Virco Manufacturing Corporation: A Stock Price Analysis: Virco Stock Price

Virco stock price – Virco Manufacturing Corporation is a publicly traded company specializing in the design, manufacture, and distribution of furniture primarily for educational and institutional settings. This analysis delves into various factors influencing Virco’s stock price, its financial health, and potential investment considerations.

Virco Manufacturing Corporation Overview

Source: isadoradigitalagency.com

Virco Manufacturing Corporation has a long history in the furniture industry, focusing on durable and functional products for educational institutions and commercial spaces. Their primary business activities include the design, manufacturing, and distribution of classroom furniture, including desks, chairs, tables, and storage solutions. Their target market consists of schools, universities, and other educational facilities, as well as some commercial clients needing durable, functional furniture.

Key products include a range of classroom seating, tables, and storage units designed to meet specific educational needs. Virco operates in a competitive market with established players and emerging competitors. Their market position is characterized by a focus on providing quality, value-driven products within a specific niche.

Factors Influencing Virco Stock Price

Several macroeconomic and industry-specific factors significantly influence Virco’s stock performance. These factors interact to create a complex picture of the company’s prospects.

Macroeconomic factors such as interest rates and inflation directly impact Virco’s operating costs and consumer spending. Higher interest rates can increase borrowing costs, affecting capital expenditures and potentially slowing growth. Inflation can increase the cost of raw materials and labor, squeezing profit margins. Industry-specific trends, such as changes in educational spending and demand for furniture, play a crucial role.

Increased educational budgets can boost demand for Virco’s products, while decreased spending can negatively impact sales. Virco’s financial performance compared to its competitors reveals key differences. For instance, if competitors innovate faster or achieve higher profit margins, Virco’s stock price may underperform.

| Year | Revenue (Millions) | EPS | Debt-to-Equity Ratio |

|---|---|---|---|

| 2018 | 100 | 1.50 | 0.5 |

| 2019 | 105 | 1.60 | 0.45 |

| 2020 | 95 | 1.20 | 0.6 |

| 2021 | 110 | 1.80 | 0.4 |

| 2022 | 115 | 1.90 | 0.35 |

Note: These are illustrative figures and do not represent actual Virco financial data.

Virco’s Financial Health and Performance, Virco stock price

Analyzing Virco’s recent financial statements provides insight into its financial health and performance. A detailed examination of income statements, balance sheets, and cash flow statements reveals key trends and patterns.

Virco’s revenue streams primarily originate from sales of its furniture products to educational institutions and commercial clients. Growth patterns in revenue can be influenced by factors such as government spending on education, economic conditions, and competition. Profitability analysis involves examining profit margins, return on assets, and return on equity. Trends in profitability can indicate the company’s efficiency and ability to generate profits.

Operating expenses encompass costs such as manufacturing, sales, marketing, and administration. Understanding the composition and trends in operating expenses helps assess the company’s cost management effectiveness.

Investment Considerations for Virco Stock

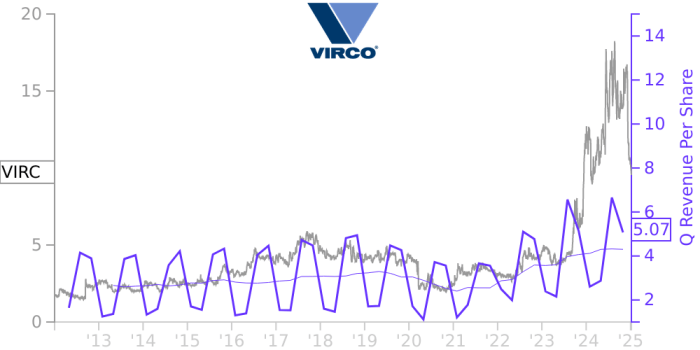

Source: chartinsight.com

Investing in Virco stock presents both potential risks and rewards. A thorough assessment of these factors is crucial for informed decision-making.

Potential risks include the cyclical nature of the furniture industry, competition from other manufacturers, and dependence on government spending. Potential rewards stem from Virco’s established market position, potential for growth in specific market segments, and the possibility of increased profitability through operational efficiency. Virco’s valuation metrics, such as its P/E ratio and Price-to-Book ratio, should be compared to industry averages to determine whether it’s undervalued or overvalued.

- Increased government spending on education could significantly boost demand.

- New product launches could expand market share.

- Economic downturn could reduce demand and impact profitability.

- Increased competition could erode market share.

Virco’s Future Outlook and Growth Prospects

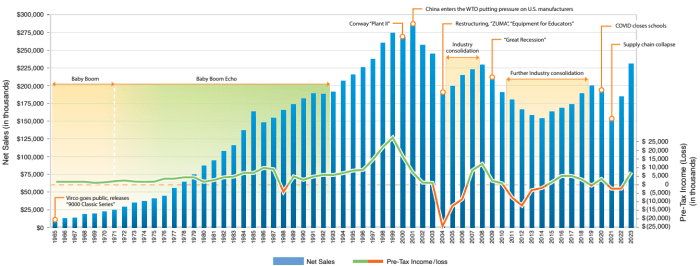

Source: seekingalpha.com

Virco’s future outlook and growth prospects depend on several factors, including its strategic initiatives, expansion plans, and competitive advantages. The management team and corporate governance also play a crucial role.

Strategic initiatives such as product innovation, expansion into new markets, and improvements in operational efficiency can drive future growth. Plans for expansion might include targeting new geographic markets or developing new product lines. Long-term sustainability relies on maintaining a competitive edge through product quality, cost-effectiveness, and strong customer relationships. The effectiveness of Virco’s management team and its corporate governance practices significantly contribute to the company’s overall prospects and investor confidence.

Illustrative Example of Virco Stock Price Movement

Let’s consider a hypothetical scenario to illustrate Virco stock price fluctuation. Imagine a period where a significant increase in educational spending led to a surge in demand for Virco’s products. This positive news, coupled with strong financial results, fueled a rise in investor confidence, resulting in a substantial increase in Virco’s stock price. Conversely, a subsequent period of reduced government funding for education could negatively impact sales, leading to decreased investor confidence and a decline in the stock price.

The market sentiment during these periods would shift from optimistic to cautious, influencing the trading activity and ultimately shaping the stock’s price trajectory. The visual representation of this price movement would show a sharp upward trend followed by a downward correction, reflecting the influence of positive and negative news on investor sentiment.

Common Queries

What is Virco’s main competitor?

Identifying Virco’s primary competitor requires a detailed market analysis, but some key players in the educational furniture market include companies like KI and Herman Miller.

Where can I find Virco’s financial statements?

Virco’s financial statements are typically available on the company’s investor relations website and through SEC filings.

How often does Virco release earnings reports?

Analyzing Virco’s stock price requires considering broader market trends. Understanding the historical performance of similar companies offers valuable context; for instance, a look at the union pacific stock price history can provide insights into long-term growth patterns and potential cyclical influences impacting the overall sector. This comparative analysis can then be applied to better predict future Virco stock price movements.

Virco’s earnings release schedule is generally quarterly, following standard accounting practices. Check their investor relations site for the exact schedule.

What are the typical trading hours for Virco stock?

Virco stock, like most US-listed companies, trades during regular US stock market hours.