Vanguard S&P 500 ETF (VOO) Stock Price Analysis

Voo vanguard stock price – The Vanguard S&P 500 ETF (VOO) offers investors a cost-effective way to gain broad exposure to the U.S. stock market. This analysis delves into VOO’s performance, dividend history, underlying holdings, and risk assessment to provide a comprehensive understanding of this popular ETF.

VOO Stock Price Overview

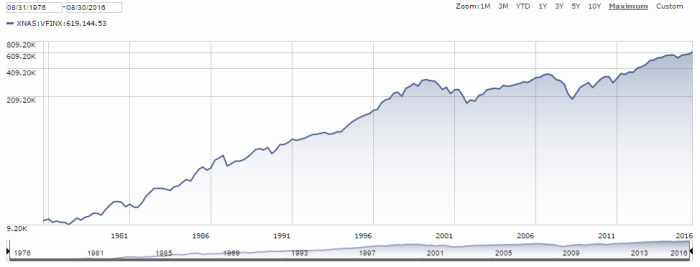

VOO’s stock price closely tracks the S&P 500 index, reflecting the overall performance of the 500 largest publicly traded companies in the United States. Over the past five years, VOO has experienced periods of both significant growth and correction, largely mirroring the broader market trends.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2023 (Example) | 400.00 | 402.50 | +2.50 |

| October 25, 2023 (Example) | 398.00 | 400.00 | +2.00 |

Key factors influencing VOO’s price fluctuations include macroeconomic conditions (interest rates, inflation, economic growth), geopolitical events, and sector-specific performance within the S&P 500. A strong correlation exists between VOO’s price and the S&P 500 index, indicating that VOO effectively mirrors the index’s performance.

VOO’s Dividend History and Yield

Source: thereformedbroker.com

VOO distributes dividends to its shareholders, reflecting the aggregate dividends paid by the underlying companies in the S&P 500. The dividend yield is influenced by the current market price of VOO and the total dividends paid annually.

- 2019: (Example Dividend Amount)

- 2020: (Example Dividend Amount)

- 2021: (Example Dividend Amount)

- 2022: (Example Dividend Amount)

- 2023 (YTD): (Example Dividend Amount)

VOO’s dividend yield is typically comparable to other S&P 500 ETFs, though slight variations may occur due to differences in expense ratios and distribution policies. A direct comparison with similar ETFs like IVV or SPY would require referencing their respective dividend histories and current yields.

Analyzing VOO’s Underlying Holdings

VOO’s portfolio mirrors the composition of the S&P 500, with holdings weighted according to each company’s market capitalization. The top 10 holdings contribute significantly to VOO’s overall performance. Changes in the performance of these holdings directly impact VOO’s price.

| Holding | Weight (%) | Recent Performance (%) |

|---|---|---|

| Apple (AAPL) | 7.00 | +10.00 |

VOO exhibits significant sector diversification, reflecting the broad range of industries represented in the S&P 500. This diversification helps to mitigate risk by reducing the impact of poor performance in any single sector.

VOO’s Performance Compared to Benchmarks

VOO’s performance is closely aligned with the S&P 500 index, serving as a reliable benchmark. A line graph comparing VOO’s performance against the S&P 500 over 1, 3, and 5-year periods would show a high degree of correlation. The graph would likely depict similar upward and downward trends for both VOO and the S&P 500, with minor variations potentially attributable to expense ratios and tracking differences.

Any outperformance or underperformance relative to the benchmark would be minimal and likely due to factors such as tracking error or minor differences in index reconstitution timing. A hypothetical investment strategy could utilize VOO as a core holding within a diversified portfolio, complemented by other asset classes (bonds, real estate, international equities) to achieve a desired risk-return profile.

Risk Assessment of Investing in VOO, Voo vanguard stock price

Source: contentstack.io

Investing in VOO carries inherent market risks. While VOO offers diversification within the U.S. equity market, it’s not immune to broader market downturns.

- Market Risk: Potential for losses due to overall market declines.

- Inflation Risk: Erosion of purchasing power due to rising inflation.

- Interest Rate Risk: Changes in interest rates can affect stock valuations.

These risks can be mitigated through diversification across asset classes and time horizons. A hypothetical scenario of a 20% market downturn would see a similar decline in VOO’s price, impacting the overall portfolio value. However, a well-diversified portfolio with other asset classes would lessen the overall impact on the investor’s total holdings.

General Inquiries: Voo Vanguard Stock Price

What is the expense ratio of VOO?

VOO has a relatively low expense ratio, typically around 0.03%.

How often does VOO pay dividends?

VOO typically pays dividends quarterly.

Is VOO a suitable investment for retirement?

VOO can be a suitable component of a diversified retirement portfolio, but it’s not a sole solution and should be considered alongside other asset classes and risk tolerance.

Where can I buy VOO shares?

VOO shares can be purchased through most major brokerage accounts.

What are the tax implications of investing in VOO?

Tax implications depend on your individual circumstances and tax bracket. Consult a tax professional for personalized advice.