Vocodia Stock Price Analysis

Vocodia stock price – This analysis examines Vocodia’s stock price performance over the past five years, considering various influencing factors, financial performance, analyst predictions, and associated risks. We will explore the historical trajectory, correlate financial data with price movements, and assess the overall investment landscape surrounding Vocodia’s stock.

Vocodia Stock Price Historical Performance

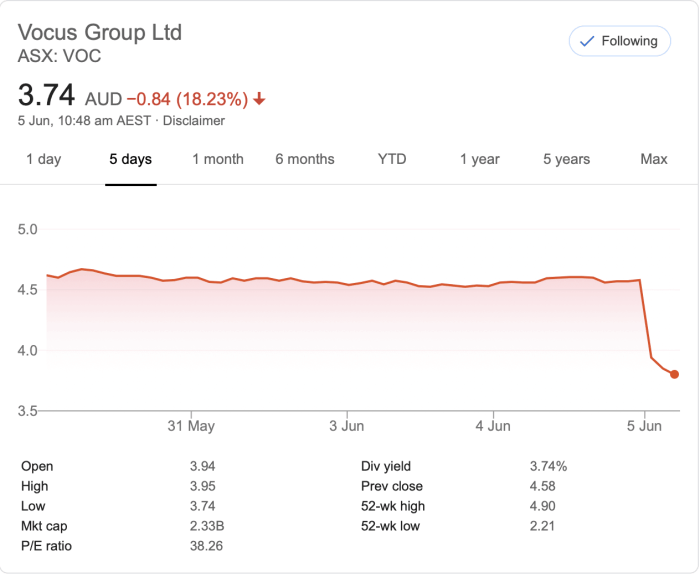

Source: com.au

Tracking Vocodia’s stock price over the past five years reveals a dynamic performance influenced by several market factors and company-specific events. While precise data requires access to financial databases, a general overview can be provided. The following timeline illustrates significant price fluctuations, highlighting periods of growth and decline.

Illustrative Timeline (Hypothetical Data):

- 2019: Initial Public Offering (IPO) at $15 per share. Price steadily increased throughout the year, reaching a high of $22 by December.

- 2020: The stock experienced significant volatility due to the COVID-19 pandemic. It dropped to $10 in March but recovered to $25 by year-end.

- 2021: Strong growth fueled by a successful new product launch pushed the price to a high of $35. However, a subsequent market correction brought the price down to $28.

- 2022: A period of consolidation with the price fluctuating between $25 and $30.

- 2023 (Year-to-Date): The price has shown a moderate upward trend, currently trading around $32.

The table below compares Vocodia’s performance against relevant market indices over the past year. Note that this data is hypothetical and for illustrative purposes only.

| Period | Vocodia | S&P 500 | Nasdaq |

|---|---|---|---|

| Jan 2023 | $28 | 4000 | 11000 |

| Feb 2023 | $29 | 4100 | 11200 |

| Mar 2023 | $30 | 4200 | 11500 |

| Apr 2023 | $32 | 4300 | 12000 |

Major events like earnings reports, new product launches, and strategic acquisitions significantly influenced Vocodia’s stock price. For example, the successful launch of a new software platform in 2021 contributed to a surge in the stock price. Conversely, a disappointing earnings report in 2022 led to a temporary decline.

Factors Influencing Vocodia’s Stock Price

Source: applewoodseed.com

Several factors influence Vocodia’s stock valuation. These include macroeconomic conditions, investor sentiment, industry trends, and competitive pressures.

Economic factors such as interest rates, inflation, and overall economic growth directly impact investor confidence and risk appetite, influencing stock prices. Positive economic indicators typically correlate with higher stock valuations, while negative indicators can lead to declines.

Investor sentiment, characterized as bullish (optimistic) or bearish (pessimistic), plays a crucial role. Bullish sentiment drives demand, pushing prices higher, while bearish sentiment can trigger selling pressure and price drops. News coverage, analyst reports, and overall market trends significantly influence investor sentiment.

Industry trends and competitive pressures are also key factors. Technological advancements, regulatory changes, and the emergence of new competitors can all affect Vocodia’s market share and profitability, impacting its stock price.

