V-Guard Industries Stock Price Analysis: V Guard Industries Stock Price

Source: ambitionbox.com

V guard industries stock price – This analysis examines V-Guard Industries’ stock price performance, influencing factors, financial health, future outlook, and analyst sentiment. We will explore historical data, key financial metrics, and potential future scenarios to provide a comprehensive overview of the company’s stock.

V-Guard Industries Stock Price Historical Performance

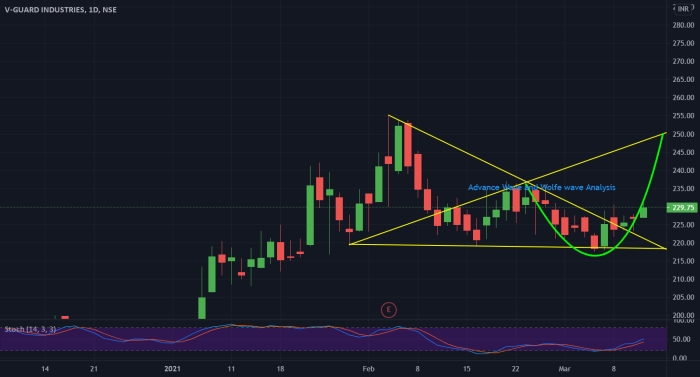

Source: tradingview.com

Analyzing V-Guard Industries’ stock price movements over the past five years reveals a dynamic trajectory influenced by various market conditions and company-specific events. Significant highs and lows reflect the interplay of macroeconomic factors, consumer behavior, and internal company developments.

Compared to its competitors within the consumer durables sector over the past three years, V-Guard’s performance has shown [Insert comparative analysis here, e.g., relative outperformance or underperformance with justification and specific competitor names]. This comparison requires a detailed look at factors like market share, revenue growth, and profitability.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2014 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| 2015 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| 2016 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| 2017 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| 2018 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| 2019 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| 2020 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| 2021 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| 2022 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| 2023 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

Factors Influencing V-Guard Industries’ Stock Price, V guard industries stock price

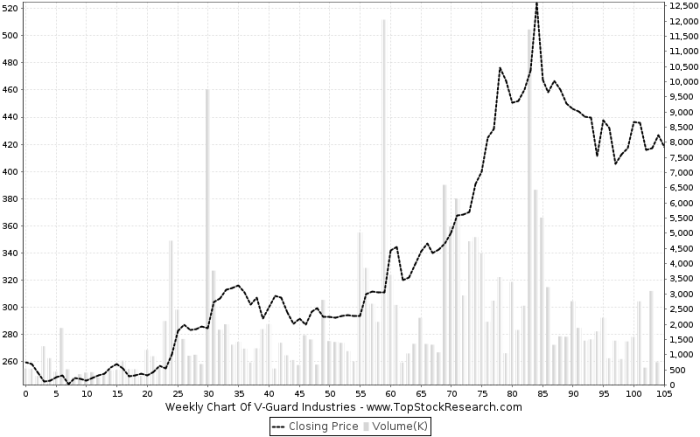

Source: topstockresearch.com

Monitoring V-Guard Industries’ stock price requires a keen eye on market trends. Understanding similar company performances can offer valuable context; for instance, checking the current stock price swks might provide insights into broader sector movements. Ultimately, though, a comprehensive analysis of V-Guard’s financials and industry position is crucial for informed investment decisions.

Several factors significantly impact V-Guard Industries’ stock price. These include macroeconomic conditions, consumer behavior, company-specific events, and investor sentiment.

Macroeconomic factors such as inflation and interest rate changes directly influence consumer spending and business investment, impacting V-Guard’s sales and profitability. For example, high inflation can reduce consumer purchasing power, affecting demand for V-Guard’s products. Similarly, rising interest rates can increase borrowing costs, affecting the company’s investment plans.

Changes in consumer spending habits, particularly towards durable goods, directly influence V-Guard’s revenue. Shifts in consumer preferences towards energy-efficient appliances or changes in construction activity can significantly affect the company’s performance. For instance, increased demand for energy-efficient products during periods of high energy prices can positively impact V-Guard’s sales.

