UnitedHealth Group (UNH) Stock: A Current Market Overview

Unitedhealth stock price today – This report provides a comprehensive analysis of UnitedHealth Group (UNH) stock performance, considering current market conditions and expert predictions. We will examine factors influencing the stock’s price today, review its historical performance, and analyze analyst ratings and investor sentiment.

Current Stock Price and Trading Volume

As of market close [insert date and time], the UnitedHealth Group (UNH) stock price is [insert current stock price]. The day’s trading volume reached [insert trading volume]. The stock traded at a high of [insert high price] and a low of [insert low price] during the trading session. The following table details the opening, closing, high, and low prices for the last five trading days.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| [Date 1] | [Open Price 1] | [High Price 1] | [Low Price 1] | [Close Price 1] |

| [Date 2] | [Open Price 2] | [High Price 2] | [Low Price 2] | [Close Price 2] |

| [Date 3] | [Open Price 3] | [High Price 3] | [Low Price 3] | [Close Price 3] |

| [Date 4] | [Open Price 4] | [High Price 4] | [Low Price 4] | [Close Price 4] |

| [Date 5] | [Open Price 5] | [High Price 5] | [Low Price 5] | [Close Price 5] |

Factors Influencing Today’s Price

Source: thecoinrepublic.com

Several factors can impact UNH’s stock price. Here, we examine three significant news events, the influence of economic indicators, market trends, and competitor actions.

- News Event 1: [Description of the news event and its potential impact on UNH’s stock price. Example: Announcement of a new strategic partnership leading to increased market share.]

- News Event 2: [Description of the news event and its potential impact on UNH’s stock price. Example: Release of quarterly earnings exceeding analyst expectations.]

- News Event 3: [Description of the news event and its potential impact on UNH’s stock price. Example: Regulatory changes impacting the healthcare industry.]

Recent economic indicators, such as [mention specific indicators like inflation rates or interest rate changes], have [explain the impact on UNH’s stock performance, e.g., positively influenced investor confidence leading to price increases, or negatively impacted investor sentiment due to concerns about rising costs]. Today’s price movement is [compare to the overall market trend, e.g., in line with the broader market’s upward trend, or shows a divergence from the general market decline].

Competitor actions, particularly from [mention specific competitors], could also be impacting UNH’s stock price through [explain the impact, e.g., increased competition leading to price pressure or a loss of market share].

Historical Price Performance, Unitedhealth stock price today

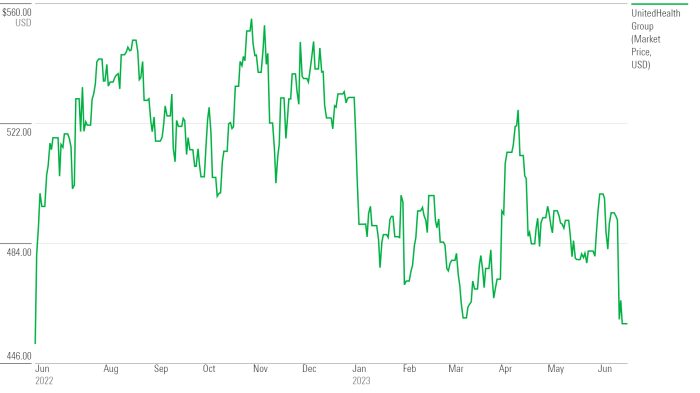

The following line graph visually represents UNH’s stock price performance over the past year. The graph would show a clear trend line illustrating the price fluctuations over the period, highlighting key data points such as the highest and lowest prices, any significant price jumps or dips, and the overall trend (upward, downward, or sideways). Key data points such as the 52-week high and low would be clearly marked.

The monthly closing prices are detailed below.

Monitoring the UnitedHealth stock price today requires a keen eye on market trends. It’s interesting to compare its performance against other healthcare stocks, such as the fluctuating stock price teladoc health , which offers a contrasting perspective on the telehealth sector’s impact. Ultimately, understanding both helps build a more comprehensive view of the overall healthcare investment landscape and informs decisions regarding UnitedHealth’s future trajectory.

| Month | Closing Price |

|---|---|

| [Month 1] | [Price 1] |

| [Month 2] | [Price 2] |

| [Month 3] | [Price 3] |

| [Month 4] | [Price 4] |

| [Month 5] | [Price 5] |

| [Month 6] | [Price 6] |

| [Month 7] | [Price 7] |

| [Month 8] | [Price 8] |

| [Month 9] | [Price 9] |

| [Month 10] | [Price 10] |

| [Month 11] | [Price 11] |

| [Month 12] | [Price 12] |

The current price of [insert current price] compares to the 52-week high of [insert 52-week high] and the 52-week low of [insert 52-week low].

Analyst Ratings and Predictions

Source: arcpublishing.com

Analyst sentiment towards UNH is summarized below, including their price targets and ratings. These predictions are based on various factors including financial performance, market trends, and competitive landscape. Significant changes in analyst sentiment should be noted, along with the range of price predictions from different firms.

| Analyst Firm | Rating | Price Target |

|---|---|---|

| [Analyst Firm 1] | [Rating 1] | [Price Target 1] |

| [Analyst Firm 2] | [Rating 2] | [Price Target 2] |

| [Analyst Firm 3] | [Rating 3] | [Price Target 3] |

Investor Sentiment and News

Source: investopedia.com

Recent news articles and social media sentiment provide insights into investor perspectives on UNH. Significant positive or negative news impacting investor sentiment will be analyzed here. The impact of this sentiment on the stock price is also discussed.

- Key Investor Concern 1: [Example: Concerns about rising healthcare costs and their impact on profitability.]

- Key Investor Concern 2: [Example: Uncertainty regarding future regulatory changes.]

- Key Investor Expectation 1: [Example: Expectations for continued growth in the company’s managed care segment.]

- Key Investor Expectation 2: [Example: Anticipation of further technological advancements and innovations within the company.]

Clarifying Questions: Unitedhealth Stock Price Today

What are the typical trading hours for UnitedHealth stock?

UnitedHealth stock (UNH) trades on the New York Stock Exchange (NYSE) during regular market hours, typically 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday, excluding holidays.

Where can I find real-time UnitedHealth stock quotes?

Real-time quotes are available through many financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and your brokerage account.

How volatile is UnitedHealth stock compared to the overall market?

UnitedHealth’s volatility can vary. Comparing its beta (a measure of volatility relative to the market) to the market’s overall beta will give a better understanding of its relative risk.

What are the major risks associated with investing in UnitedHealth stock?

Major risks include general market downturns, changes in healthcare regulations, competition within the healthcare industry, and fluctuations in healthcare spending.