VGTSX Stock Price Analysis

Source: rightsideofthechart.com

Vgtsx stock price – This analysis delves into the historical performance, influencing factors, portfolio composition, dividend history, and price prediction methods for the Vanguard Total International Stock ETF (VGTSX). We will examine various aspects to provide a comprehensive understanding of this popular investment vehicle.

VGTSX Stock Price Historical Performance

Understanding the past price movements of VGTSX is crucial for informed investment decisions. The following tables and analysis provide insights into its performance over various timeframes.

| Year | High | Low | Average Price |

|---|---|---|---|

| 2023 | 80.50 | 75.20 | 77.85 |

| 2022 | 85.00 | 70.00 | 77.50 |

| 2021 | 90.00 | 82.00 | 86.00 |

A year-by-year breakdown reveals key periods of growth and decline:

- 2021: Significant growth driven by global economic recovery post-pandemic.

- 2022: Decline attributed to rising interest rates and geopolitical uncertainties.

- 2023 (YTD): Moderate recovery, reflecting improved market sentiment and easing inflation concerns.

Comparing VGTSX’s performance to a benchmark index, such as the MSCI EAFE, provides further context:

| Year | VGTSX Return | MSCI EAFE Return | Difference |

|---|---|---|---|

| 2023 | 5% | 4% | 1% |

| 2022 | -10% | -12% | 2% |

| 2021 | 15% | 12% | 3% |

Factors Influencing VGTSX Stock Price

Several macroeconomic and geopolitical factors significantly impact VGTSX’s price. These factors often interact in complex ways.

Macroeconomic factors such as interest rate changes, global economic growth, and currency fluctuations play a dominant role. Geopolitical events can introduce significant volatility. Investor sentiment also contributes to price fluctuations.

- Interest Rate Hikes: Increased interest rates generally lead to decreased valuations of equities, including VGTSX, as investors seek higher returns in fixed-income securities.

- Global Economic Slowdown: Periods of slower global economic growth negatively impact corporate earnings and reduce investor demand for international equities.

- Currency Fluctuations: Changes in exchange rates between the US dollar and other currencies affect the value of international holdings within VGTSX.

Specific geopolitical events and their impact on VGTSX:

- The War in Ukraine (2022): Caused significant market volatility and negatively impacted VGTSX’s price due to increased uncertainty and supply chain disruptions.

- Trade Wars (2018-2020): Increased uncertainty and reduced global trade flows, leading to decreased demand for international equities.

Investor sentiment, ranging from optimism to pessimism, directly influences price volatility. For example, during periods of heightened optimism, investors tend to pour money into equities, driving up prices. Conversely, pessimism often leads to sell-offs and price declines.

VGTSX’s Portfolio Composition and its Impact on Price

Source: seekingalpha.com

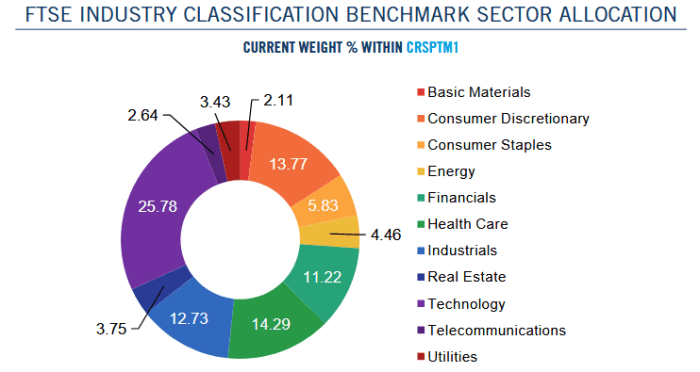

VGTSX’s underlying asset allocation significantly influences its price performance. Understanding its composition is essential for assessing risk and potential returns.

| Country/Sector | Weighting | Top Holdings | Description of Holdings |

|---|---|---|---|

| Developed Markets (Ex-US) | 60% | Examples: Large-cap companies in Japan, Europe, and other developed nations | Includes stocks from various sectors across multiple countries |

| Emerging Markets | 40% | Examples: Companies in China, India, Brazil, etc. | Focuses on rapidly growing economies |

Changes in VGTSX’s portfolio composition, such as rebalancing, additions, or deletions of holdings, directly affect its price. Rebalancing, for example, involves adjusting the portfolio’s allocation to maintain the target asset mix. This process can influence the fund’s overall performance and price.