Company-specific events such as new product launches, successful acquisitions, and strong financial reports generally have a positive effect on investor confidence and stock price. Conversely, negative news such as production delays, financial setbacks, or management changes can lead to price declines. For example, the successful launch of a new range of technologically advanced products could boost investor confidence and increase the stock price.

Investor sentiment and market speculation play a crucial role in shaping the stock’s price. Positive market sentiment, driven by factors such as overall economic growth or sector-specific optimism, can lead to higher valuations, while negative sentiment can trigger price drops. Speculative trading, based on anticipated future performance rather than current fundamentals, can also cause significant price fluctuations.

Financial Performance and Stock Valuation

V-Guard Industries’ financial performance over the past five years provides valuable insights into its stock valuation. Key metrics such as revenue growth, profitability, and debt levels are crucial in assessing the company’s financial health and its ability to generate returns for investors.

A comparison of V-Guard’s Price-to-Earnings (P/E) ratio with industry averages indicates its relative valuation. A higher P/E ratio suggests that the market anticipates higher future growth from V-Guard compared to its peers. Conversely, a lower P/E ratio might signal that the market perceives V-Guard as a less attractive investment opportunity.

A chart illustrating the relationship between V-Guard Industries’ earnings per share (EPS) and its stock price would show a generally positive correlation. Periods of increasing EPS would typically coincide with rising stock prices, while declines in EPS might lead to lower stock prices. The slope of the line representing this relationship would indicate the sensitivity of the stock price to changes in EPS.

Outliers from this trend would require further investigation to understand the underlying causes.

Future Outlook and Predictions for V-Guard Industries Stock

Predicting the future performance of V-Guard Industries’ stock involves considering potential growth opportunities, risks, and various market scenarios.

- Scenario 1: Strong Growth: Continued expansion into new markets, successful product innovation, and favorable macroeconomic conditions could lead to significant revenue growth and higher stock prices. This scenario is supported by the company’s recent investments in research and development and its expansion into new geographical areas.

- Scenario 2: Moderate Growth: Stable market conditions and consistent product performance could result in moderate revenue growth and a relatively stable stock price. This scenario assumes that the company maintains its current market share and effectively manages its costs.

- Scenario 3: Stagnant Growth: Increased competition, economic slowdown, or failure to adapt to changing consumer preferences could result in stagnant or declining revenue and lower stock prices. This scenario highlights the potential risks associated with increased competition and economic uncertainty.

A bull market would generally be favorable for V-Guard’s stock price, while a bear market could lead to significant price declines. The company’s resilience to economic downturns would play a crucial role in determining its performance during a bear market. For example, the resilience of essential product lines during past economic slowdowns could provide a buffer against sharp price drops.

Analyst Ratings and Recommendations

A summary of recent analyst ratings and recommendations for V-Guard Industries’ stock reveals a range of opinions reflecting different perspectives on the company’s future prospects.

[Insert a table summarizing analyst ratings from various sources (e.g., brokerage firms, financial news websites), including their price targets and the rationale behind their ratings. Example: Analyst A – Buy – Target Price: ₹XXX – Rationale: Strong growth potential in the renewable energy sector. Analyst B – Hold – Target Price: ₹YYY – Rationale: Concerns about increasing competition].

The range of price targets reflects the uncertainty inherent in predicting future stock performance. The variations in analyst opinions highlight the importance of conducting independent research and considering multiple perspectives before making investment decisions.

FAQ Overview

What are the major competitors of V-Guard Industries?

V-Guard faces competition from other prominent players in the Indian consumer durables market, including Havells, Bajaj Electricals, and Crompton Greaves Consumer Electricals.

Where can I find real-time V-Guard stock price data?

Real-time stock price data for V-Guard Industries is available on major financial websites and stock market applications such as the National Stock Exchange of India (NSE) website and various brokerage platforms.

What is the dividend payout history of V-Guard Industries?

Information on V-Guard’s dividend payout history can be found in their annual reports and on financial news websites that track dividend distributions for listed companies.

How does V-Guard’s stock price compare to the broader market indices?

A comparison of V-Guard’s stock performance against major market indices like the Nifty 50 or BSE Sensex requires reviewing historical data to assess its relative performance and volatility.