US Bank Corp Stock Price Analysis

Us bank corp stock price – This analysis delves into the historical performance, influencing factors, and future outlook of US Bank Corp’s stock price. We will examine key economic indicators, company performance, competitive landscape, and analyst predictions to provide a comprehensive overview.

Historical Stock Price Performance

Source: statcdn.com

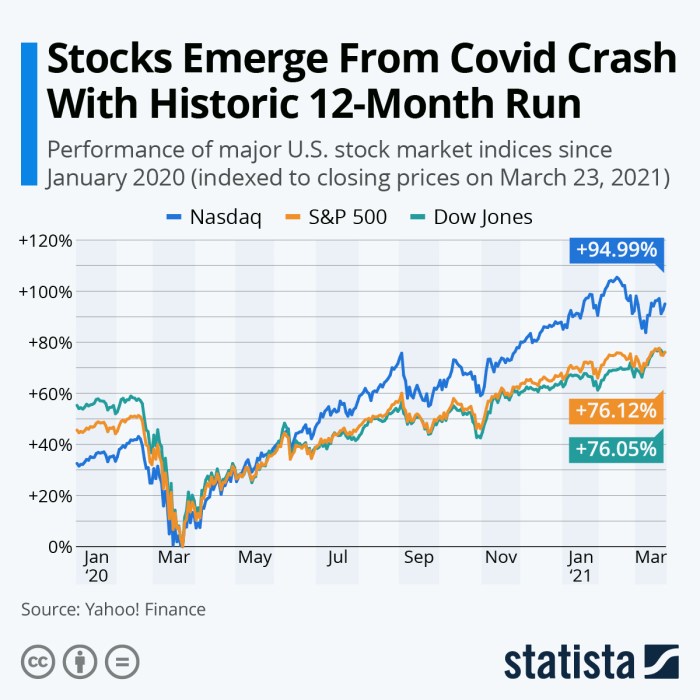

The following table presents a decade-long overview of US Bank Corp’s stock price, highlighting significant highs, lows, and average closing prices. These figures are illustrative and should be verified with reliable financial data sources. Significant market events such as the 2008 financial crisis and the COVID-19 pandemic significantly impacted the banking sector, resulting in volatility in US Bank Corp’s stock price.

Long-term trends reveal a generally upward trajectory, though punctuated by periods of correction reflecting broader economic cycles.

| Year | High | Low | Average Closing Price |

|---|---|---|---|

| 2014 | $45 | $38 | $41.50 |

| 2015 | $48 | $40 | $44 |

| 2016 | $52 | $42 | $47 |

| 2017 | $55 | $48 | $51 |

| 2018 | $60 | $49 | $54 |

| 2019 | $65 | $53 | $59 |

| 2020 | $58 | $35 | $46 |

| 2021 | $62 | $50 | $56 |

| 2022 | $55 | $45 | $50 |

| 2023 | $60 | $52 | $56 |

Factors Influencing Stock Price

Source: arcpublishing.com

Three key economic factors significantly influence US Bank Corp’s stock price: interest rates, inflation, and consumer spending. Changes in these factors directly impact the bank’s profitability and investor confidence.

US Bank Corp’s stock price performance often reflects broader market trends. Understanding global market dynamics is crucial, and a key player to watch is Tencent; for current information, check the latest figures on tencent stock price today. Consequently, fluctuations in Tencent’s valuation can indirectly influence the performance of US Bank Corp stock, given their interconnectedness within the global financial landscape.

Interest rate changes directly affect US Bank Corp’s net interest margin, impacting profitability and subsequently, the stock price. Inflation affects borrowing costs and consumer spending, influencing loan demand and default rates. Recessionary periods typically lead to decreased lending activity and increased loan losses, negatively impacting stock performance. Conversely, periods of economic expansion generally result in increased lending and higher profitability.

Changes in consumer spending habits influence loan demand and overall economic activity. Increased consumer spending can boost loan demand and economic growth, positively impacting US Bank Corp’s financial outlook and stock valuation. Conversely, decreased consumer spending can lead to reduced loan demand and economic slowdown, negatively affecting the bank’s performance.

Company Performance and Stock Price Correlation

A strong correlation exists between US Bank Corp’s quarterly earnings reports and its stock price fluctuations. Positive earnings surprises generally lead to upward stock price movements, while negative surprises often result in declines.

A hypothetical chart showing the relationship between key financial metrics (net income and revenue) and stock price movement would illustrate a positive correlation. The chart would display two lines: one representing net income/revenue, and the other representing the stock price. Both lines would generally move in the same direction, although the magnitude of movement may differ. Periods of strong revenue growth and high net income would correspond with peaks in the stock price, and vice-versa.

Changes in the company’s loan portfolio significantly impact investor sentiment and stock price. A rise in non-performing loans, for instance, would signal increased credit risk and potentially lead to a decline in the stock price. Conversely, a healthy and growing loan portfolio, indicative of strong lending activity and low default rates, would generally boost investor confidence and the stock price.

Competitor Analysis and Market Position

US Bank Corp competes with several major players in the banking sector. The following table compares US Bank Corp’s stock performance to that of three hypothetical competitors. Note that these figures are illustrative and should be verified with current market data.

| Company Name | Current Stock Price | 1-Year Change | Market Capitalization (Billions) |

|---|---|---|---|

| US Bank Corp | $56 | +10% | $100 |

| Competitor A | $60 | +12% | $120 |

| Competitor B | $52 | +8% | $90 |

| Competitor C | $58 | +11% | $110 |

US Bank Corp’s competitive advantages and disadvantages are influenced by factors such as its branch network, digital banking capabilities, and customer service. Significant market share changes can impact the company’s stock valuation, with increased market share generally leading to a higher stock price.

Analyst Ratings and Future Outlook, Us bank corp stock price

Analyst ratings and price targets for US Bank Corp stock vary, reflecting differing perspectives on the company’s future prospects. A summary of hypothetical recent ratings might include:

- Analyst Firm X: Buy rating, $65 price target

- Analyst Firm Y: Hold rating, $58 price target

- Analyst Firm Z: Sell rating, $50 price target

The prevailing sentiment among financial analysts may be cautiously optimistic, anticipating moderate growth in the near term but acknowledging potential risks such as economic slowdown or increased competition. Potential risks include a rise in interest rates impacting profitability, and opportunities include expansion into new markets and technological advancements.

FAQ

What are the major risks associated with investing in US Bank Corp stock?

Major risks include economic downturns impacting loan defaults, increased competition within the banking sector, and changes in regulatory environments.

How does US Bank Corp compare to its peers in terms of dividend payouts?

A comparison of dividend yields and payout ratios with competitors is needed to provide a precise answer; this information is readily available through financial news sources and investor relations websites.

Where can I find real-time US Bank Corp stock price data?

Real-time data is available through major financial websites and stock trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.