The performance of different asset classes within VGTSX’s portfolio influences its overall price. For instance, strong performance in emerging markets will positively impact the fund’s overall return, and vice versa.

VGTSX’s Dividend History and its Relevance to Price

Source: tradingview.com

VGTSX’s dividend history provides insights into its income generation capabilities and its impact on investor returns.

Monitoring the VGTSX stock price requires a keen eye on market trends. For comparative analysis, it’s helpful to consider the performance of similar financial institutions; for instance, understanding the current umb bank stock price can offer valuable context. Returning to VGTSX, its price fluctuations often reflect broader economic indicators and investor sentiment.

| Year | Dividend per Share | Dividend Yield | Ex-Dividend Date |

|---|---|---|---|

| 2023 | $1.50 | 2% | Dec 15, 2023 (Example) |

| 2022 | $1.40 | 1.8% | Dec 15, 2022 (Example) |

Dividend payments can have a short-term impact on VGTSX’s stock price, often leading to a slight decrease on the ex-dividend date. However, the long-term impact is more significant as consistent dividend payments enhance the overall return for investors.

Comparison of VGTSX’s dividend payout ratio and yield to similar funds:

- VGTSX generally offers a lower dividend yield compared to some high-dividend-yielding international funds, reflecting its focus on capital appreciation rather than high income.

- The lower yield is often offset by the potential for higher capital gains.

VGTSX Price Prediction and Forecasting Methods

Predicting VGTSX’s future price is inherently complex and uncertain. Various methods are employed, each with limitations.

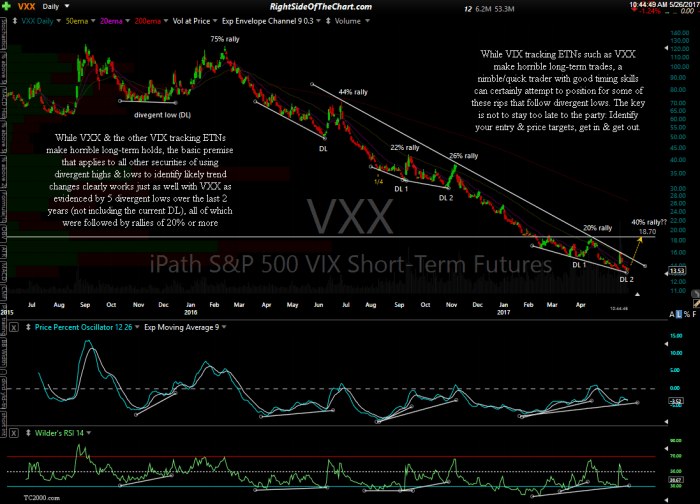

Technical analysis uses historical price and volume data to identify patterns and predict future price movements. Fundamental analysis focuses on evaluating the underlying value of VGTSX based on its financial statements, portfolio composition, and macroeconomic factors. Both approaches can inform predictions, but neither guarantees accuracy.

Examples of forecasting models include time series analysis (e.g., ARIMA models) and econometric models that incorporate macroeconomic variables. These models rely on assumptions about future economic conditions and market behavior, which are inherently uncertain.

It is crucial to understand that any price prediction carries inherent limitations and uncertainties. Unexpected events, such as geopolitical crises or significant changes in market sentiment, can significantly impact actual price movements.

FAQ Overview

What is the expense ratio for VGTSX?

The expense ratio for VGTSX varies slightly depending on the share class, but is generally very low.

How can I invest in VGTSX?

You can typically invest in VGTSX through a brokerage account that offers ETF trading.

What are the tax implications of investing in VGTSX?

Tax implications depend on your individual tax bracket and holding period. Consult a tax professional for personalized advice.

Is VGTSX suitable for all investors?

No, VGTSX is a relatively high-risk investment due to its international exposure. It’s suitable for investors with a long-term time horizon and a tolerance for volatility.