pressure is expected to outweigh selling pressure, while resistance levels indicate the opposite. High trading volumes often accompany price breakthroughs or breakdowns, suggesting significant shifts in market sentiment.

- Moving Averages: Moving averages (e.g., 50-day, 200-day) smooth out price fluctuations, helping identify trends and potential reversal points. A crossing of short-term and long-term moving averages could be a significant trading signal.

- Relative Strength Index (RSI): The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Readings above 70 suggest an overbought market, while readings below 30 suggest an oversold market.

Ujaas Stock Price Performance Analysis (Fundamental Aspects)

Analyzing Ujaas Energy’s financial statements—income statement, balance sheet, and cash flow statement—is crucial for understanding its financial health and profitability. Key profitability ratios such as gross profit margin, operating profit margin, and net profit margin would provide insights into the company’s efficiency in generating profits. Debt levels and the company’s ability to service its debt are also critical aspects.

A detailed analysis, beyond the scope of this brief overview, is needed to draw meaningful correlations between these fundamental aspects and the stock price.

Ujaas Energy’s stock price performance has been a topic of discussion lately, particularly in comparison to other players in the renewable energy sector. Understanding the trajectory of similar companies is crucial for analysis; for example, consider the potential of Tilray’s future stock price, as detailed in this insightful article: tilray future stock price. Analyzing such comparisons helps to contextualize Ujaas Energy’s prospects and potential for future growth.

- Example Correlation: For instance, a consistent increase in net profit margin, coupled with a decrease in debt-to-equity ratio, could generally be expected to lead to a positive impact on the stock price, all else being equal.

Future Outlook and Potential Risks, Ujaas stock price

The future outlook for Ujaas Energy depends on several factors, including the growth of the renewable energy sector, government policies, technological advancements, and the company’s ability to execute its projects efficiently. However, several risks and challenges could hinder the company’s growth, such as intense competition, regulatory hurdles, and the inherent volatility of the energy sector.

| Scenario | Probability | Projected Price (1 Year) |

|---|---|---|

| [Scenario 1, e.g., Strong Growth] | [Probability, e.g., 30%] | [Projected Price] |

| [Scenario 2, e.g., Moderate Growth] | [Probability, e.g., 50%] | [Projected Price] |

| [Scenario 3, e.g., Stagnation or Decline] | [Probability, e.g., 20%] | [Projected Price] |

General Inquiries: Ujaas Stock Price

What are the major risks associated with investing in Ujaas Energy?

Major risks include volatility in the energy sector, competition from established players, regulatory changes impacting renewable energy projects, and the company’s debt levels.

Where can I find real-time Ujaas stock price data?

Real-time data is typically available through major financial websites and stock market applications that track Indian stock exchanges.

How does Ujaas Energy compare to its competitors in terms of profitability?

A direct comparison requires analyzing key profitability metrics like net profit margins and return on equity against similar companies in the renewable energy sector. This comparison should be based on publicly available financial data.

What is Ujaas Energy’s dividend policy?

Information on Ujaas Energy’s dividend policy, including dividend history and future expectations, can be found in their investor relations section on their official website or through financial news sources.