Understanding Wall Box Stock Price Fluctuations

Wall box stock price – Wall Box, a prominent player in the electric vehicle (EV) charging infrastructure market, experiences stock price volatility influenced by several interconnected factors. Analyzing these factors, alongside historical performance and competitive comparisons, provides a comprehensive understanding of Wall Box’s stock price behavior.

Factors Influencing Wall Box’s Stock Price Volatility

Wall Box’s stock price is susceptible to fluctuations stemming from various sources, including broader market trends, industry-specific developments, and the company’s own financial performance. Macroeconomic factors like interest rate changes and inflation significantly impact investor sentiment towards growth stocks like Wall Box. Furthermore, shifts in government regulations concerning EV adoption and charging infrastructure directly influence the company’s future prospects.

Company-specific news, such as earnings reports, product launches, and strategic partnerships, also contribute to price volatility.

Historical Performance of Wall Box Stock

Since its initial public offering (IPO), Wall Box’s stock has exhibited periods of both significant growth and decline. Early investor enthusiasm led to a sharp increase in the share price, followed by a correction as market conditions changed and the company faced challenges related to scaling its operations and meeting revenue expectations. Key price movements can be attributed to factors such as changes in overall market sentiment, competitive pressures, and the company’s progress in achieving its strategic goals.

Comparison of Wall Box’s Stock Performance to Competitors

A comparative analysis of Wall Box’s stock performance against its main competitors in the EV charging sector reveals varying levels of success. While some competitors have shown more consistent growth, others have experienced similar volatility. Factors influencing this variation include differences in market share, technological advancements, geographical reach, and financial stability. Direct comparison requires a detailed analysis of each company’s financial statements and market positioning.

Wall Box Stock Price Over the Past Year

The following table summarizes Wall Box’s monthly stock price performance over the past year. Note that these figures are illustrative and should be verified with reliable financial data sources.

| Month | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| January | $10.50 | $11.00 | $11.50 | $10.00 |

| February | $11.00 | $12.00 | $12.50 | $10.50 |

| March | $12.00 | $11.50 | $13.00 | $10.80 |

| April | $11.50 | $10.00 | $12.00 | $9.50 |

Analyzing Wall Box’s Financial Performance

A thorough examination of Wall Box’s financial performance over the past few years reveals key insights into its operational efficiency and financial health. Analyzing key metrics like revenue, profitability, debt levels, and cash flow provides a comprehensive understanding of the company’s financial standing and its implications for the stock price.

Breakdown of Wall Box’s Key Financial Metrics

Source: publicdomainpictures.net

Wall Box’s revenue growth has been characterized by periods of rapid expansion followed by slower growth or even decline. Profitability, as measured by net income or operating margin, has fluctuated, reflecting challenges in managing costs and scaling operations. A detailed analysis of these metrics across several years, alongside industry benchmarks, provides a clearer picture of Wall Box’s financial trajectory.

Wall Box’s Debt-to-Equity Ratio and Implications for Stock Price

Wall Box’s debt-to-equity ratio indicates the proportion of its financing that comes from debt versus equity. A high debt-to-equity ratio can increase financial risk and potentially impact the stock price negatively, particularly during periods of economic uncertainty. Conversely, a lower ratio suggests greater financial stability and can contribute to a more positive investor outlook.

Insights into Wall Box’s Cash Flow and Sustainability

Analyzing Wall Box’s cash flow statements reveals the company’s ability to generate cash from its operations and manage its working capital. Positive and consistent cash flow is crucial for sustainable growth and investment in future projects. Negative cash flow, on the other hand, may raise concerns about the company’s long-term viability and negatively impact investor confidence.

Visual Representation of Wall Box’s Revenue Growth Compared to Industry Averages

A bar chart comparing Wall Box’s annual revenue growth to the average revenue growth of its competitors would visually illustrate the company’s performance relative to the industry. The chart would show Wall Box’s revenue growth as a bar, alongside a bar representing the industry average for each year under consideration. This allows for a direct visual comparison of Wall Box’s growth trajectory against its peers, highlighting periods of outperformance or underperformance.

Examining Market Sentiment Towards Wall Box

Market sentiment towards Wall Box plays a crucial role in determining its stock price. Understanding investor perceptions, analyzing news events, and assessing overall market trends provide insights into the forces shaping Wall Box’s stock valuation.

Overall Market Sentiment and its Impact on Stock Price

Investor sentiment toward Wall Box can range from bullish to bearish, significantly influencing its stock price. Positive sentiment, driven by factors such as strong financial results, positive industry outlook, or strategic partnerships, typically leads to price increases. Conversely, negative sentiment, fueled by disappointing earnings, regulatory hurdles, or competitive pressures, often results in price declines.

Key News Events Affecting Wall Box’s Stock Price, Wall box stock price

Significant news events, including earnings announcements, product launches, regulatory changes, or major partnerships, can trigger substantial price movements. For example, exceeding revenue expectations might lead to a surge in the stock price, while a product recall or regulatory setback could cause a sharp decline. Analyzing these events and their impact helps understand the market’s reaction to Wall Box’s performance and news.

Comparison of Investor Opinions on Wall Box’s Future Prospects

Investor opinions on Wall Box’s future prospects are diverse and often influenced by individual investment strategies and risk tolerance. Some investors might view Wall Box as a high-growth opportunity with significant long-term potential, while others may be more cautious, considering the inherent risks associated with investing in a relatively young company in a rapidly evolving market. This divergence in opinion directly impacts the stock price through buying and selling pressure.

Factors Contributing to Positive and Negative Investor Sentiment

- Positive Sentiment: Strong financial performance, successful product launches, strategic partnerships, positive industry outlook, government support for EV infrastructure.