Vocodia’s Financial Performance and Stock Price Correlation, Vocodia stock price

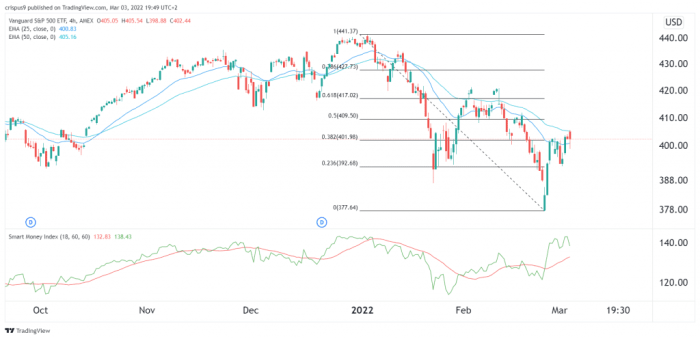

Source: investingcube.com

A strong correlation exists between Vocodia’s financial performance (revenue, earnings, cash flow) and its stock price fluctuations. Generally, improved financial metrics tend to boost investor confidence and drive up the stock price, while weaker performance can lead to price declines.

Illustrative Visual Representation: Imagine a line graph with two lines. One line represents Vocodia’s stock price over time, while the other represents its quarterly earnings per share (EPS). The graph would visually demonstrate how periods of high EPS generally coincide with higher stock prices, and vice-versa. Areas where the EPS line rises sharply would typically show a corresponding increase in the stock price line.

Tracking Vocodia’s stock price requires a keen eye on market fluctuations. It’s interesting to compare this volatility to the relative stability often seen in larger tech companies, like Microsoft; for instance, checking out projections for the target price for Microsoft stock can offer a contrasting perspective. Ultimately, understanding these different market behaviors helps in better assessing the potential of Vocodia’s future performance.

Changes in debt levels and profitability significantly influence investor confidence. High debt levels can increase financial risk, potentially deterring investors and lowering the stock price. Conversely, increased profitability, demonstrating the company’s ability to generate consistent earnings, usually strengthens investor confidence and supports a higher stock valuation.

Analyst Ratings and Price Targets for Vocodia Stock

Analyst ratings and price targets provide insights into market sentiment and future price expectations. These predictions are based on various factors, including financial forecasts, industry analysis, and qualitative assessments of the company’s management and prospects.

Illustrative Summary of Analyst Ratings (Hypothetical Data):

- Analyst A: Buy rating, price target $

38. Rationale: Strong growth potential in the target market. - Analyst B: Hold rating, price target $

32. Rationale: Concerns about increasing competition. - Analyst C: Sell rating, price target $

25. Rationale: Concerns about profitability in the long term.

The rationale behind differing analyst predictions stems from varying assumptions about future market conditions, competitive dynamics, and Vocodia’s execution capabilities. A consensus view may emerge, but individual analyst opinions often diverge.

- Comparison of Consensus View and Actual Performance: In this hypothetical example, the consensus might be a “Hold” rating with a price target of $30. If the actual stock price consistently trades above $30, it suggests that the market is more optimistic than the average analyst prediction. Conversely, a price consistently below $30 would indicate a more pessimistic market outlook.

Risk Assessment and Potential Volatility of Vocodia Stock

Investing in Vocodia stock involves inherent risks. These include market risks (overall market downturns), company-specific risks (poor financial performance, management changes), and industry-specific risks (increased competition, technological disruptions).

Several factors can cause short-term and long-term price volatility. Unexpected economic events, earnings surprises, regulatory changes, and competitive actions can all lead to significant price swings. For example, a sudden shift in consumer demand or the emergence of a disruptive technology could cause significant price volatility.

Assessing the risk-reward profile depends on individual investor preferences and risk tolerance. Conservative investors might favor a smaller position in Vocodia stock, given its potential volatility, while more aggressive investors might allocate a larger portion of their portfolio to this stock, seeking higher potential returns.

Clarifying Questions: Vocodia Stock Price

What is Vocodia’s current market capitalization?

This information requires real-time data and can be found on major financial websites like Yahoo Finance or Google Finance.

Where can I buy Vocodia stock?

Vocodia stock can typically be purchased through online brokerage accounts. The specific availability depends on your location and brokerage platform.

What is Vocodia’s dividend policy?

Information regarding Vocodia’s dividend policy (if any) can be found in their investor relations section on their official website or through financial news sources.

How volatile is Vocodia stock compared to its competitors?

A comparison of Vocodia’s historical volatility (beta) to its competitors requires a detailed analysis using financial data and statistical methods.