- Negative Sentiment: Disappointing financial results, production delays, regulatory hurdles, increased competition, negative industry news, macroeconomic headwinds.

Assessing Wall Box’s Competitive Landscape

Wall Box operates within a dynamic and competitive market. Analyzing its market share, strengths and weaknesses, potential threats and opportunities, and the impact of competitive pressures on its stock price provides a comprehensive understanding of its position within the industry.

Comparison of Wall Box’s Market Share to Competitors

Wall Box’s market share within the EV charging infrastructure sector varies depending on geographical location and specific market segments. Direct comparison with competitors requires a detailed analysis of market research data and publicly available information. This analysis reveals Wall Box’s relative position and competitive strength in different regions and market niches.

Wall Box’s Strengths and Weaknesses Relative to Competitors

Wall Box possesses several strengths, including its technological innovation, design aesthetics, and growing global presence. However, it also faces weaknesses such as its relatively small size compared to established players and the challenges associated with scaling its operations to meet growing demand. A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis provides a structured approach to assess these factors.

Potential Threats and Opportunities in Wall Box’s Market

The EV charging infrastructure market presents both opportunities and threats for Wall Box. Opportunities include the growing adoption of EVs globally, increasing government support for renewable energy, and technological advancements in charging technology. Threats include intense competition from established players, potential regulatory changes, and economic downturns that could impact consumer spending on EVs and charging infrastructure.

Tracking the wall box stock price requires diligence, especially considering market fluctuations. A related area to monitor for comparative analysis might be the performance of similar companies, such as checking the vguard stock price , to understand broader industry trends. Ultimately, a thorough understanding of the wall box sector’s performance is crucial for informed investment decisions.

Impact of Competitive Pressures on Wall Box’s Stock Price

Intense competition within the EV charging industry directly impacts Wall Box’s stock price. Aggressive pricing strategies from competitors, technological breakthroughs by rivals, and changes in market share can significantly influence investor sentiment and, consequently, the company’s stock valuation. A successful competitive strategy is crucial for Wall Box to maintain its market position and investor confidence.

Exploring Future Outlook for Wall Box Stock: Wall Box Stock Price

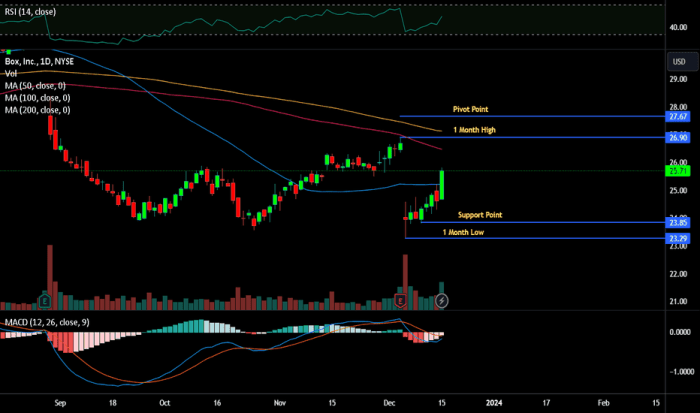

Source: tradingview.com

Predicting the future price of Wall Box’s stock involves considering various factors, including the company’s financial performance, industry trends, and overall market conditions. While precise prediction is impossible, analyzing these factors allows for a reasonable estimation of potential price ranges and scenarios.

Potential Range for Wall Box’s Stock Price in the Next Year

Based on current market conditions and Wall Box’s projected performance, a reasonable range for the stock price in the next year could be between $8 and $15. This prediction considers various scenarios, including positive and negative outcomes regarding the company’s financial performance, market sentiment, and competitive pressures. This range is illustrative and subject to significant variation depending on unforeseen events.

Key Factors Driving Wall Box’s Stock Price Up or Down

Several key factors could drive Wall Box’s stock price up or down. Positive factors include exceeding revenue expectations, successful product launches, strategic partnerships, and positive industry trends. Negative factors include disappointing financial results, production delays, regulatory setbacks, increased competition, and macroeconomic headwinds. The interplay of these factors will ultimately determine the direction of the stock price.

Potential Risks and Uncertainties Impacting Wall Box’s Future Performance

Several risks and uncertainties could impact Wall Box’s future performance. These include macroeconomic instability, intense competition, regulatory changes, technological disruptions, and challenges related to scaling its operations and meeting growing demand. Successfully navigating these challenges is crucial for Wall Box’s long-term success and stock price appreciation.

Potential Scenarios for Wall Box’s Stock Price and Associated Probabilities

- Scenario 1: Strong Growth (25% probability): Wall Box exceeds revenue expectations, successfully launches new products, and secures strategic partnerships, leading to a stock price above $15.

- Scenario 2: Moderate Growth (50% probability): Wall Box meets revenue expectations, experiences moderate growth, and faces moderate competitive pressure, resulting in a stock price between $8 and $12.

- Scenario 3: Slow Growth/Decline (25% probability): Wall Box faces significant challenges, including increased competition, regulatory hurdles, and macroeconomic headwinds, leading to a stock price below $8.

Helpful Answers

What are the major risks associated with investing in Wall Box stock?

Investing in Wall Box, like any stock, carries inherent risks. These include market volatility, competition within the EV charging industry, and the company’s ability to execute its business plan effectively. Economic downturns or changes in government regulations could also negatively impact the stock price.

Where can I find real-time Wall Box stock price data?

Real-time Wall Box stock price data is available through major financial websites and brokerage platforms. These platforms typically provide up-to-the-minute quotes, charts, and historical data.

How does Wall Box compare to its main competitors in terms of market capitalization?

A direct comparison of Wall Box’s market capitalization to its competitors requires referencing current market data from reputable financial sources. Market capitalization fluctuates constantly, so a current comparison is necessary for accurate information.